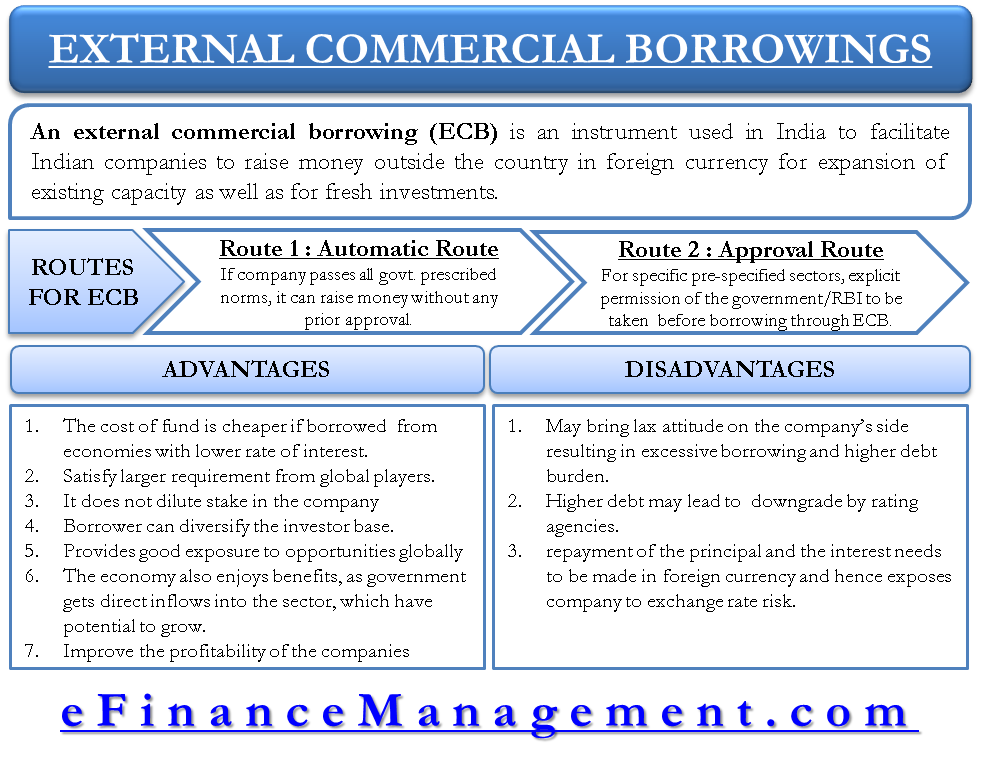

External equity refers to the practice of using external sources of capital, such as loans or investments from external investors, to finance a business or project. This can be an attractive option for businesses and organizations, as it allows them to access additional funds without having to use their own capital or resources. There are several advantages to using external equity, which are discussed below.

One advantage of external equity is that it can provide access to larger amounts of capital than a business or organization may have access to internally. This can be especially useful for businesses that are growing rapidly or seeking to expand into new markets. By accessing external equity, businesses can fund their expansion efforts and take advantage of new opportunities that may not have been possible with their internal resources alone.

Another advantage of external equity is that it can provide a source of capital that is not tied to the performance of the business or organization. This can be particularly useful in times of economic downturn or other challenging circumstances, as it allows businesses to continue operating and investing in their growth despite difficult conditions.

External equity can also provide a source of capital that is not tied to the personal assets of the business or organization's owners or shareholders. This can be beneficial in protecting the personal assets of the business's owners in the event of financial difficulties or legal issues.

In addition, using external equity can help a business or organization to diversify its sources of funding. By relying on a mix of internal and external sources of capital, a business can reduce its risk and increase its financial stability.

Finally, external equity can also be a way for businesses to bring in new expertise and resources. For example, external investors may have valuable industry experience or connections that can help a business to grow and succeed.

In conclusion, external equity can provide access to larger amounts of capital, a source of capital that is not tied to the performance of the business, protection of personal assets, diversification of funding sources, and access to new expertise and resources. These advantages make external equity an attractive option for businesses and organizations seeking to finance their growth and expansion efforts.

:max_bytes(150000):strip_icc()/CapitalStructureV3-f35fe15141e6459989ddc22ecd181162.png)