In Nigeria, the revenue allocation formula is a process by which the country's national revenues are distributed among the various levels of government (federal, state, and local) and among the different sectors (such as education, health, and infrastructure). The formula is an important part of the country's fiscal federalism system, as it determines how much money each level of government and sector receives and how those funds are used.

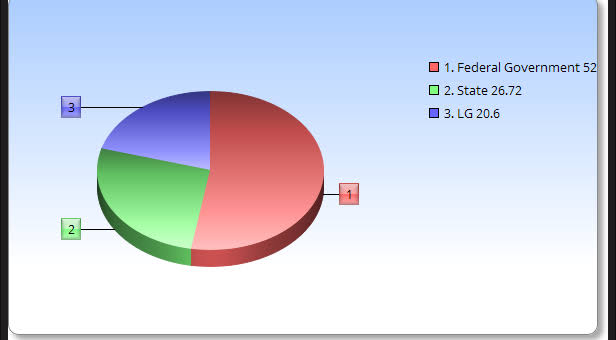

The revenue allocation formula in Nigeria has undergone several changes over the years, with the most recent revision occurring in 2020. The current formula consists of three tiers: the first tier is the allocation of revenue to the federal government, the second tier is the allocation of revenue to the state governments, and the third tier is the allocation of revenue to the local governments.

At the federal level, the largest share of revenue goes towards defense, debt service, and the judiciary. Other sectors that receive a significant share of federal revenue include education, health, and infrastructure.

At the state level, the revenue allocation formula takes into account the population, land area, and internally generated revenue of each state. States with a larger population and land area, as well as those that generate more internal revenue, receive a larger share of the revenue. The revenue allocated to the states is used to fund various sectors, including education, health, and infrastructure.

At the local government level, the revenue allocation formula is based on the population and land area of each local government area. Local governments with a larger population and land area receive a larger share of the revenue. The revenue allocated to the local governments is used to fund various sectors, including education, health, and infrastructure.

The revenue allocation formula in Nigeria has been a source of controversy in the past, as different levels of government and sectors have argued for a larger share of the revenue. However, the current formula has generally been seen as fair and has helped to ensure that all levels of government and sectors receive the funding they need to provide essential services to the people of Nigeria.