The Lehman Brothers accounting scandal was a financial disaster that had far-reaching consequences and played a significant role in the global financial crisis of 2008. Lehman Brothers was a large investment bank that was founded in 1850 and had a long history of success. However, in the years leading up to the financial crisis, the bank engaged in risky financial practices that ultimately led to its downfall.

One of the key issues at Lehman Brothers was its use of off-balance-sheet financing. This is a financial technique where a company can move certain assets and liabilities off of its balance sheet, which can make the company appear more financially stable than it actually is. Lehman Brothers used this technique to hide billions of dollars in risky assets, such as subprime mortgages, which made it appear as though the bank was in better financial shape than it actually was.

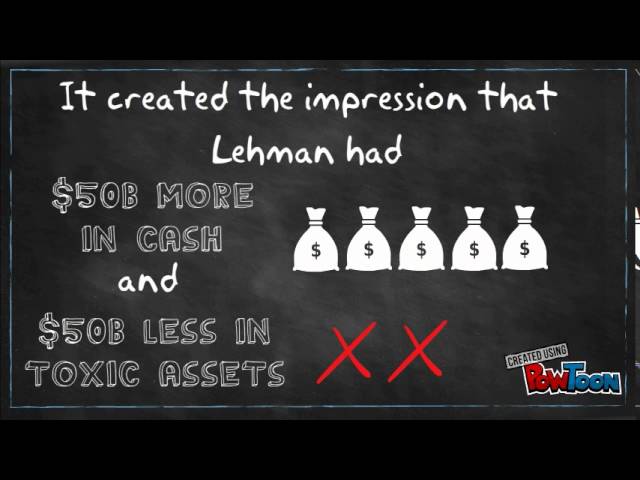

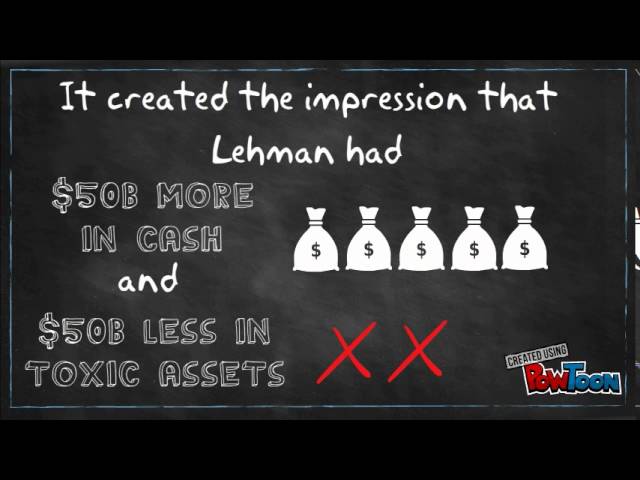

Another issue at Lehman Brothers was its use of repurchase agreements, also known as repo 105 transactions. These transactions allowed Lehman Brothers to temporarily remove assets from its balance sheet in order to make the bank's leverage ratios look better. However, these transactions were not disclosed to investors, and they gave a false impression of the bank's financial health.

The Lehman Brothers accounting scandal came to a head in 2008 when the global financial crisis hit and the bank was unable to meet its financial obligations. The bank filed for bankruptcy on September 15, 2008, which sent shockwaves through the global financial system and contributed to the severity of the crisis.

The Lehman Brothers accounting scandal serves as a cautionary tale about the dangers of financial fraud and the importance of transparency and honesty in the financial industry. It also highlights the need for strong regulatory oversight in order to prevent similar financial disasters from occurring in the future.

Lehman Brothers Scandal Rocks the Fed

It was in the year 2001 when it was found that the company had been using creative accounting techniques to not only hide billions of dollars of debt but also to inflate the earnings of the company. The Enron Scandal 2001 Enron Corporation was a US energy, commodities, and services company based out of Houston, Texas. By colorable claims Valukus means there is sufficient evidence for the Justice Department or the Securities and Exchange Commission to bring charges against top Lehman executives, including CEO Richard Fuld, for overseeing and certifying misleading financial statements, and against Lehman's accountant, Ernst and Young, for failing to challenge Lehman's numbers. Therefore, firms strive to attain the forecasted figures to avoid their stock value from falling. The scandal was discovered when the SEC and the office of the District Attorney of Manhattan carried out investigations related to certain questionable accounting practices by the company. There have been a number of business scandals that came as a shock to the business world including the famous Enron scandal 2001, Waste Management scandal 1998, Tyco scandal 2002, WorldCom scandal 2002, Lehman Brothers scandal 2008, and so on. Everyone spent the rest of the day preparing for Lehman's bankruptcy.

The Collapse of Lehman Brothers: A Case Study

So under accounting rules, the assets a bank uses in repo deals stay on the bank's balance sheet. Anton Valukas: Everybody got hurt. An investigation was initiated by Securities and Exchange Commission SEC and it was found that the CEO of the company, Jeff Skillings, and former CEO, Ken Lay, had indulged in unethical practices of keeping billions of dollars of debt off the balance sheet. They were getting the material. They had screwed up on a truly collosal scale, and lined their pockets all the while. The very last effort that the company used involved a spirited attempt to champion for a take over by Barclays PLC and Bank of America. Lesson learnt Companies need to handle poor performance by the use of sound problem solving strategies rather than resorting to fraudulent accounting techniques as a cover up.

Ernst & Young accused of hiding Lehman troubles

Some suspect that other banks engaged in similar maneuvers. The so-called lending facility that the Fed set up was called the Primary Dealer Credit Facility or PDCF. It is worth mentioning that such practices are unethical but not illegal because they are used by the company without violating the rules. The trick made Lehman Brothers look much healthier — on paper, at least. The big As the financial crisis grew in 2007 and 2008, Lehman knew it needed to reduce its reliance on borrowed money. If you want a more in-depth explanation of how the scheme worked, here's Dylan Rattigan of MSNBC: Accounting "Gimmicks," or Just Plain Fraud? Following the earnings report, Lehman said the risks posed by rising home delinquencies were well contained and would have little impact on the firm's earnings.

Repo 105: Lehman's 'Accounting Gimmick' Explained : Planet Money : NPR

But that and other damaging information was never disclosed to investors who continued to pump billions of dollars into the firm. The activities of the New York Fed NYFRB , which at the time was headed by Timothy Geithner, is particularly suspect in this regard. Matthew Lee: November 30th, 2007 was the end of our fiscal year. Anton Valukas: Our job is to determine what actually happened, put the cards face up on the table, and let everybody see what the facts truly are. This may involve the proper use of creative accounting. Tyco Scandal 2002 Tyco International was an American blue-chip security systems company based out of Princeton, New Jersey.

Accounting Scandals

Anton Valukas: They were on premises. But in November of 2007 he declined to do it. But the move was misleading, as Lehman also entered into a forward contract giving it the right to buy the assets back, Bushee says. Valukas says the SEC also knew that Lehman was being less than truthful when it said it had enough assets to survive the crisis. Therefore, non performing firms may engage in profit smoothing to avoid negative publicity by the stock market. Richard Fuld's view on that was that he has no knowledge of it.

Lehman Brothers: Accounting Left to Interpretation — Fraud Conference News

Steve Kroft: And then the next financial statement, they would move it overseas again, and file the report, and then move it back? Allen says regulators made the right call in letting Lehman fail, given what they knew at the time. Anton Valukas: No, they have not. Lehman was one ofthe largest bank not bailed out by the U. HealthSouth Scandal 2003 HealthSouth Corporation is a top US publicly traded healthcare company based out of Birmingham, Alabama. Steve Kroft: Isn't the government, the SEC in this case, the people who were supposed to protect the investors? I'm now putting it in writing. The examiner looked at 10 million e-mails and 20 million documents in the case.

Lehman Brothers Collapse: Causes, Impact

This practice should be avoided at all cost because it amounts to accounting fraud. Steve Kroft: And who got hurt? After the reports were published, Lehman then borrowed cash and repurchased its original assets. By agreeing to buy the assets back for 105% of their sales price, the firm could book them as a sale and remove them from the books. Lehman would then use the proceeds from the sale of securities to reduce its liabilities and improve its leverage ratios. One of the biggest questions is this: Were any other banks using similar tricks? It also emerges that the NY Fed, and thus Timothy Geithner, were at a minimum massively derelict in the performance of their duties, and may well be culpable in aiding and abettingLehman in accounting fraud and Sarbox violations….