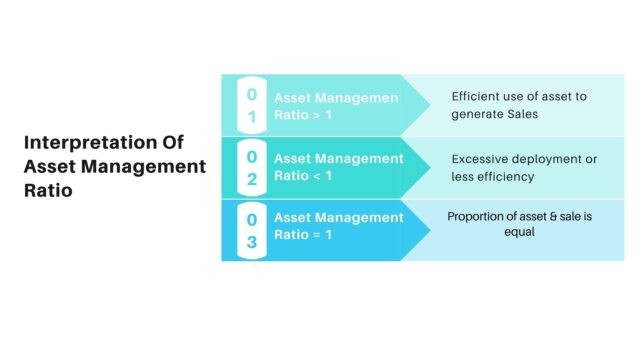

Management efficiency ratios are a set of financial metrics used to evaluate the effectiveness of a company's management in using its resources to generate profits. These ratios measure how efficiently a company is using its assets, liabilities, and equity to generate sales and profits. In other words, management efficiency ratios show how well a company is able to utilize its resources to achieve its financial objectives.

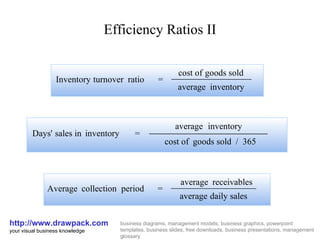

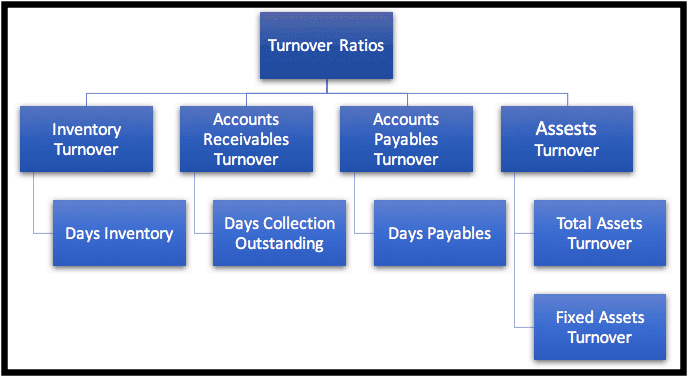

There are several different management efficiency ratios that can be calculated, each of which measures a specific aspect of a company's management efficiency. Some of the most common management efficiency ratios include the inventory turnover ratio, the accounts receivable turnover ratio, and the fixed asset turnover ratio.

The inventory turnover ratio measures the number of times a company's inventory is sold and replaced over a given period of time. A high inventory turnover ratio indicates that a company is able to quickly sell its inventory and replace it with new products, which can be a sign of efficient inventory management. On the other hand, a low inventory turnover ratio may indicate that a company is having difficulty selling its inventory, which can lead to excess inventory and increased carrying costs.

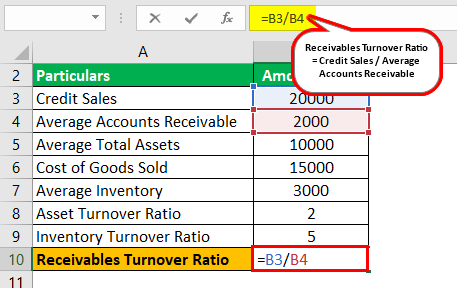

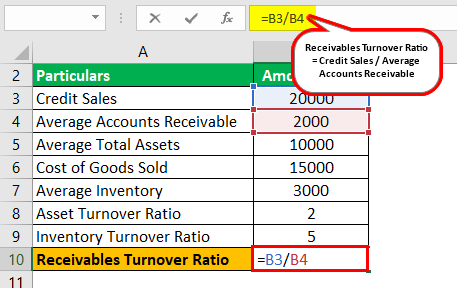

The accounts receivable turnover ratio measures the number of times a company's accounts receivable are collected over a given period of time. This ratio is an indication of how quickly a company is able to collect payments from its customers. A high accounts receivable turnover ratio suggests that a company is able to efficiently manage its accounts receivable and collect payments in a timely manner. A low accounts receivable turnover ratio, on the other hand, may indicate that a company is having difficulty collecting payments from its customers, which can lead to cash flow problems.

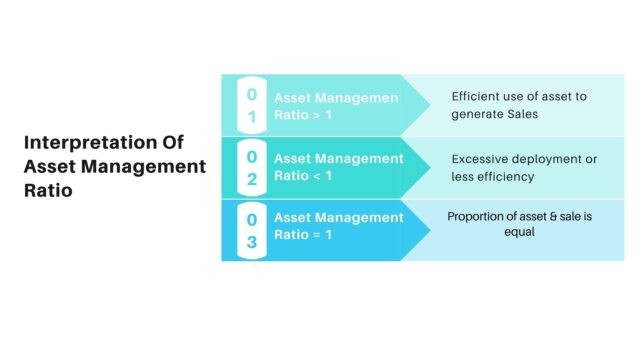

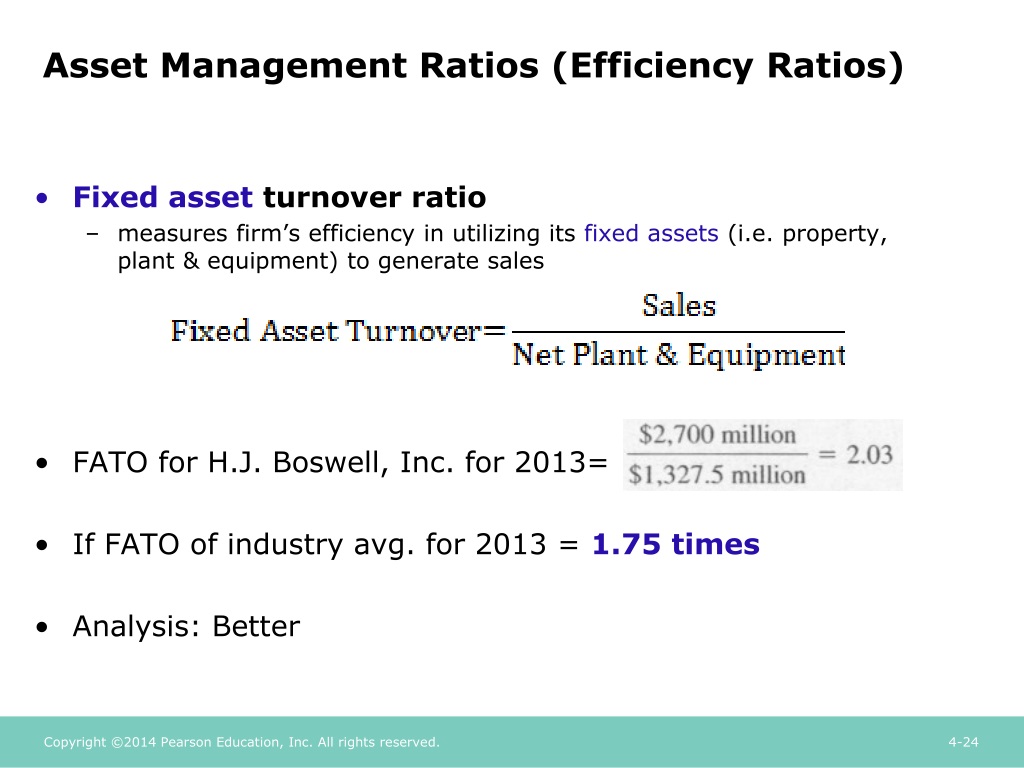

The fixed asset turnover ratio measures the amount of sales a company generates per dollar of its fixed assets. This ratio is an indication of how efficiently a company is using its fixed assets, such as machinery, equipment, and buildings, to generate sales. A high fixed asset turnover ratio suggests that a company is able to effectively utilize its fixed assets to generate sales, while a low fixed asset turnover ratio may indicate that a company is not using its fixed assets efficiently.

In conclusion, management efficiency ratios are a useful tool for evaluating the effectiveness of a company's management in using its resources to generate profits. By analyzing these ratios, investors and financial analysts can get a better understanding of a company's management efficiency and make more informed investment decisions.

Financial Ratios

It compares the amount of sales over the fixed assets. The comparison must be made over the same time periods. The formula for EM can be written as: 6. To improve your financial efficiency, you need to find opportunities to optimize any and all aspects of your business, from customer communications to the daily tools and processes that drive your business. Businesses use efficiency ratios, investors, lenders, and others to evaluate the performance of companies and determine their relative strengths and weaknesses. The firm might have a large CT ratio and be very liquid, but liquid assets are unlikely to generate a high rate of return or profits.

Efficiency Ratio: Definition, Formula, and Example

Ratios like accounts payable turnover ratio and fixed asset turnover ratio, on the other hand, indicate better cash flow the higher they are. The greater the number of days, the longer it takes to sell its inventory. Calculate average accounts receivable by using the accounts receivable figure at the start and end of a period and then dividing by two. In particular, leaders must look at the operating ratio along with other financial numbers and watch efficiency ratios over time. How Efficiency Ratios Are Used in Financial Analysis Analysts use the operating ratio and other efficiency ratios to judge the financial health of companies. To survive in the long term, the firm must be profitable and solvent. Finally, the DS ratio in contrast to the TIE ratio adds depreciation to EBIT because depreciation is a non-cash expense.

6.2 Operating Efficiency Ratios

:max_bytes(150000):strip_icc()/ratioanalysis-Final-3016e15988024ae99e10982c28e7bb79.png)

Significant in arriving at an overall financial strengths and weaknesses score of 2. However, it excludes all the indirect expenses incurred by the company. Managers may want to decrease their on-hand inventory to free up more liquid assets to use in other ways. Ratios and points in time measures. In the case of HQN, we assign to it a strengths and weaknesses score of 2. Financial efficiency ratios measure how efficiently a business can turn product physical inventory, software, or otherwise , total assets, and similar into profit. Here, we consider two key leverage ratios: 1 debt-to-equity ratio DE and 2 equity multiplier ratio EM.

Management Efficiency Ratios: Burger King vs. McDonalds

Perhaps inventory levels were too high because you overstocked. Efficiency Ratios for Banks In the banking industry, an efficiency ratio has a specific meaning. This ratio determines how many times i. A high turnover rate can be achieved by minimizing inventory levels, using a just-in-time production system, and using common parts for all products manufactured, among other methods. Step 2: Calculate average Total Assets Total Assets is the sum of a company's current and noncurrent assets. It is also necessary to maintain work-in-process in front of bottleneck operations, to ensure that they never run out of work. Efficiency ratios, also known as activity ratios, are used by analysts to measure the performance of a company's short-term or current performance.

:max_bytes(150000):strip_icc()/ratioanalysis-Final-3016e15988024ae99e10982c28e7bb79.png)