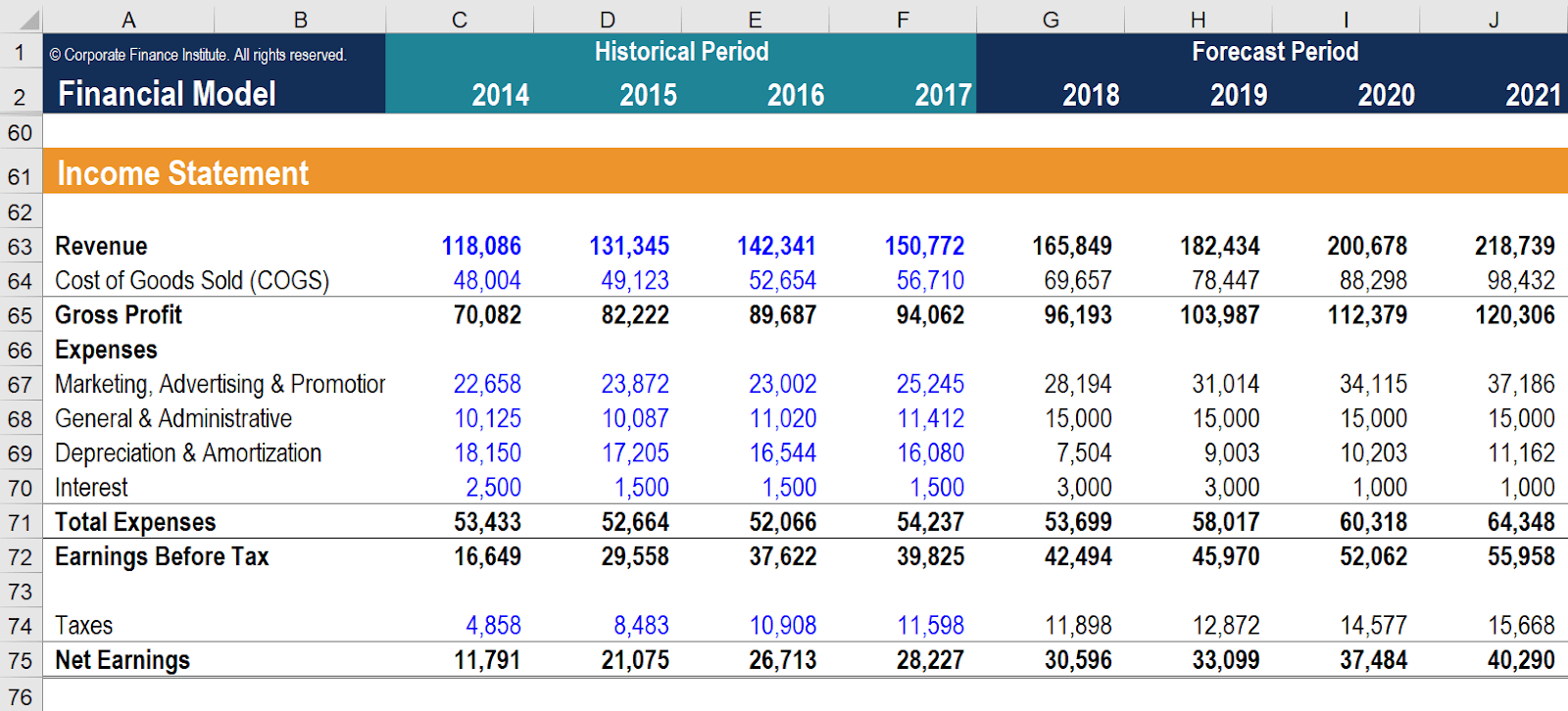

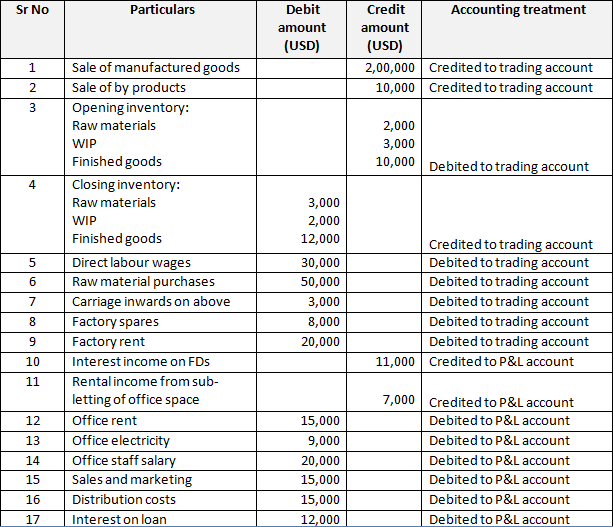

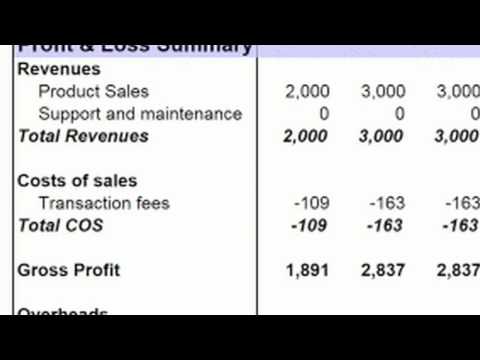

A profit and loss (P&L) account is a financial statement that outlines the revenues, costs, and expenses incurred by a business during a specific period of time, typically a month or a year. The purpose of preparing a P&L account is to evaluate the financial performance of a business and determine whether it has made a profit or incurred a loss during the period being analyzed.

There are several reasons why a business might prepare a P&L account. One of the primary reasons is to assess the profitability of the business. By analyzing the revenues, costs, and expenses, a business can determine whether it is generating sufficient profits to sustain its operations and grow. A P&L account can also help a business identify areas where it is spending too much money, such as on unnecessary overhead costs, and make adjustments to improve its financial performance.

Another reason for preparing a P&L account is to provide information to stakeholders, such as shareholders, investors, and creditors. These stakeholders rely on the P&L account to assess the financial health of a business and make informed decisions about whether to invest in or lend to the business. A P&L account can also help stakeholders understand the trends and patterns in a business's financial performance over time, which can be useful in predicting future performance and assessing the risk associated with investing in or lending to the business.

In addition to providing information to stakeholders, a P&L account can also serve as a tool for internal management. By analyzing the P&L account, a business can identify areas where it is performing well and areas where it needs to improve. This information can be used to set financial goals, allocate resources, and make informed decisions about the direction of the business.

In summary, the profit and loss account is an important financial statement that is prepared for a variety of purposes. It helps a business assess its profitability, provide information to stakeholders, and serve as a tool for internal management. By analyzing the P&L account, a business can make informed decisions about its financial performance and plan for its future growth.