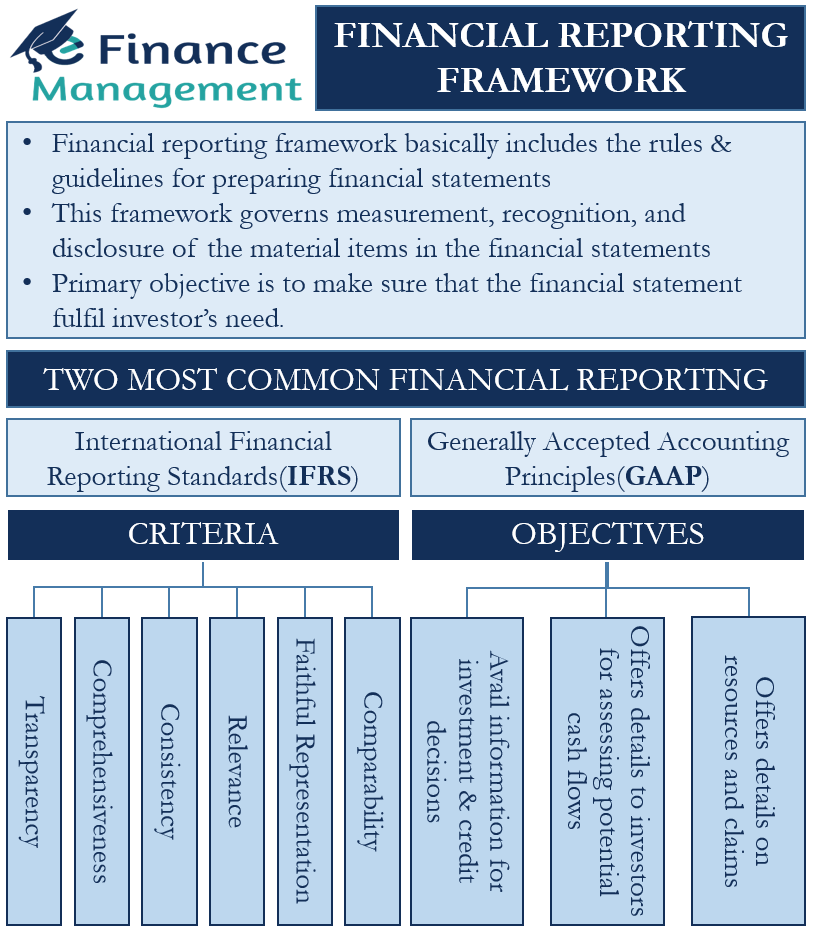

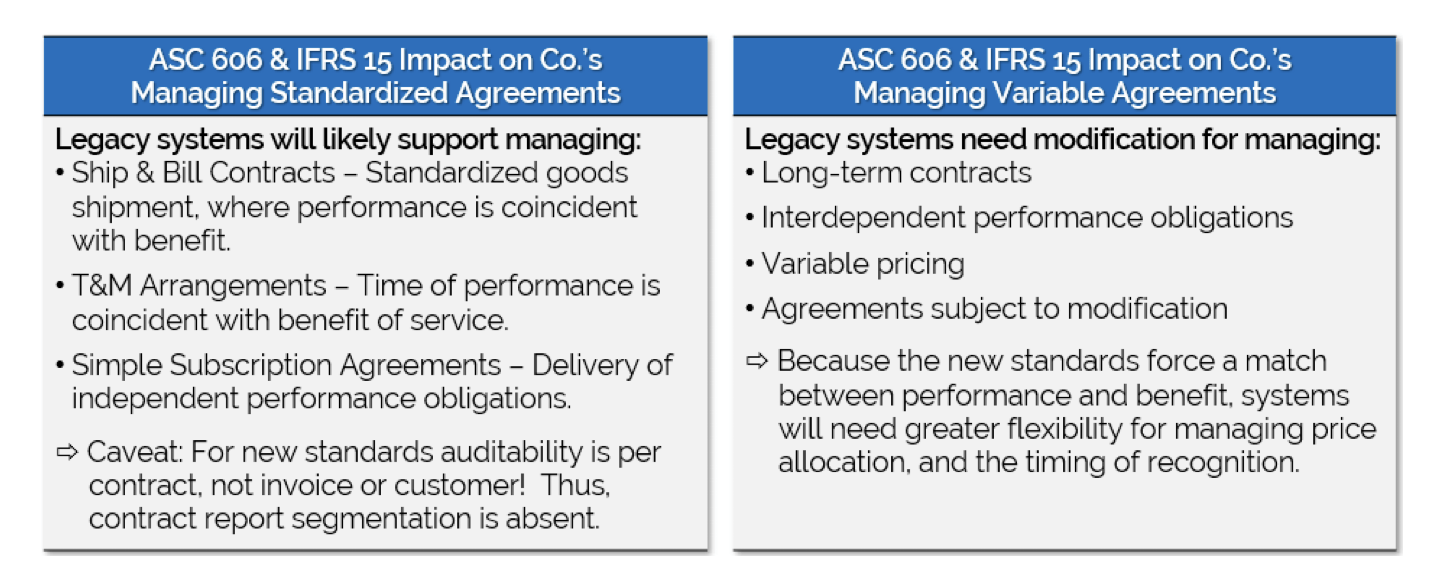

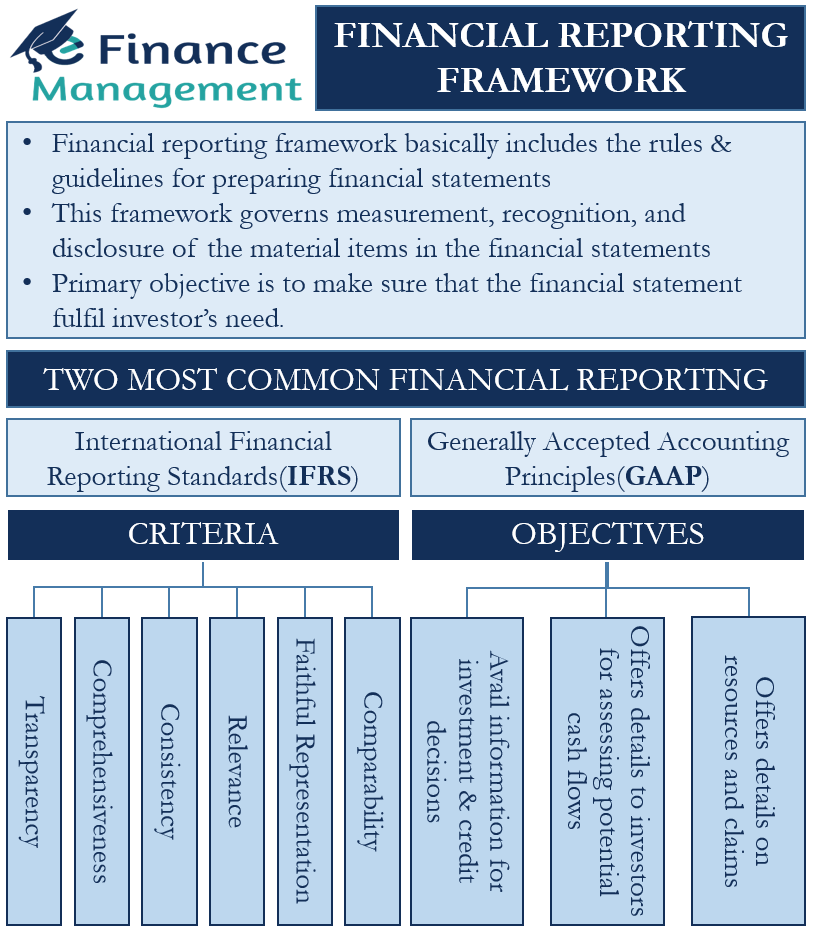

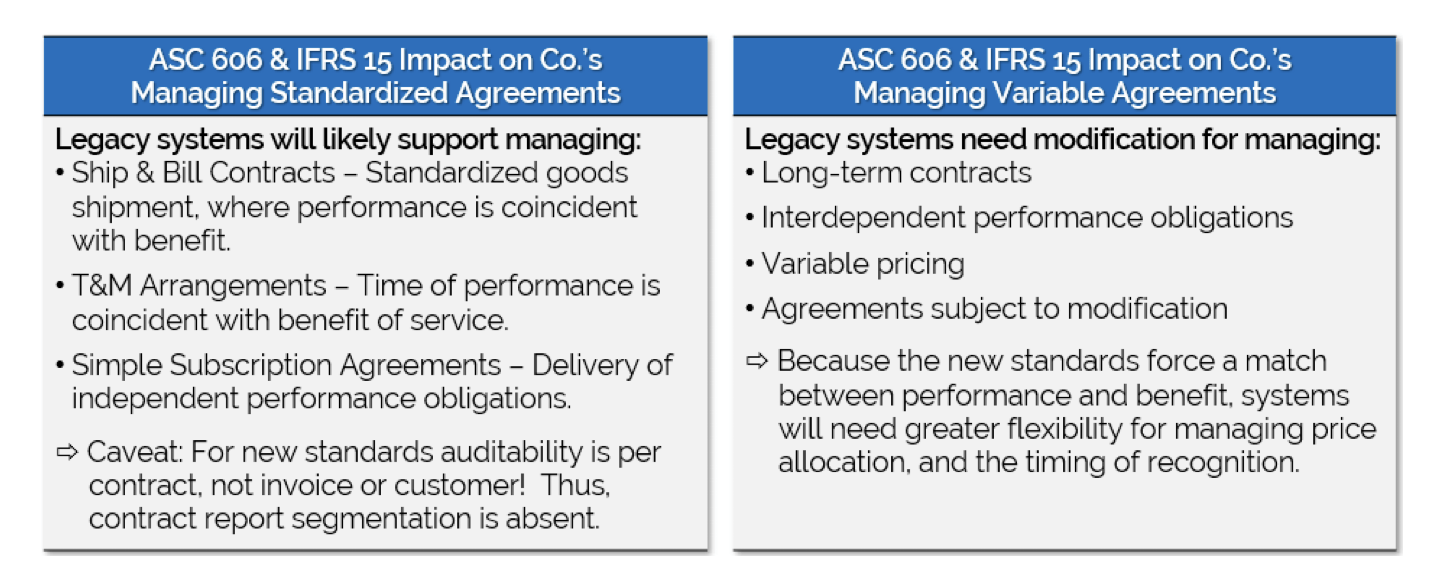

Accounting standards are guidelines and principles that dictate how financial transactions and events should be recorded, reported, and presented in financial statements. These standards serve as a common language and benchmark for financial reporting, enabling investors, creditors, and other stakeholders to understand and compare the financial performance and position of different entities.

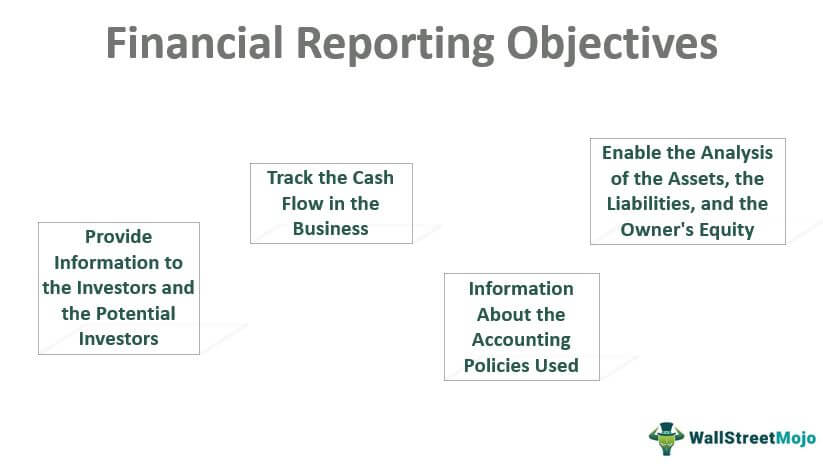

There are several objectives of accounting standards, which include:

Enhancing the comparability and transparency of financial statements: Accounting standards help ensure that financial statements of different entities are prepared using the same methods and principles, enabling users to compare and understand the financial performance and position of different entities. This promotes transparency and helps investors and creditors make informed decisions about the entities they are dealing with.

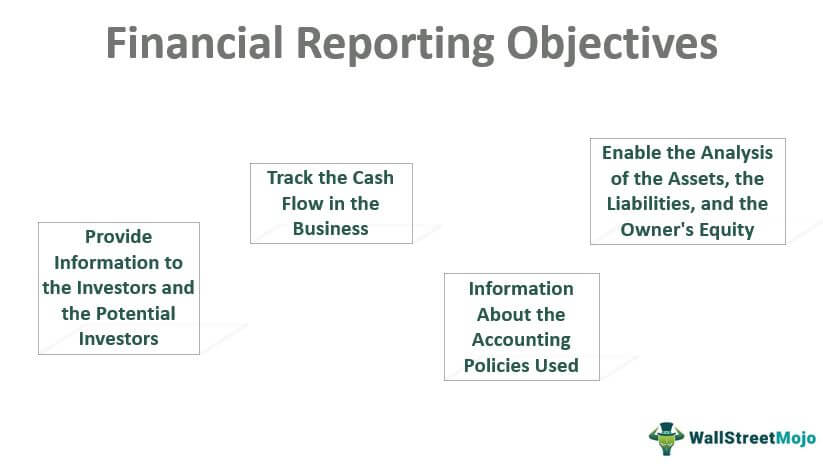

Providing a basis for informed decision-making: Accounting standards provide a framework for financial reporting that helps users make informed decisions about an entity's financial position and performance. By providing a common set of rules and principles, accounting standards help users interpret and compare financial statements of different entities.

Promoting financial stability: Accounting standards help ensure that financial statements provide a true and fair view of an entity's financial position and performance. This helps promote financial stability and reduces the risk of financial fraud and mismanagement.

Facilitating cross-border investment and trade: Accounting standards help ensure that financial statements of different entities are prepared using consistent methods and principles, making it easier for investors and creditors to understand and compare the financial performance and position of entities operating in different countries.

Protecting the interests of investors and creditors: Accounting standards help protect the interests of investors and creditors by providing them with accurate and reliable information about the financial performance and position of an entity. This helps ensure that investors and creditors can make informed decisions about whether to invest in or lend to an entity.

In conclusion, accounting standards play a crucial role in promoting the comparability, transparency, and reliability of financial statements, which helps facilitate informed decision-making, promote financial stability, and protect the interests of investors and creditors.

What are the objectives of Accounting Standards?

To Secure the better financial status in the market Accounting should play a major role in helping the organization find a position in the market. Answer : Accounting Standards play a very important role in financial reporting and play a major part in ensuring that investors can make informed investment decisions. History of International Accounting Standards: International Accounting Standards Committee IASC came into being on 29th June 1973 when 16 accounting bodies viz. Is bookkeeping covered in financial accounting? For example, a temporary difference is created between the reported amount and the tax basis of a liability for estimated expenses if, for tax purposes, those estimated expenses are not deductible until a future year. It is especially important for you to have accounting data when you need to make big decisions because it will guide you to choose the best option.

The Objectives Of Financial Accounting Standards Board

Globally comparable accounting standards promote transparency, accountability, and efficiency in financial markets around the world. Accounting standards are developed by the Accounting Standards Board constituted by the Institute of Chartered Accountantsof India. The following are the objectives of IFRS: To establish a universal language for the companies to prepare the accounting statements. Accounting Standards help entities to disclose information about their business operations so as to make it easier for investors to analyse their performance. Ans: One of the major disadvantages of accounting standards is that they can be restrictive and inflexible.

Summary of Statement No. 109

The International Accounting Standards Board will continue to develop various needed standards which are popularly known as IFRS. For instance, dividend payment impacts cash balance balance sheet and equity statement of changes in equity. The regulatory bodies keep updating the standards to restrict these limitations. To make Decisions Accounting information and financial reports can be challenging or confusing. Answer- Accounting standard is required to improve reliability and bring uniformity in the accounting process. Their main aim is to ensure transparency, reliability, consistency, and comparability of the financial statements. To Detect and prevent frauds 10.

Accounting Standards: Concept, Need, Objectives and Development

ADVERTISEMENTS: However, the reasons for setting the Standards are: a Comparison between two firms is possible if both of them maintain the same principle, otherwise proper comparison is not possible. Potential investors use accounting to decide whether to invest in your company — and how much to invest. Users of financial reports include all of the following except a. The reason causes of European Sovereign Debt occur At least at first glance, the sovereign debt problem is actually a continuation and deepening of the financial crisis. Earlier application is encouraged.

What are the Top 10 Objectives of Accounting? [With PDF]

In Second Phase: It includes companies having a Net worth of Rs. At the time of entering transactions in the accounting system, it must be backed by relevant and reliable supporting evidence. International Accounting Standards IAS : International Accounting Standard Committee IASC : It came into being on 29th June 1973 when 16 accounting bodies Viz. Enacted tax laws and rates are considered in determining the applicable tax rate and in assessing the need for a valuation allowance. So, the first step of the financial accounting process is data entry by identifying transactions involving monetary value. In order to reach this goal, there are a number of financial statements available. Why there is a need for accounting standards Class 11? Kirkpatrick, Chairman of the Board of IASC, delivered to the members of the Institute of Chartered Accountants, Ireland, is quite significant.

Accounting Standards (AS): Objectives, Benefits and Limitations

All financial information i. How Accounting helps in Decision Making? Related Party Disclosures 19. Despite the fact that financial reports and accounting can seem time-consuming and confusing, they are vital for running a business. The Financial Accounting Standards Board FASB is an independent organization that exists in the private sector. Therefore, the standards which are set by IASC are meant for universal acceptance. Ideally, the balance sheet should provide this information.

Objectives of Accounting Standards

The AS does not provide guidelines for the appropriate choice. Your financial status can help you get financing through loans or from investors if you have a creditworthy and reliable financial standing. Following these standards will allow for inter-firm and intra-firm comparisons. However, IASC issued the following International Accounting Standards till to date: ADVERTISEMENTS: IAS 17 — Accounting for Leaves. Till 1st January 2004, International Accounting Standards have been issued by IASC.

International Accounting Standards: History and Objectives (IASC)

Decision Regarding Business operations You can use accounting to make better decisions about your general day-to-day operations. The policies are used in the preparation of financial reports. It will not just affect the owners but also shareholders, investors and creditors. Deferred Tax Consequences of Temporary Differences Temporary differences ordinarily become taxable or deductible when the related asset is recovered or the related liability is settled. Accounts should provide up-to-date information on the financial conditions of the enterprise on a regular basis. To make Decisions 5. Hence, to calculate accurate tax liability, the business needs to extract detailed financial records for income, expenses, liability, assets, equity, etc.