Pros of online banking. Online Banking vs. In 2022-10-18

Pros of online banking

Rating:

9,2/10

736

reviews

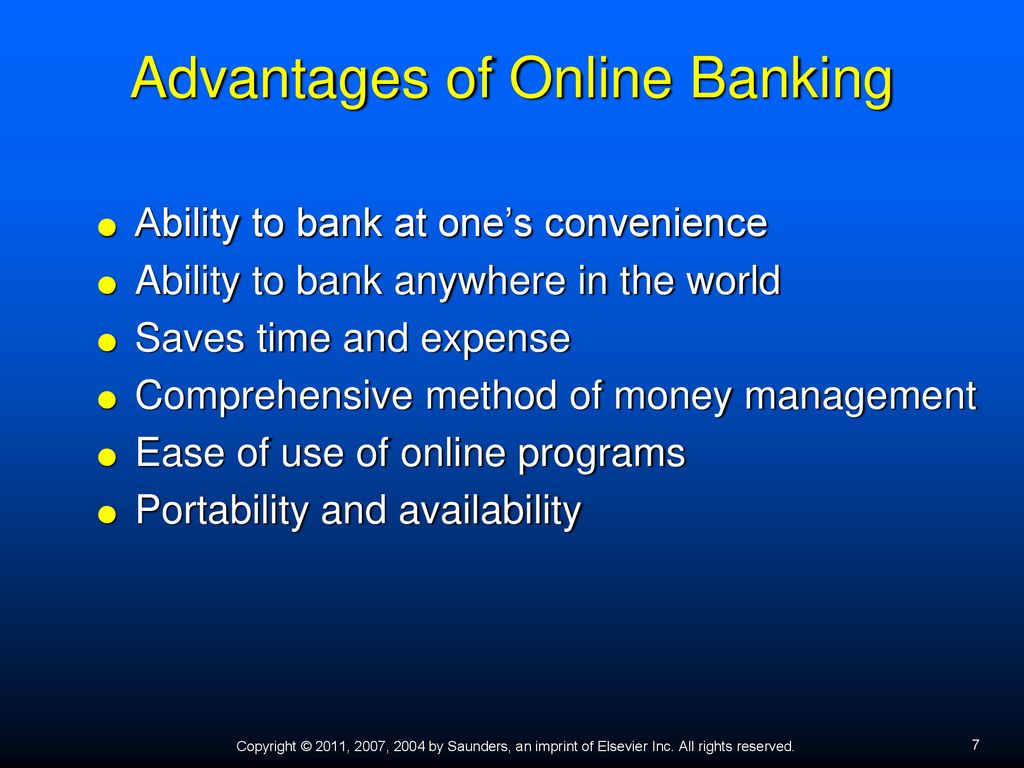

Online banking has become a popular choice for many people in recent years due to the convenience and flexibility it offers. Here are some of the main pros of online banking:

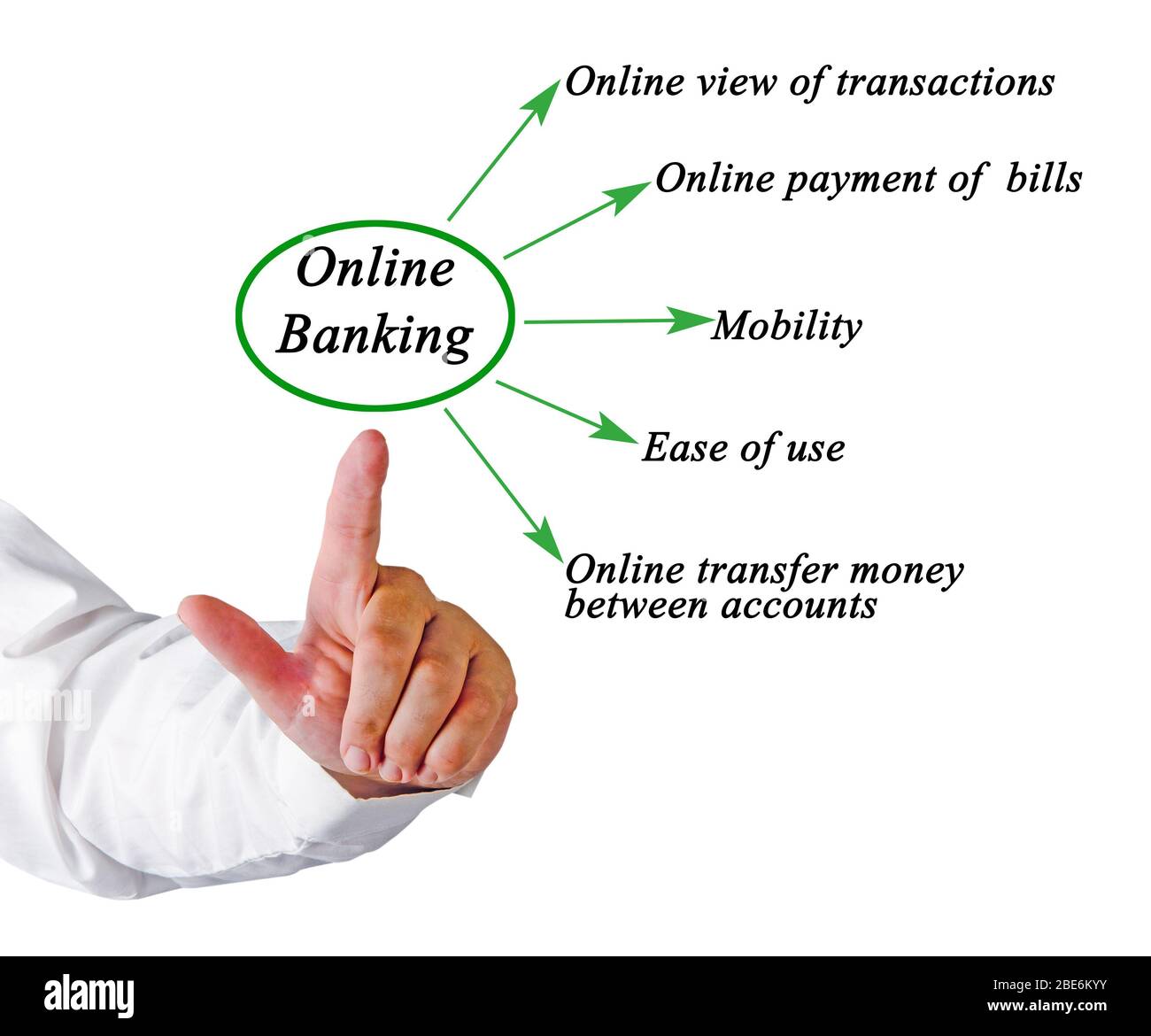

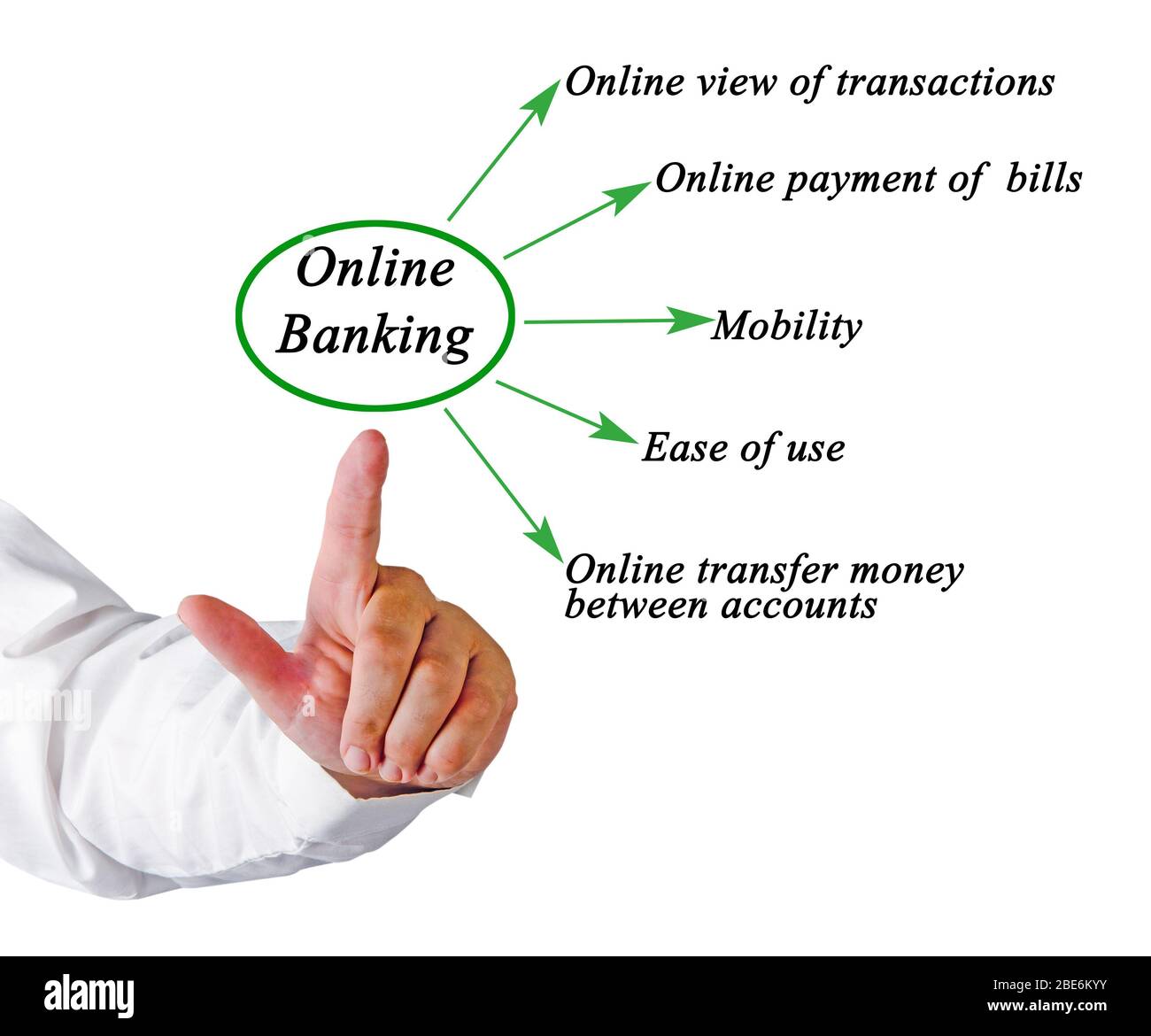

Accessibility: With online banking, you can access your accounts and perform financial transactions anytime, anywhere, as long as you have an internet connection. This is especially useful for people who are always on the go or who don't have a physical bank branch nearby.

Efficiency: Online banking allows you to manage your accounts, pay bills, transfer money, and view statements quickly and easily, without having to visit a bank branch or wait on hold for customer service.

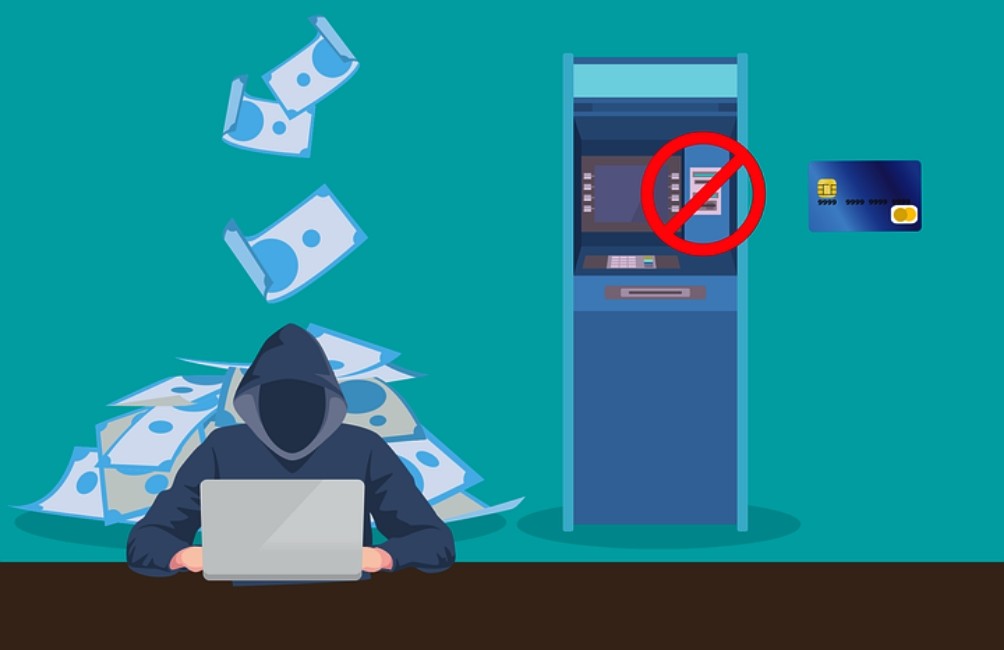

Security: Online banking has advanced security measures in place to protect your personal and financial information. Many banks use multi-factor authentication, encryption, and other security technologies to keep your information safe.

Convenience: Online banking allows you to perform a wide range of tasks from the comfort of your own home or on the go. You can pay bills, transfer money, and view account statements without having to physically visit a bank or write and mail checks.

Extra services: In addition to traditional banking services, many online banks offer additional features such as budgeting tools, financial planning resources, and investment opportunities.

Overall, online banking offers a convenient and efficient way to manage your finances and access a wide range of financial services. While there are always potential risks involved in conducting financial transactions online, the benefits of online banking far outweigh the drawbacks for many people.

Online Banking vs. In

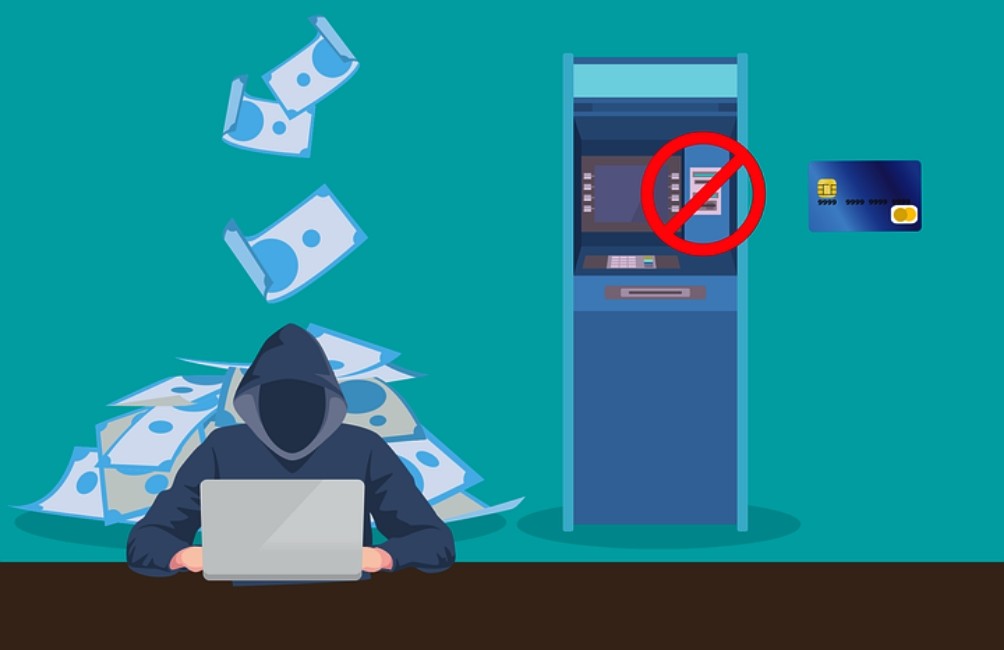

These transactions are now easily performed with a few touches on your mobile device. Potential Technology Problems Although financial institutions strive to keep their online banking systems running at all times, you may experience occasional disruptions to the service. With online-only banks, you may have to do your own research to ensure that they are authorized and registered with the proper regulators, have sufficient capital, and have satisfied clients. But if you have an online store that only takes credit cards or if all your freelance writing payments are made through direct deposit, then online banking is the way to go. The accounts allow you to check your balance regularly. Building a budget There are all types of online banking services that can help you manage your budget.

Next

Pros and Cons Of Online Banks

IS MOBILE BANKING SAFE? Savings accounts tend to have lower minimum balance requirements than checking accounts—and some banks don't require one at all—so you won't have to start out with a lot of money. Of course, you'll want to shop around and read the fine print of any online bank you're considering to make sure it really has eliminated the costs you're trying to avoid. Online banks do allow for cash withdrawals from ATMs, though. ATM transactions now make up only 8% of overall bank transactions. Conclusion The benefits of online banking outweigh its drawbacks. You could be on a business trip or vacation in another state, for example, and quickly review your account balance.

Next

Benefits of Online Banking

Credit card—based businesses will love the availability and affordability of online banking, while cash-based businesses will benefit from simple deposits and plentiful customer service options. Getting started is quick and easy, and in just a few minutes you could be accessing your account online. Or get your business done by closing time. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. A 2011 survey by the American Bankers Association showed that for the third year in a row, most bank customers 62% prefer to do their banking online compared with any other method. Interest rates are variable and subject to change at any time.

Next

Online Banking Advantages: 5 Reasons to Use Mobile or Online Banking

Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. Vimvest Securities has two separate business lines. With these providers, deposits are usually FDIC-insured through partner banks, and accounts often have the low monthly fees and strong rates that many online banks have. Retrieved January 20, 2022, from. We are providing the link to this website for your convenience, or because we have a relationship with the third party. NMLS ID 1617539 California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License 60DBO-74812 Property and Casualty insurance services offered through NerdWallet Insurance Services, Inc.

Next

Pros and Cons of Online Banking: A Comprehensive Guide

Someone who knows you may also be willing to waive an occasional fee. Better Rates Internet banks may offer better rates than your traditional bank. For example, you may be able to earn more interest by keeping money in your online savings account. Data encryption, for example, scrambles all information sent online so that only the sender and recipient can read it. Disclaimer: NerdWallet strives to keep its information accurate and up to date. Traditional banks tend to have more customer support options than their online counterparts.

Next

The Pros and Cons of Online Banking

Traditional banking facilities rarely offer this type of interest. This is easy to do, but it does require that you have multiple bank accounts. Brick-and-mortar banks make it relatively easy to deposit the cash from your food truck or boutique; you just have to visit your local bank to deposit your funds. It just takes a few minutes to register for access to enjoy the freedom and flexibility that online and mobile banking provides. Fortunately, customer service is often good at online banks. Impulse Shoppers Have a Hard Time Budgeting If you are one of those people who like to make impulse purchases, an online bank may not be a good idea for you.

Next

The Pros and Cons of Internet Banking

They will need to have a tax ID number if they are a permanent resident or a Social Security number to get started. But online banks and providers offer primarily mobile access. Banks often also offer check deposits via their mobile apps. Alternatively, you can authorize a payee, such as an electric utility or mortgage provider, to automatically debit the amount of money you owe from your account. Compare that with the national average savings rate of 0. All you need is an internet connection.

Next

The Biggest Pros and Cons of Online Banks

You may have to deposit the money into a local bank branch and transfer it over wirelessly, or may be forced to incur added costs for a money order or to make an in-person deposit with a partner. Most standard or traditional banks offer online account management, so you can handle your banking tasks via the bank website or app. Regular Changes to the Banking Platform Please note that not all banking platforms are the same. You Need a Reliable Internet Connection For online banking to work, it requires a reliable and secure internet connection. Or you can have a portion of your paycheck transferred into savings every pay period, keeping you on track without even thinking about it.

Next