Treasury bills, also known as T-bills, are a type of short-term debt instrument issued by the government of India to finance its fiscal deficit. They are considered to be one of the safest investment options as they are backed by the full faith and credit of the government.

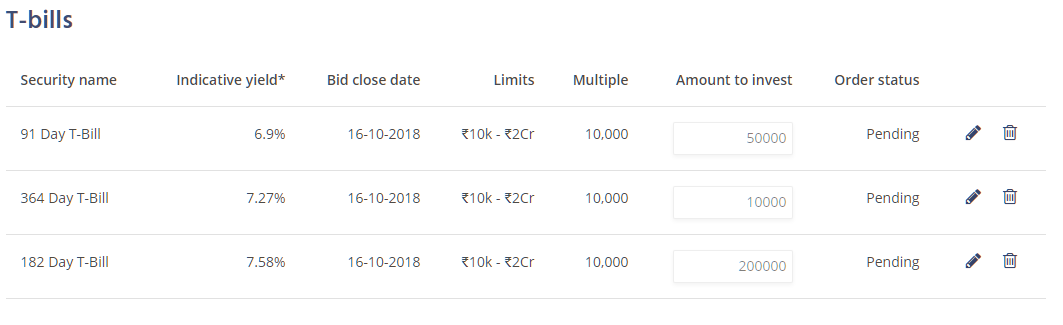

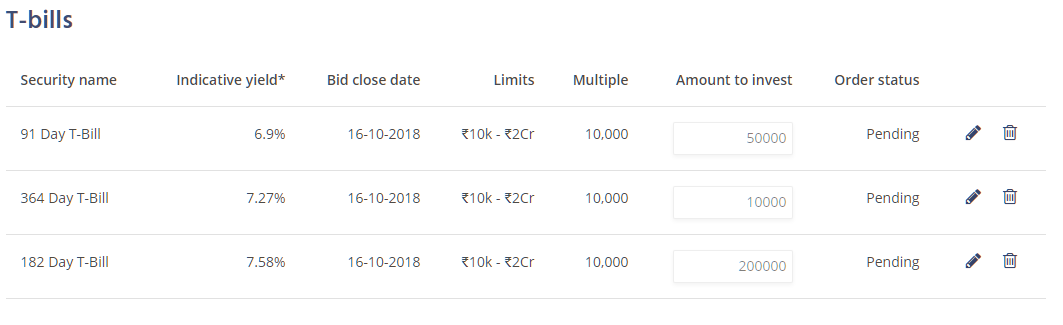

T-bills have a maturity period of 91 days, 182 days, and 364 days and are issued through auctions conducted by the Reserve Bank of India (RBI), the central bank of India. Investors can participate in these auctions either directly or through banks and other financial institutions. T-bills are issued at a discount to their face value, and the investor receives the face value upon maturity. For example, if an investor buys a T-bill with a face value of INR 10,000 at a discount of INR 500, the investor will receive INR 10,000 upon maturity, resulting in a yield of INR 500.

T-bills are highly liquid as they can be easily bought and sold in the secondary market. They are also considered to be low risk as they are backed by the government and have a very short maturity period. T-bills are an attractive option for investors looking for safe and liquid investment options with a relatively low return.

In addition to being a source of financing for the government, T-bills also serve as a benchmark for the interest rates in the economy. The yield on T-bills reflects the market's expectations of the future direction of interest rates. If the yield on T-bills increases, it may indicate that the market expects interest rates to rise in the future. Conversely, a decline in the yield on T-bills may indicate that the market expects interest rates to remain stable or decline in the future.

In conclusion, T-bills are a safe and liquid investment option issued by the government of India to finance its fiscal deficit. They serve as a benchmark for interest rates in the economy and are an attractive option for investors looking for low-risk investments with a relatively low return.

Treasury bills in India: Meaning and Details of t

Conversely, if interest rates or market yields decline, the price of the bond rises. Bids which are higher than the cut-off yield are rejected. They are auctioned on Wednesday, and payment is due the following week on Friday, when the term expires. So, T-bills offer a profit when they are redeemed. Details of bids received in the increasing order of bid yields Bid No. In the example under ii above, if the auction was Uniform Price based, all bidders would get allotment at the cut-off price, i. You can use this to set short term investment goals.

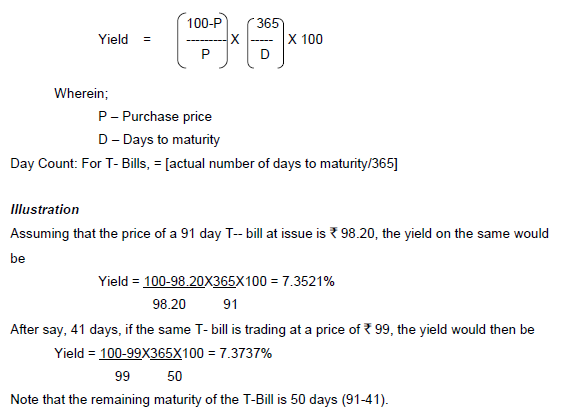

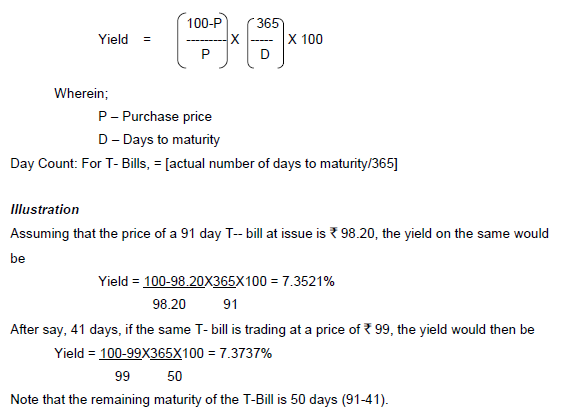

Reserve Bank of India

Holders purchase government-backed securities with a maturity period below one year. Difference between T-Bills and T-Bonds? The cut-off yield is taken as the coupon rate for the security. What are Treasury bills or T-bills? If the coupon payment date falls on a Sunday or any other holiday, the coupon payment is made on the next working day. In case, the trades are conducted on the telephone market, it would be safe to trade directly with a bank or a PD. Rate is the security's annual coupon rate. Under the Scheme, an investor can make only a single bid in an auction. In essence, yield measures the annualized rate of return on investment.

How to Buy Treasury Bills in India through NSE goBID or Zerodha?

Repurchase of seven securities of Government of Maharashtra was done through reverse auction on March 29, 2017. Therefore, the face value becomes the at par rate or redemption value upon maturity. The maturity date is the date when the security expires. However, , and debt instruments increases as the stock market rises. This facilitates trading of G-Secs on the stock exchanges. An effort has been made in this primer to present a comprehensive account of the market and the various processes and operational aspects related to investing in G-Secs in an easy-to-understand, question-answer format.

What are Treasury Bills or T

Utilize only brokers registered with NSE or BSE or OTCEI for acting as intermediary. The bidding mechanism for T-bills allows investors to participate by submitting a bid. Interested in how we think about the markets? It is an allocating facility wherein a part of total securities are allocated to bidders at a weighted average price of successful competitive bid. Currently, the shut period for the securities held in SGL accounts is one day. Depository participant details takes about one working day. In the secondary market, where already-issued debt securities are bought and sold between investors, the price one pays for a bond is based on a host of variables, including market interest rates, accrued interest, supply and demand, credit quality, maturity date, state of issuance, market events and the size of the transaction. The bidding and allotment procedure is similar to that of G-Secs.

All that you should be familiar with Treasury Bills

T-Bills are for investors with a low Risk Appetite Risk appetite refers to the amount, rate, or percentage of risk that an individual or organization as determined by the Board of Directors or management is willing to accept in exchange for its plan, objectives, and innovation. A treasury bill is a money market instrument that the government of India issues. They are issued at discount and redeemed at par. Reserve Bank of India would welcome suggestions in making this primer more user-friendly. Long-term instruments include debentures, bonds, GDRs from foreign investors. Interest Treasury bills are issued at a discounted price. Overnight market - The tenor of transactions is one working day.

What is T

The government issues long-term capital market securities called T-bonds. At present, the Government of India issues three types of treasury bills, namely, 91-day, 182-day and 364-day. I have even just invested 40,000 Rupees last week on 91 days T-Bill through Zerodha Demat account. In other words, duration is the elasticity of the bond's price with respect to interest rates. Also, payment for the bid shall be successful if your bank supports TPV i. The following are the major risks associated with holding G-Secs: 29. The cut-off yield is then fixed as the coupon rate for the security.