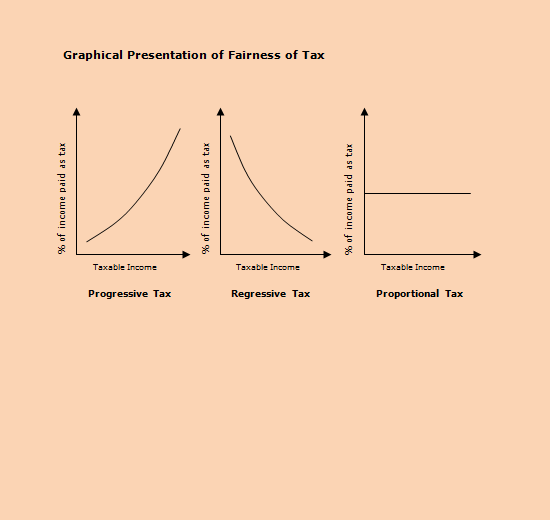

Progressive, regressive, and proportional taxes are three different ways that governments can structure their tax systems. Each type of tax has its own set of advantages and disadvantages, and the best tax system for a given country will depend on its specific needs and goals.

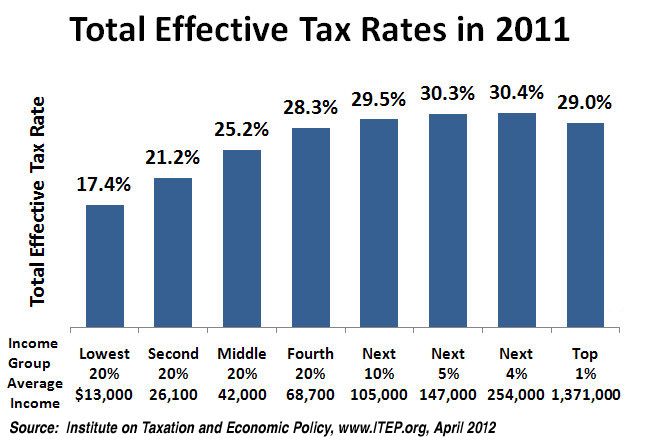

Progressive taxes are taxes that take a larger percentage of income from higher earners than from lower earners. For example, a progressive tax system might have a tax rate of 10% for incomes under $50,000 per year, 15% for incomes between $50,000 and $75,000, and 20% for incomes over $75,000. Progressive taxes are often justified on the grounds that they help to reduce income inequality, as they require those who can afford it to pay a larger share of their income in taxes.

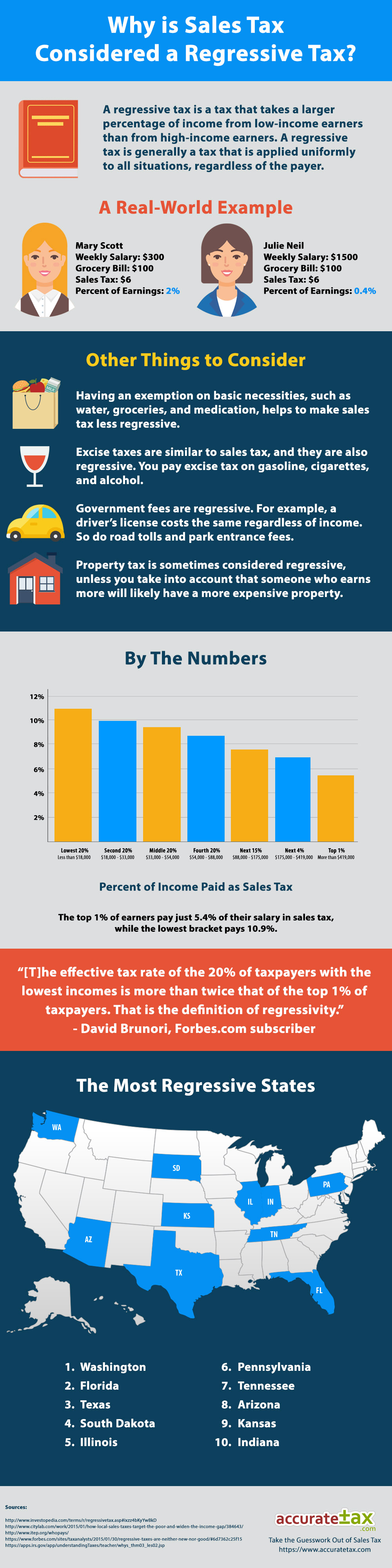

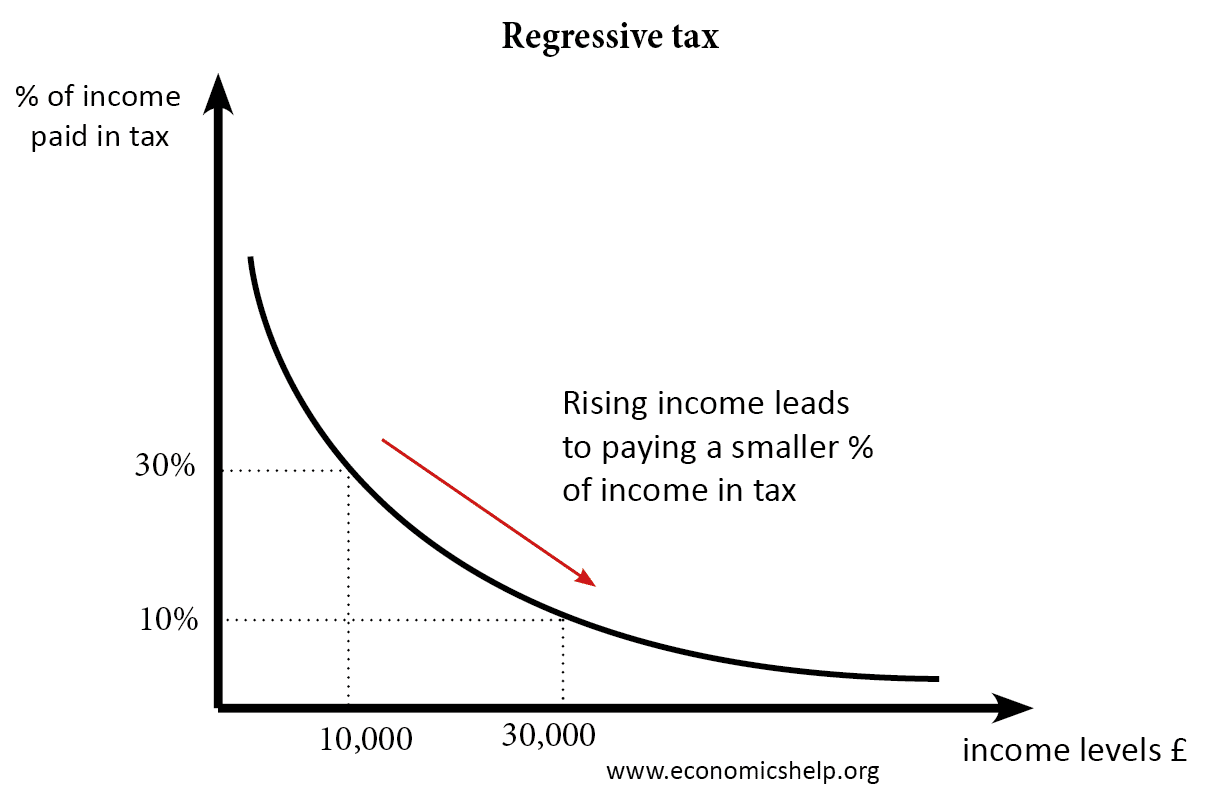

Regressive taxes, on the other hand, are taxes that take a larger percentage of income from lower earners than from higher earners. One example of a regressive tax is a flat tax, where everyone pays the same percentage of their income in taxes, regardless of their income level. Sales taxes are also often regressive, as they take a larger percentage of income from those with lower incomes, who may have to spend a larger share of their income on necessities such as food and clothing.

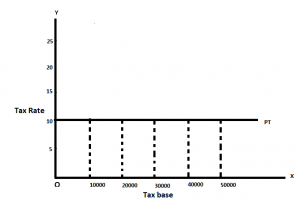

Proportional taxes, also known as flat taxes, are taxes that take the same percentage of income from everyone, regardless of their income level. For example, a proportional tax system might have a tax rate of 10% for all incomes. Proportional taxes are often attractive to policymakers because they are simple and easy to administer, but they can also be controversial because they may not take into account differences in income and ability to pay.

In conclusion, progressive, regressive, and proportional taxes are three different ways that governments can structure their tax systems. Each type of tax has its own set of advantages and disadvantages, and the best tax system for a given country will depend on its specific needs and goals.