A perfect introduction paragraph is one that effectively captures the reader's attention, sets the tone for the rest of the essay, and provides a clear and concise overview of the main points that will be discussed.

There are a few key elements that should be included in a well-written introduction paragraph. First, it should contain a hook or attention-grabber that draws the reader in and makes them want to continue reading. This could be a quote, a rhetorical question, or a surprising statistic.

Next, the introduction should provide some context or background information on the topic being discussed. This helps the reader understand the context of the essay and why the topic is important or relevant.

Finally, the introduction should clearly state the main points or arguments that will be made in the essay. This gives the reader a roadmap for what is to come and helps them follow the main points of the essay.

Overall, a perfect introduction paragraph should be engaging, informative, and concise, setting the stage for a well-written and well-organized essay.

Victoria Chemicals PLC (B): Merseyside and Rotterdam

Product Quality Moreover, this differentiation can fluctuate from item to item, market to market and industry to industry. Spending too much time will leave lesser time for the rest of the process. It will help you evaluate various aspects of a company's operating and financial performance which can be done in Victoria Chemicals PLC A The Merseyside Project Excel. As we see on exhibit 2, the worst case scenario of 100% internal cannibalization still produces a positive NPV of 8. Net worth is a very important concept when solving any finance and accounting case study as it gives a deep insight into the company's potential to perform in future. However, over the proposal was citizen by the management as the bulk amount of detail does not make any project attractive Elizabeth Eustace Constraints on Solution Constraints 1 As the company is having two mutually exclusive projects among which only one has to be accepted. Victoria Chemicals PLC A The Merseyside Project shortcomings are as per the following: 5.

case 24, 25

Corporate financial reporting and analysis: Text and cases. The proposed plan which Elizabeth Eustace provided was quite contrary and disturbing to the proposal placed by the Morris to upgrade the existing facilities and production process of polypropylene. Multiple criteria decision analysis. The company can deploy both of the methods and it is completely in different to select whether to go for inflation or cannibalization. For example, Business 3 in 1 Coffee target those customers whose lifestyle is quite hectic and don't have much time. Quality and Quantity, 52 2 , 815-828.

Victoria Chemicals PLC A The Merseyside Project Case Study Solution and Case Analysis

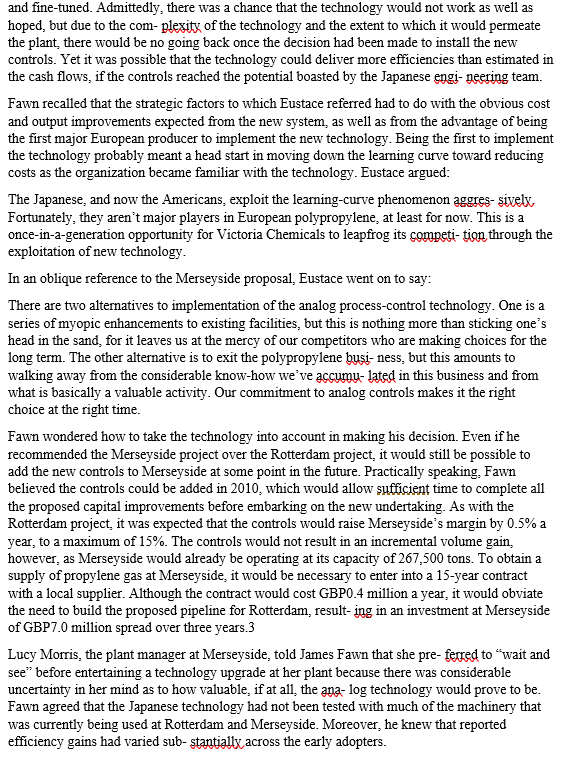

Analysis A comparison of the two different investment plans and a critical assessment of included cash flow When considering investments it is important that the decisions, in regards to which projects to invest in, are based on analyses with relevant, forecasted, figures of revenues and costs that will be used to indicate the cash flows of the project. Acquisition of company's which do not fit with the business's values like Kraftz foods can lead the company to deal with misunderstanding of customers about Business core values of healthy and healthy items. Use of progressive harvesting methods The company makes use of modern as well as new and innovative means of cropping and harvesting as well. Victoria Chemicals , a major competitor in the worldwide chemicals industry, was a leading producer of polypropylene. This has allowed the company to develop an inimitable resource that is aligned with the organizational goals, and mission, and which is synonymous to the organization itself. Thus, it is a snapshot of the company and helps analysts assess whether the company's performance has improved or deteriorated. Merseyside Average gross profit can shrink 6,8 % which gives a NPV of 0.

Victoria Chemicals PLC (A): The Merseyside Project Case Solution And Analysis, HBR Case Study Solution & Analysis of Harvard Case Studies

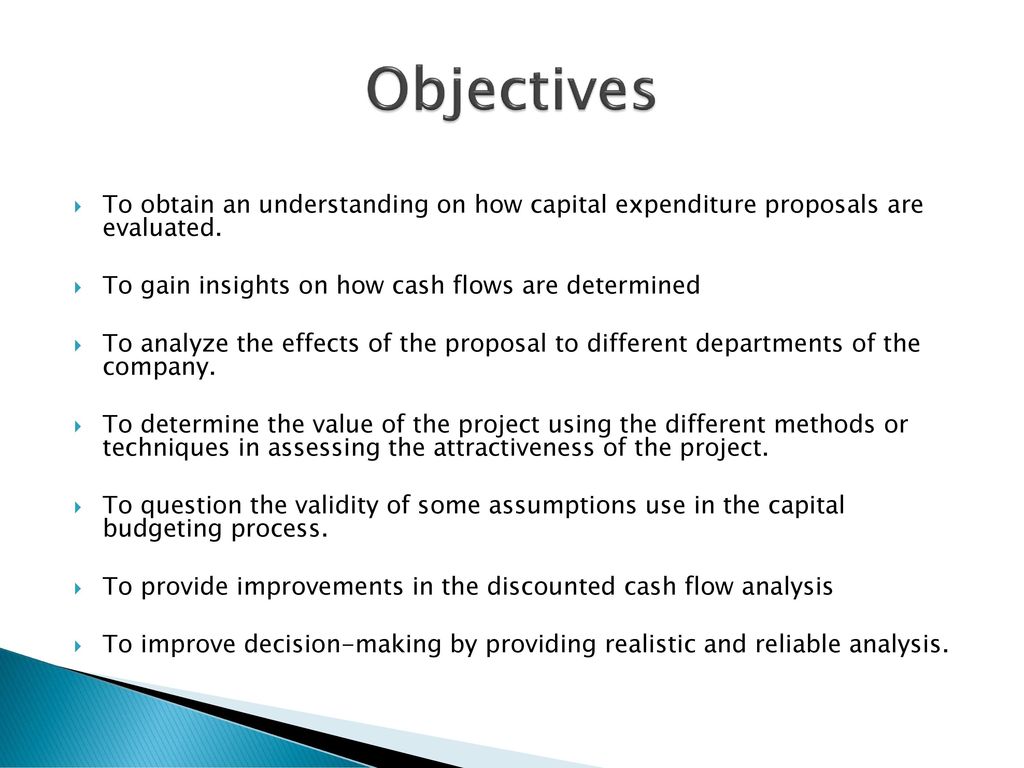

They act as supplier to customers in Europe and the Middle East. The process of evaluating capital budgeting proposals at Victoria Chemicals were 1 Earning Per Share EPS , 2 Payback Period PBP , 3 Discounted Cash Flow DCF or Net Present Value NPV , and Internal Rate of Return IRR. When comparing the two different investment plans and the cash flows included, you can see that there are differences between the Merseyside and Rotterdam projects. In the adjusted calculations for the Merseyside project, we removed both the overhead cost and the sunk preliminary engineering cost, before also adding the cannibalization cost. Strategies to Overcome Weaknesses to Exploit Opportunities Victoria Chemicals Plc A The Merseyside Project should do mindful acquisition and merger of organizations, as it might impact the client's and society's understandings about Business.

Case Report: Victoria Chemicals Plc (a): the Merseyside Project

Value addition at each step of the value chain However, the account of value does not finish at getting incredible quality of raw materials. Therefore, you need to be mindful of the financial analysis method you are implementing to write your Victoria Chemicals PLC A The Merseyside Project case study solution. Investments at Merseyside are much higher than at Rotterdam witch gives us the wrong conditions to make a fair comparison. Supply Chain Finance: A supply chain-oriented perspective to mitigate commodity risk and pricing volatility. In these two cases it is difficult to say what cash flows that are used. Capital Budgeting and Financial Structure. Into urn, that gives a strong financial cushioning to the business.