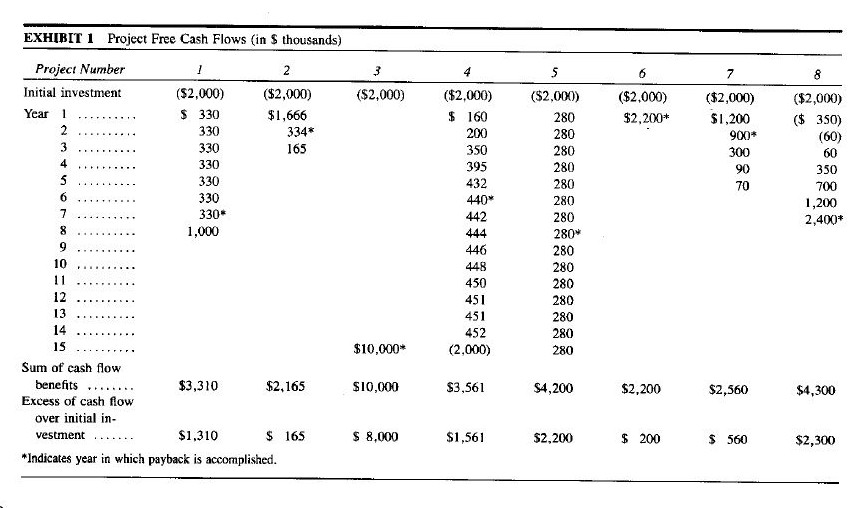

The Investment Detective case is a classic example of the importance of thorough financial analysis in the investment decision-making process. The case, which was first introduced in the Harvard Business Review in 1976, presents a situation in which an investment analyst must evaluate a potential investment opportunity and make a recommendation to his superiors.

At the heart of the Investment Detective case is the concept of net present value (NPV), which is a measure of the profitability of an investment. NPV takes into account the time value of money, meaning that it considers the fact that a dollar received in the future is worth less than a dollar received today. To calculate NPV, an analyst must determine the expected cash flows from an investment, discount those cash flows to their present value using a required rate of return, and then subtract the initial investment from the sum of the discounted cash flows. If the NPV is positive, the investment is expected to generate a return that is higher than the required rate of return, and therefore it should be undertaken. If the NPV is negative, the investment is expected to generate a return that is lower than the required rate of return, and therefore it should be rejected.

In the Investment Detective case, the investment analyst is presented with a potential investment opportunity in a company called All-State Manufacturing. The company has developed a new product that it believes will be very successful, and it is seeking an investment of $100,000 to fund the production and marketing of the product. The company has provided the analyst with a detailed forecast of the expected cash flows from the investment, which includes estimates of the sales, costs, and expenses associated with the new product.

After carefully reviewing the financial projections, the investment analyst must decide whether to recommend the investment to his superiors. To do so, he must first determine the required rate of return for the investment. This is the rate of return that the investment must generate in order to be considered attractive to the company. The required rate of return will depend on a number of factors, including the company's risk profile, the level of competition in the market, and the economic climate.

Once the required rate of return has been determined, the investment analyst can use it to calculate the NPV of the investment. If the NPV is positive, the investment is expected to generate a return that is higher than the required rate of return, and therefore it should be recommended. If the NPV is negative, the investment is expected to generate a return that is lower than the required rate of return, and therefore it should be rejected.

In the Investment Detective case, the investment analyst ultimately decides to recommend the investment to his superiors. He concludes that the expected cash flows from the investment are strong enough to justify the required rate of return, and that the new product has the potential to be a major success. By thoroughly analyzing the financial projections and carefully considering the risks and rewards of the investment, the analyst is able to make a sound recommendation that is based on solid financial analysis.

In conclusion, the Investment Detective case highlights the importance of thorough financial analysis in the investment decision-making process. By using tools such as net present value, investment analysts can carefully evaluate the potential profitability of an investment and make informed recommendations to their superiors.