4 main functions of money. What Are The 4 Main Functions Of Money? 2022-10-24

4 main functions of money

Rating:

9,3/10

1324

reviews

Money plays a central role in modern economies and serves several important functions. These functions can be grouped into four main categories:

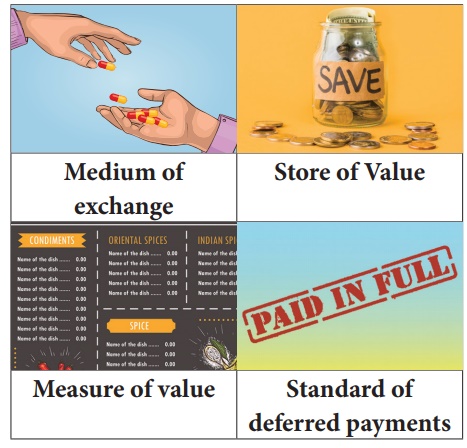

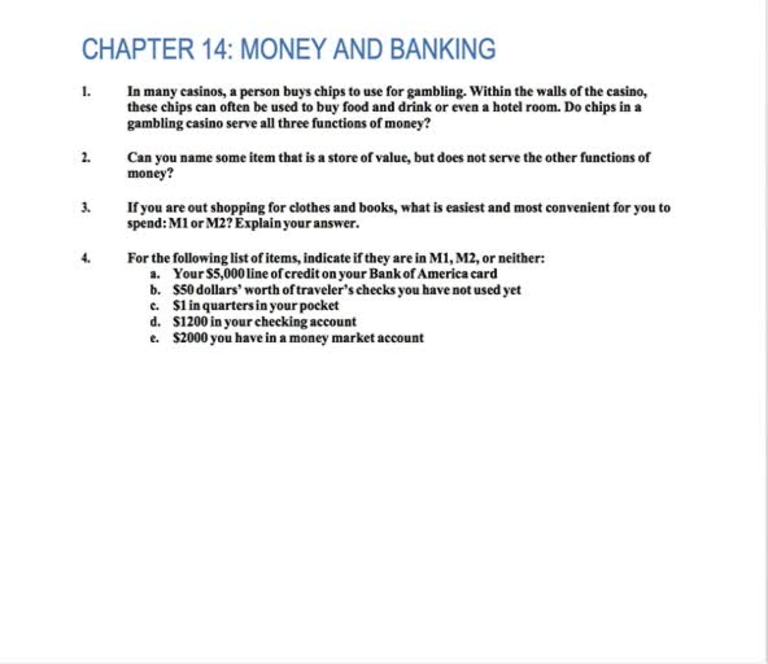

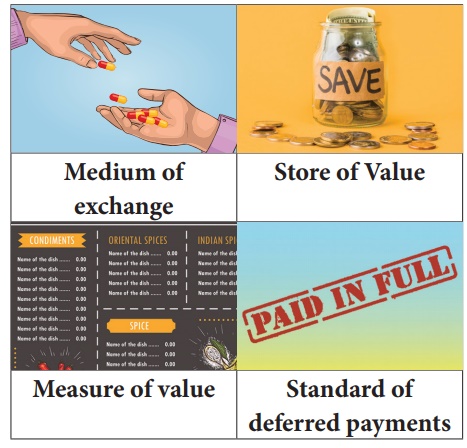

Medium of exchange: Money serves as a medium of exchange, meaning that it is used as a way to buy and sell goods and services. When money is accepted as a medium of exchange, it eliminates the need for bartering, which can be cumbersome and inefficient. For example, if you want to buy a television, you can simply exchange money for the television rather than trying to find someone who has a television and is willing to trade it for something you have.

Store of value: Money also serves as a store of value, meaning that it can be saved and used to make purchases in the future. When money holds its value over time, it allows people to save and plan for the future. This is important because it enables people to smooth out their consumption over time, rather than being forced to consume all of their resources immediately.

Unit of account: Money serves as a unit of account, meaning that it is used to measure the value of goods and services. This allows people to compare the relative value of different goods and make informed decisions about what to buy. For example, if a television costs $500 and a car costs $20,000, it is clear that the car is much more expensive than the television.

Standard of deferred payment: Money also serves as a standard of deferred payment, meaning that it is used to facilitate transactions that involve borrowing and lending. For example, if you want to buy a house but do not have enough money to pay for it upfront, you can take out a mortgage and pay the lender back over time. Money makes this type of deferred payment possible by serving as a common denominator that can be used to compare the value of different goods and services.

In summary, money serves several important functions in modern economies. It is a medium of exchange, a store of value, a unit of account, and a standard of deferred payment. These functions make money a crucial component of the economic system, facilitating trade and allowing people to plan for the future.

What Are The 4 Main Functions Of Money?

It is a medium of exchange. It, in essence, means that Person A loaned the use of the goods and services that person B purchased, even though he did not originally own the goods and services. Store of value refers to the ability of an asset to hold its purchasing power over time. In case the value of money is changing very much, the creditors or debtors will be put to much loss and sufferings. Essay on Money: Meaning and Main Functions of Money For it to be considered money, it must have value for a long period, meaning that you can still buy goods and services with it.

Next

The main functions of money. Reading: The Functions of Money. 2022

Money has overcome thedrawbacks of barter system in the following manners: a Medium of exchange i Under barter system, there is lack of double coincidence of wants. Store of value For money to serve as a store of value, it should be reliably saved for future use and be used as a medium of exchange when it is retrieved. As with precious stones, money has a significant value to people and a country's economy in general. For something to be considered money, it must be a unit of account, a medium of exchange and a store of value. Money Definition and Function Think about it; if it weren't for money, there wouldn't be a good way to trade for goods and services to meet your needs.

Next

4 Essential Functions of Money

Census Bureau, 2011 , there are more than three hundred million people in the United States. The use of money as a medium of exchange overcomes the drawbacks of barter. In a market situation such as this, it is difficult to get the wants of those exchanging goods to coincide due to conflicting interests. What is money and function? Why money is important in economy? It should be convenient for consumers to carry smaller quantities of the commodity when purchasing goods and services from retail stores. It includes only notes, coins and demand deposits as money.

Next

Money

By serving as a very convenient medium of exchange money has made possible the complex division of labour or specialization-in the modern economic organisation. Suppose, a shopkeeper likes to pay ten kilograms of detergent to his workers as wages. As the value of all goods and services is measured in a standard unit of money, their relative values can be easily compared. For example, to buy a house, Tony has written a check for 500,000 dollars, which he is now carrying around in his wallet. What are the 4 main functions of money? The value of either item can be higher or lower, meaning that the buyer or seller can both lose from this transaction. Money has removed this difficulty.

Next

Top 4 Functions of Money

Durability The materials used in making money are long lasting. In reality the significance of credit has increased so much that it will not be improper to call it as the foundation stone of modem economic progress. Is store of value a function of money? Not consenting or withdrawing consent, may adversely affect certain features and functions. However, it is important to note that gold itself is not considered money because it lacks the characteristics of money such as portability and durability. As the value of all goods and services is measured in a standard unit of money, their relative values can be easily compared. Characteristics of Money The four main characteristics of money are durability, divisibility, transportability, and non-counterfeit as seen in Figure 2. Measure of Value: Another important function of money is that it serves as a common measure of value or a unit of account.

Next

😍 Four main functions of money. Functions of Money. 2022

Medium of exchange: The most important function of money is that it acts as a medium of exchange. They are not required to wait for, say ten years, so as to be able to save enough money to buy costly items like cars, refrigerators, T. That is because, in times of crisis, currencies lose value quickly, and the purchasing power drop. Note: In C-C Economy C stands for commodity. It is a medium of exchange, a unit of account, and a store of value: Medium of Exchange: When money is used to intermediate the exchange of goods and services, it is performing a function as a medium of exchange. In the barter economy a great difficulty was experienced in the exchange of goods as the exchange in the barter system required double coincidence of wants.

Next

What are the 4 main functions of money?

The technical storage or access is strictly necessary for the legitimate purpose of enabling the use of a specific service explicitly requested by the subscriber or user, or for the sole purpose of carrying out the transmission of a communication over an electronic communications network. A measure of Value — The value of a product or service is determined on the basis of the money needed for its possession. In addition to these two main functions, money also serves as a store of value. What is the nature of money? As money acts as a unit of account it has greatly reduced the number of exchange rates. An unstable commodity will require frequent re-evaluation to determine its actual value in successive transactions. We all desire it, work for it, and consider it.

Next

Money Functions: Top 4 Functions of Money

These four functions of money can be expressed with the help of the following couplet: Money is a matter of functions four. What are the three basic functions of money? Functions of Money 2: Unit of Accounting Money, as a unit of accounting, provides a straightforward means of recognizing and conveying value. Another key function of money is as a unit of account. The person asked John for a two-hundred-dollar deposit via credit card in order to reserve his package. This means that it can be saved, rather than being spent immediately, and it retains its value over time. If money may be used to make purchases now, it must also be possible to make purchases that will be paid for later.

Next

Functions of Money

She then sells her gold bars and makes enough money to make the purchase. C-C exchange refers to barter system of exchange. That is, each party to the exchange must have precisely what the other party requires, and in appropriate quantity and at the time required. Further, all parties involved in the transactions must accept it. A unit of account is required when formulating legal agreements that involve debt. Narrow definition of money: Functional definition of money is a narrow definition of money. Top 6 Functions of Money Money is a commodity accepted by general consent as a medium of economic exchange.

Next

What are the four main functions of money? Describe each function.

This means that money is a sort of common denominator, through which the exchange value of all goods and services can be expressed without any difficulty. Money, like bonds, government securities etc. Primary or main functions 2 Secondary functions l. A five-dollar note can be split into five one-dollar notes. In the barter economy a great difficulty was experienced in the exchange of goods as the exchange in the barter system required double coincidence of wants. The aspect of money being countable makes it useful to account for losses, profits, and debt. When the commodity is non-recognizable, the parties in the transaction will incur 5.

Next