A mixture of debt and equity, also known as hybrid financing, refers to the use of both debt and equity instruments to finance a company's operations and growth. This type of financing can offer a number of benefits to companies, including the potential for lower interest rates, greater flexibility in terms of repayment, and the ability to raise capital without diluting ownership stakes.

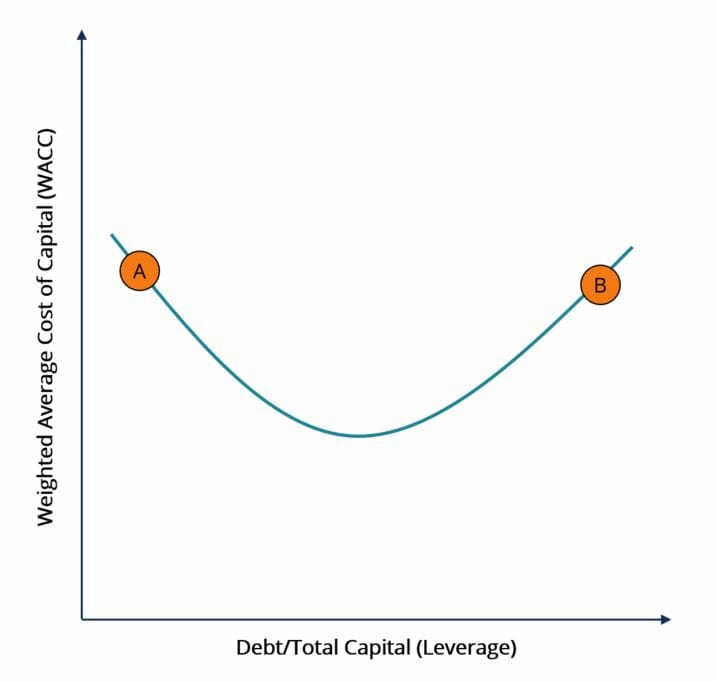

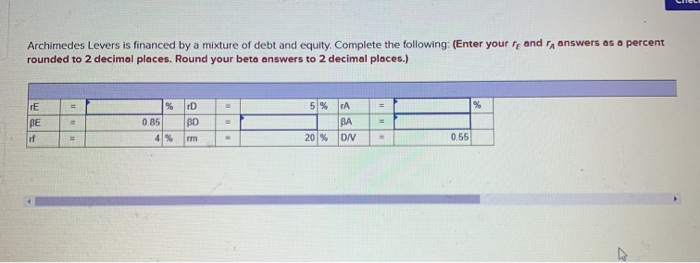

One of the main advantages of using a mixture of debt and equity is the potential for lower interest rates. Debt financing, such as loans and bonds, typically carries a lower interest rate than equity financing, such as the sale of stocks or the issuance of new shares. By using a combination of debt and equity, a company can potentially access lower interest rates, which can help to reduce the overall cost of financing.

Another benefit of hybrid financing is greater flexibility in terms of repayment. Debt instruments often have strict repayment terms and schedules, which can be inflexible for companies experiencing financial difficulties or rapid growth. On the other hand, equity instruments do not typically have fixed repayment terms, and the shareholders who provide the equity capital do not expect to receive a fixed return on their investment. By using a mixture of debt and equity, a company can benefit from the flexibility of equity financing while still accessing the lower interest rates of debt financing.

In addition to these benefits, hybrid financing can also help companies to raise capital without diluting ownership stakes. When a company issues new shares of stock to raise capital, the ownership of the company is diluted among a larger number of shareholders. This can be disadvantageous for existing shareholders, who may see their ownership stake and influence in the company reduced. By using a mixture of debt and equity, a company can raise capital without issuing new shares of stock, which can help to preserve the ownership stakes of existing shareholders.

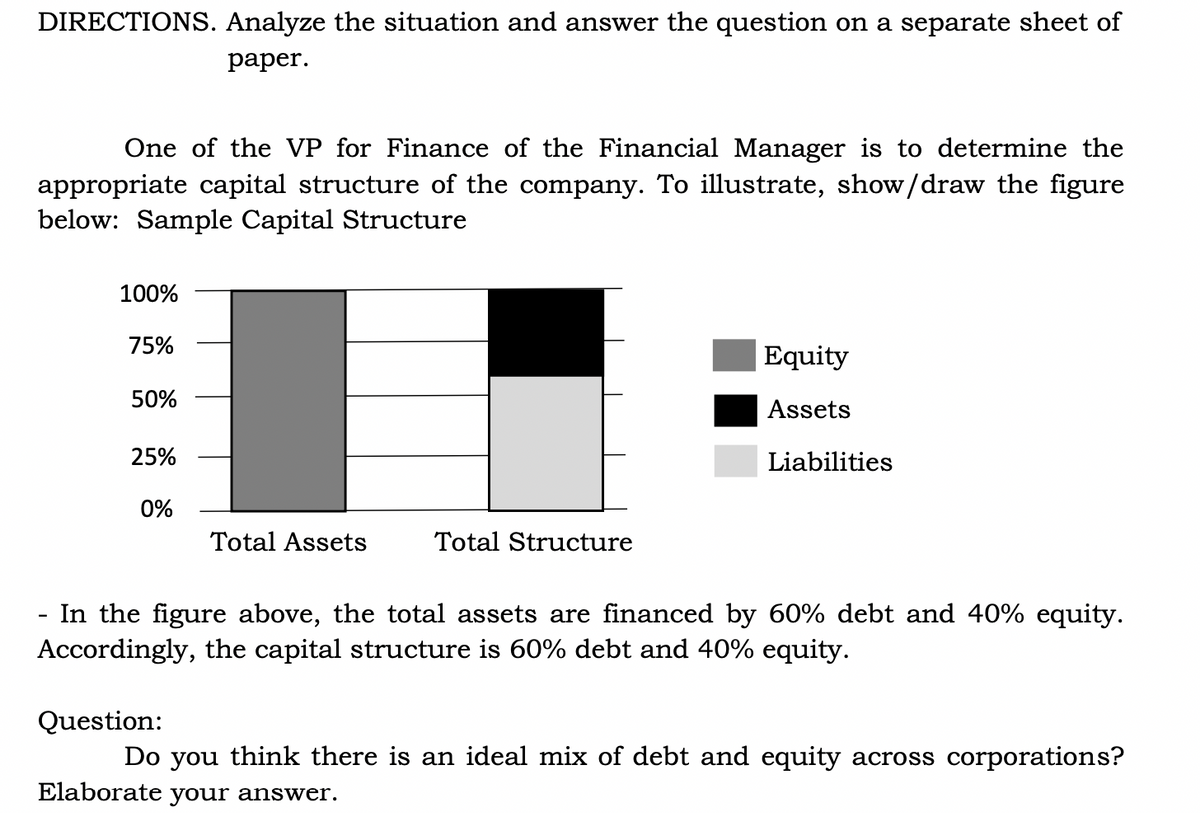

While hybrid financing can offer a number of benefits, it is important for companies to carefully consider the balance between debt and equity in their financing mix. Too much debt can increase a company's financial risk and make it vulnerable to financial difficulties if it is unable to make timely debt payments. On the other hand, too much equity can dilute ownership stakes and reduce the potential returns for shareholders. Finding the right balance between debt and equity can help companies to access the benefits of both types of financing while minimizing financial risk.