Tesla, Inc. is an American multinational corporation that specializes in electric vehicles, energy storage and solar panel manufacturing based in Palo Alto, California. Founded in 2003, the company specializes in electric cars, lithium-ion battery energy storage, and residential photovoltaic panels (through the subsidiary company named Tesla Energy). Tesla Motors is a public company that trades on the NASDAQ stock exchange under the symbol TSLA.

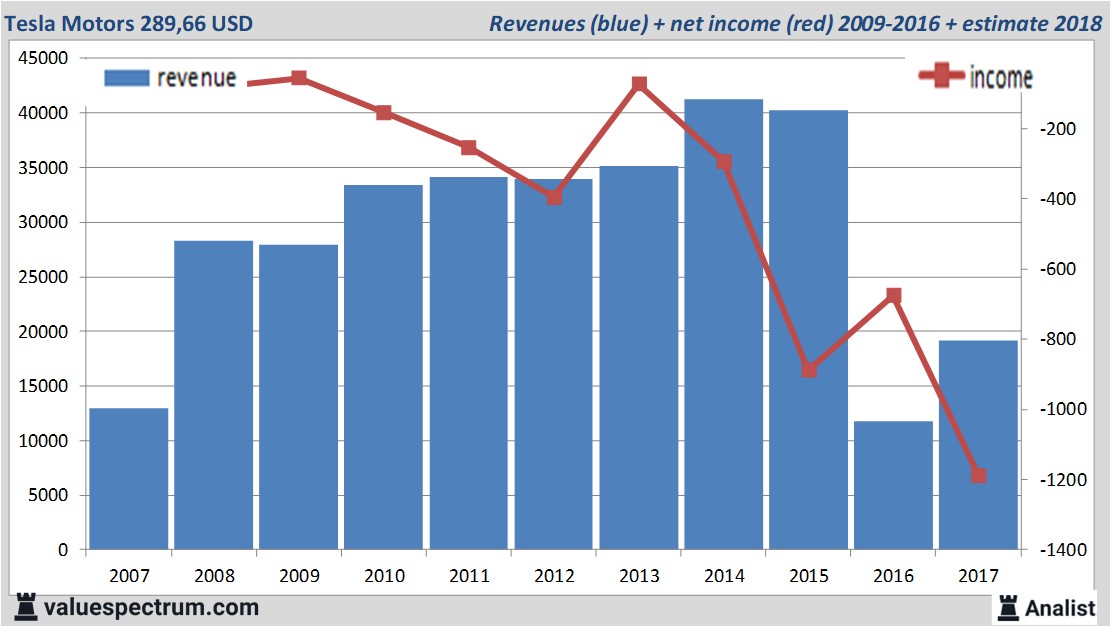

The company's financial performance has been a topic of much discussion and analysis in recent years. Tesla has experienced rapid growth since its founding, with revenues increasing from $204 million in 2012 to over $31 billion in 2020. This growth has been driven in part by the increasing demand for electric vehicles, as well as the company's expansion into new markets such as China and Europe.

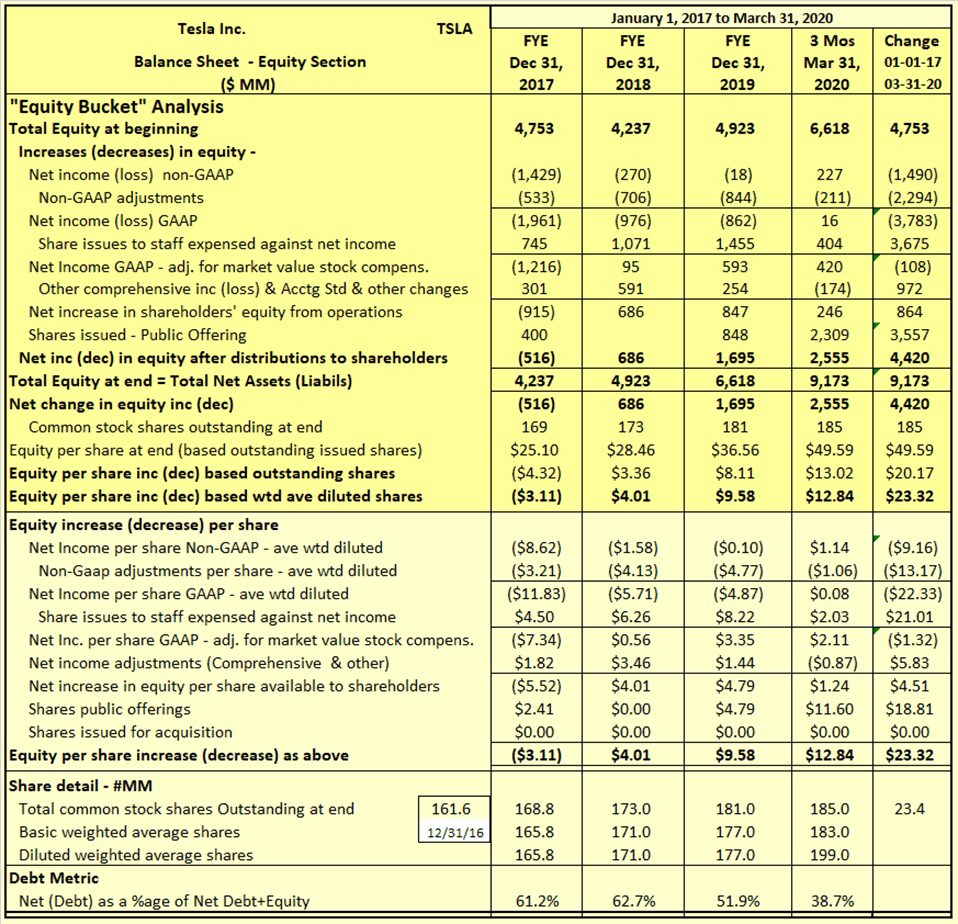

Despite this impressive growth, Tesla has faced several financial challenges. The company has consistently reported losses in its financial statements, with net losses totaling over $6 billion from 2012 to 2020. These losses have been primarily due to the high costs of research and development, as well as the investment in new production facilities and infrastructure.

However, Tesla has also experienced strong growth in its profitability in recent years. In 2020, the company reported its fifth consecutive quarter of profitability, with net income of $721 million. This profitability has been driven by a combination of factors, including increased production efficiency, cost-cutting measures, and strong demand for the company's electric vehicles.

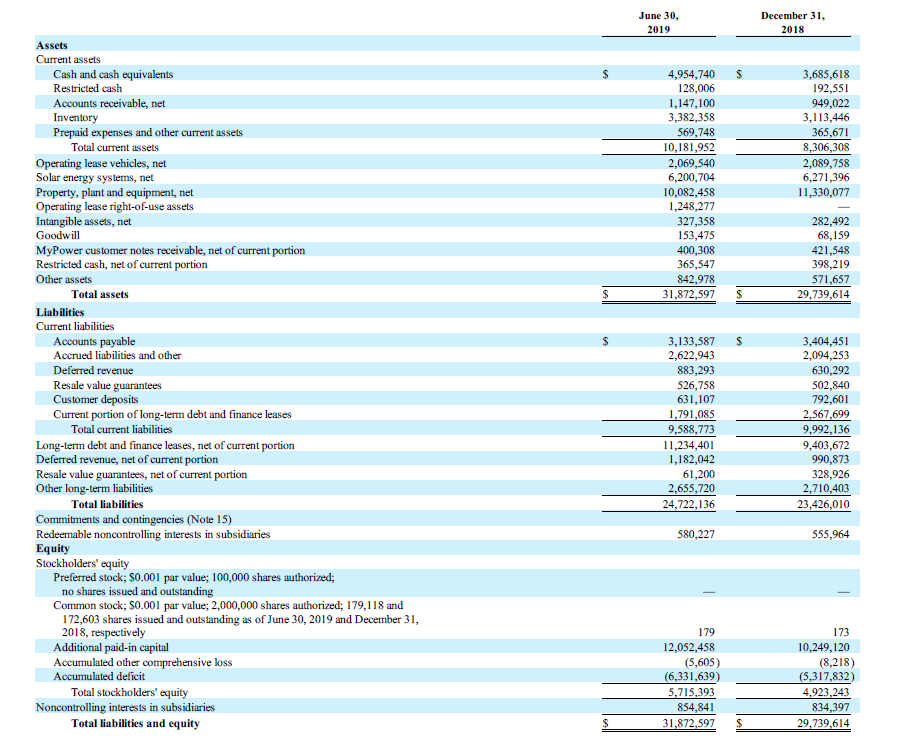

In terms of its financial position, Tesla has a strong balance sheet with a significant amount of cash on hand. As of the end of 2020, the company had $19 billion in cash and cash equivalents, which provides a strong financial foundation for future growth.

Overall, Tesla's financial performance has been a mixed bag. While the company has experienced rapid revenue growth and has achieved profitability in recent years, it has also faced significant losses and financial challenges. Looking forward, the company's financial success will likely depend on its ability to continue to innovate and drive demand for its products, as well as its ability to effectively manage its costs and expenses.