E-banking, also known as electronic banking or online banking, refers to the use of electronic means, such as the internet and mobile devices, to conduct financial transactions and access banking services. In the digital age, e-banking has become an essential part of modern banking and has revolutionized the way people interact with their financial institutions.

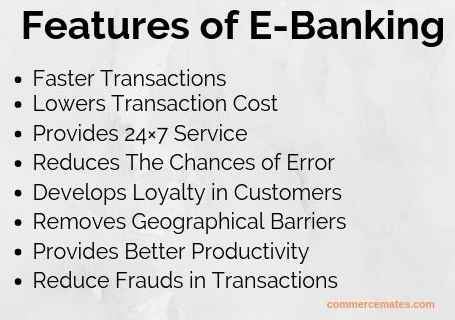

There are several reasons why e-banking is important and necessary in today's world.

First and foremost, e-banking provides convenience and accessibility to banking services. With e-banking, customers can conduct financial transactions and access their account information anytime and anywhere, as long as they have an internet connection. This eliminates the need to visit a physical branch or ATM and allows customers to manage their finances on their own schedule. E-banking also enables customers to set up automatic payments and transfers, which can help them stay on top of their bills and budget.

E-banking also helps financial institutions reduce costs and improve efficiency. By providing online services, banks can save on the cost of maintaining physical branches and ATMs, as well as the cost of hiring and training staff to handle in-person transactions. E-banking also allows banks to process transactions faster, as they can be completed electronically without the need for physical paperwork.

In addition to the benefits for customers and financial institutions, e-banking also has the potential to contribute to economic growth and development. By making financial services more accessible and efficient, e-banking can help to increase financial inclusion, particularly in developing countries where access to traditional banking services may be limited. E-banking can also facilitate cross-border transactions and international trade, which can stimulate economic growth.

Despite the many advantages of e-banking, it is important to note that it is not without risks. The use of electronic means to conduct financial transactions exposes customers to the risk of cyber attacks and data breaches. Financial institutions must therefore take measures to protect their systems and customers' personal and financial information. Customers should also be vigilant in protecting their own information, such as by using strong passwords and being cautious when clicking on links or downloading attachments.

In conclusion, e-banking is a vital and necessary part of modern banking. It provides convenience, accessibility, and efficiency for both customers and financial institutions, and has the potential to contribute to economic growth and development. While it is important to be aware of the risks associated with e-banking, the benefits far outweigh the potential risks, and e-banking will continue to play a crucial role in the financial world.