The Baumol model, also known as the Baumol-Tobin model, is a theoretical framework developed in the 1960s by economists William Baumol and James Tobin to explain and predict the demand for cash balances by households and firms. The model suggests that individuals and businesses hold a certain amount of cash as a buffer against unexpected expenses or income fluctuations, and that this demand for cash is influenced by several factors, including the level of income, the opportunity cost of holding cash, and the availability of alternative forms of financial instruments.

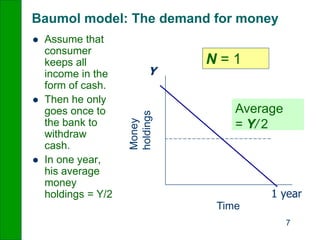

One key insight of the Baumol model is that the demand for cash is a function of the level of income. As income increases, so too does the demand for cash, as individuals and businesses have more disposable income available to them and therefore a greater need for a buffer against unexpected expenses. This relationship is known as the income elasticity of demand for cash.

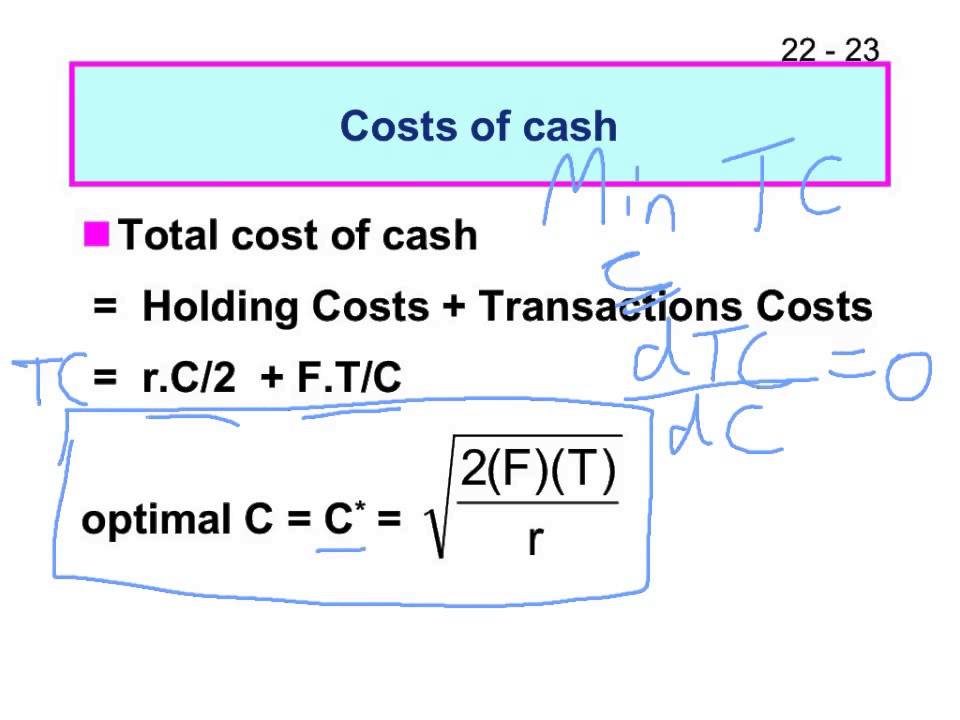

The opportunity cost of holding cash is another important factor that influences the demand for cash according to the Baumol model. This refers to the opportunity cost of not investing cash in alternative financial instruments, such as bonds or stocks, which may offer a higher return on investment. As the opportunity cost of holding cash increases, the demand for cash decreases, as individuals and businesses are more likely to prefer the higher returns available from alternative investments.

Finally, the availability of alternative financial instruments also plays a role in the demand for cash according to the Baumol model. As the number and variety of alternative financial instruments available to individuals and businesses increases, the demand for cash may decrease, as individuals and businesses have more options for managing their financial assets.

Overall, the Baumol model provides a useful framework for understanding and predicting the demand for cash by households and firms. It highlights the importance of income, opportunity cost, and the availability of alternative financial instruments in shaping this demand, and has had a significant influence on economic theory and policy.

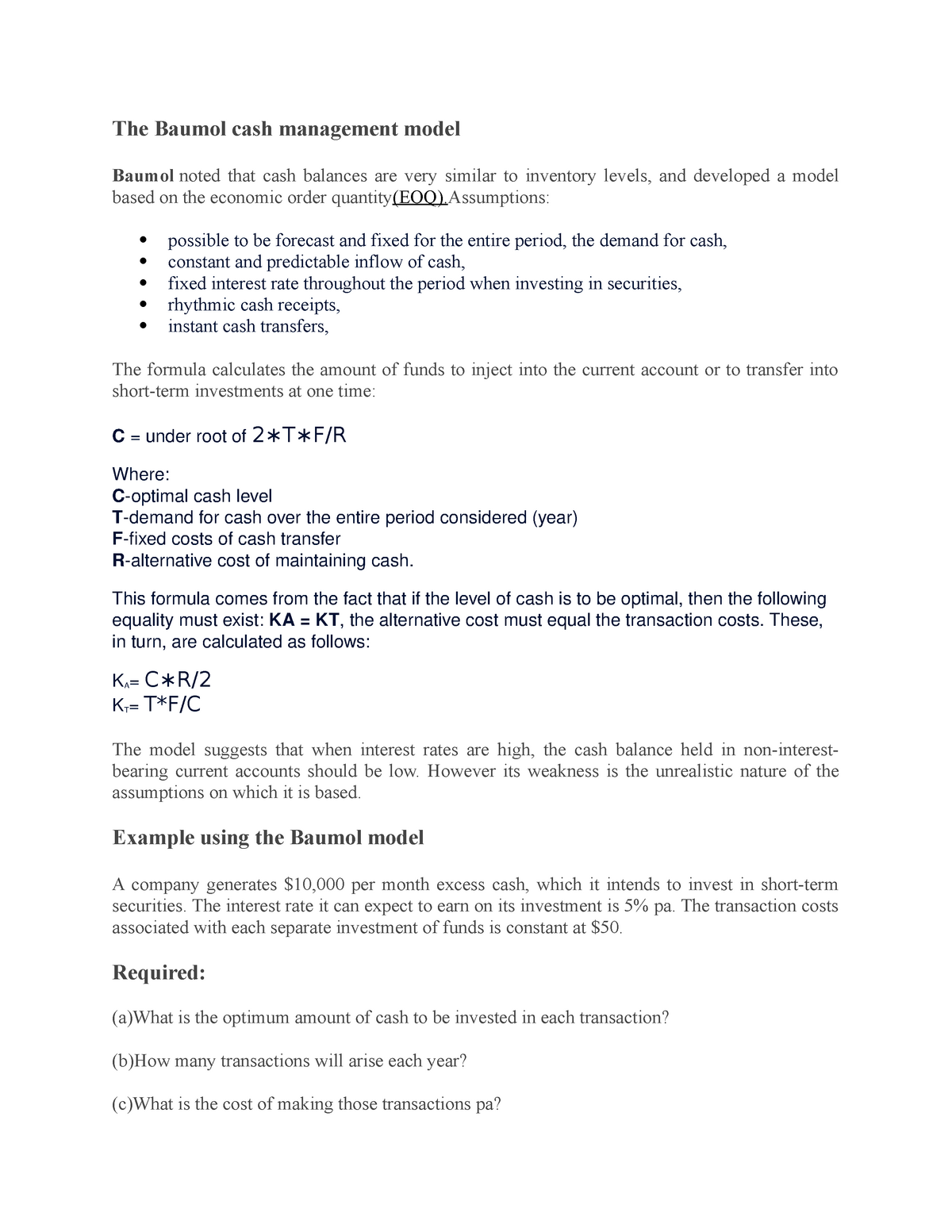

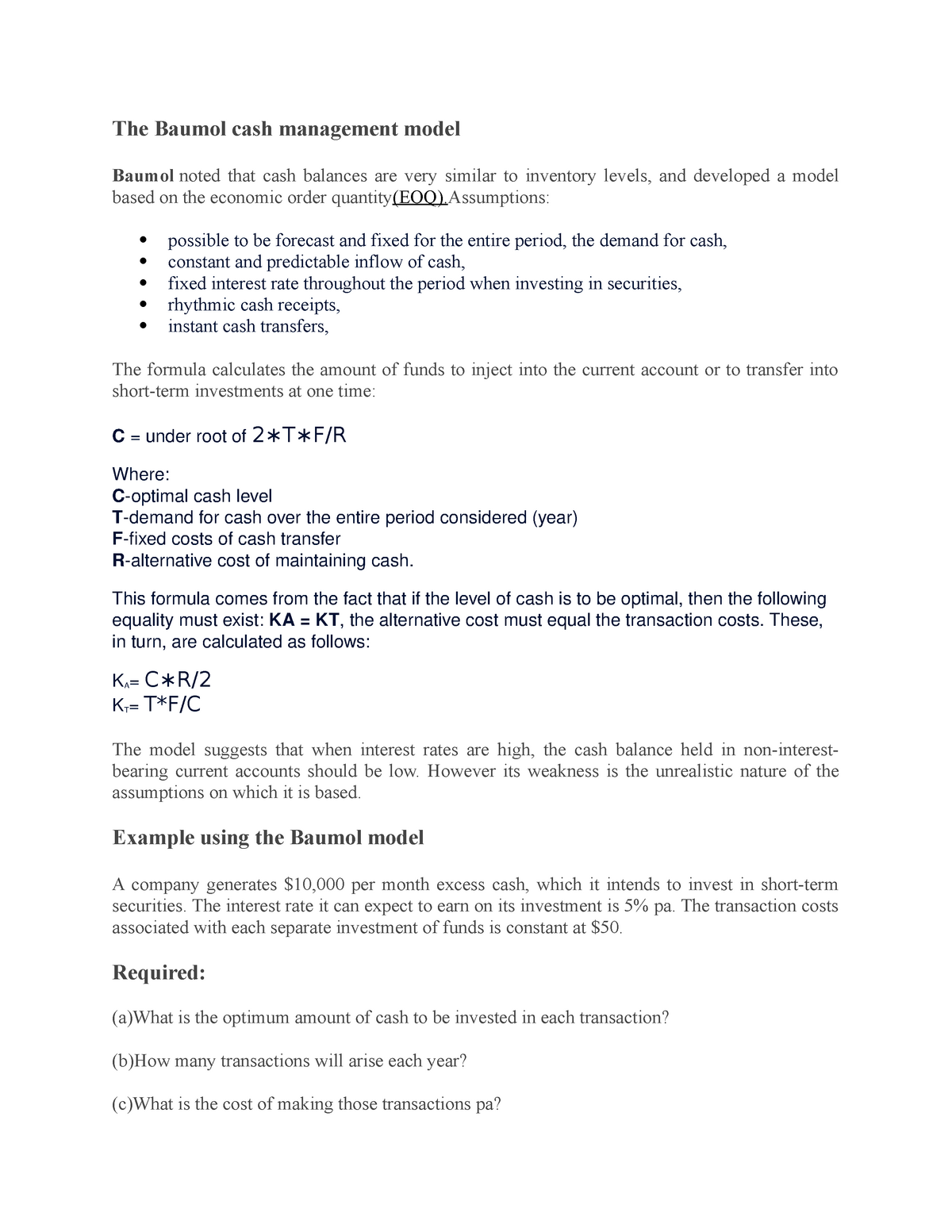

What is Baumol model of cash management?

Competing markets contain only a few large firms, and since there are no regulatory norms, differentiations in costs could only be justified by quality, or pricing. The profit level is also more stable in the Baumol model then in traditional profit-maximizing model. The Baumol model is possibly the simplest and most stripped-down, sensible model for determining the optimal cash position. American Journal of Health Economics. Firms will probably want to hold a safety stock of cash designed to reduce the possibility of a cash shortage or cash-out. Retrieved March 1, 2022.

Baumol

However, criteria such as competitive markets with a cap on pricing, subaddivity and sustainability need to be maintained in order to operate without stricter governance and regulatory measures. In fact, most firms experience both cash inflows and outflows daily. Y gradually over a year. However, as enunciated by Baumol, airlines industry, especially after deregulation, provides classic examples of fly-by-night operators, who entered the market at low pricing fares, make their profits and moved out, almost as quickly as they entered. It is seen that higher fares at hub airports support the argument that feeder traffic may be controlled by two major airliners.

The model of Baumol

Spawned by the development of Management Discretionary theories, which advocated that managers are empowered and are therefore, at liberty to exercise decision making without having to consult ownership, managers may need to make economic decisions that may even have traits of ownership, especially in areas of demand determination, pricing, profits and performance. Rather they are predictable within a range. In the line with this analysis, the model suggests that for a digopolists whose ultimate aim and major feature is sales maximization yet the output does not yield adequate profit, the indifferent managemnmt may opt to choose the output level which guarantees adequate profit even if the required sales maximization lecvel is not attained. According to him, it is the restricted usage of entrepreneurship in the market that has contributed, in no small measure for its present stature. The sales revenue maximizer will earn a lower profit, but produce a greater quantity then the profit maximizer. Retrieved March 25, 2022. However, it might be argued that a theory of innovation based growth needs to take into account the different types of firms that exist, their mutual interaction and the selection processes allowing some firms to grow while others may be forced out of business.

Baumol's cost disease

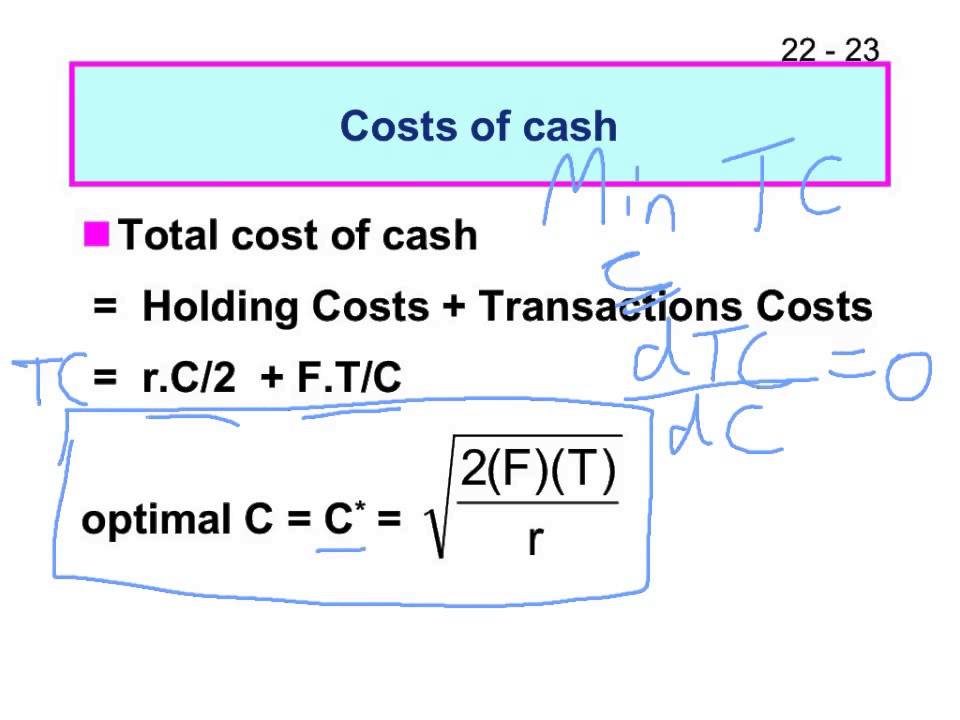

The model is also used in corporate finance by companies to manage the amount of cash the company should hold. Each of them has their specific advantages and disadvantages, and comes with certain restrictions and regulations Lee and Hsieh, 1983, p. Swot Analysis Of Grace Kennedy 904 Words 4 Pages Exposure to credit risk is managed in part by obtaining collateral and corporate and personal guarantees. Empirical studies of money demand find that the income elasticity of money demand is greater than half and the interest elasticity of money demand is less than half. Increase in real income by 10% will lead to an increase in demand for real balance by 5% b Interest elasticity demand for money is half. If workers are equally capable of working in either sector, and they choose which sector to work in based upon which offers a higher wage, then they will always choose to work in the sector that offers the higher wage.

Baumol Model of cash management (500 Words)

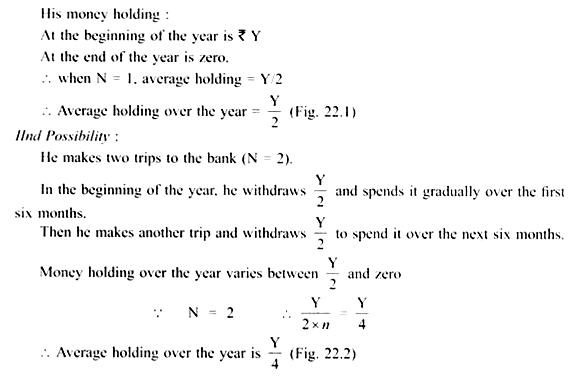

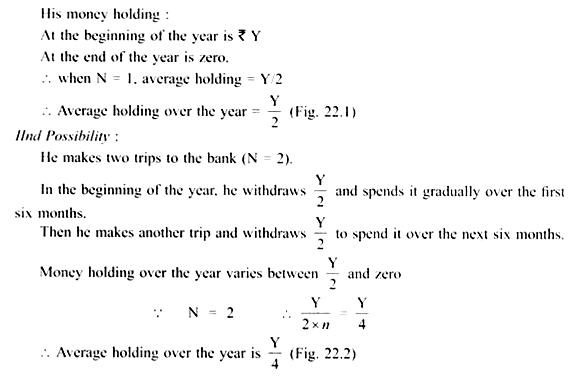

Baumol-Tobin model held that: a Income elasticity of demand for money is half. Retrieved March 1, 2022. Lat does not allow cash flows to fluctuate. In the neoclassical theory of the firm, firms compete based on price, but Baumol argues that innovation has replaced price as the most important factor that lies behind Explaining the Baumol Model of Innovation While acknowledging price competition, Baumol stresses that Baumol suggests that there are five important pre-conditions for the existence of the free market economy which are These pre-conditions are the features of the free market economy. X plans to spend Rs. Cost is the low rate of return and benefit is that, it makes transactions more convenient.

Advantages Of Baumol Model Of Cash Management

It got it final certificate of registration approval in the year 2010 from the securities and exchange board of India regarding the setup and expansion of the business of mutual funds in the country. PDF from the original on October 13, 2021. PDF from the original on March 24, 2022. Thus, Baumol-Tobin model shows that demand for money is not only a function of income level but also the interest rate. At least until we invent robotic professors, teachers, doctors, and nurses, we should expect these low-productivity sectors of the economy to get more expensive.