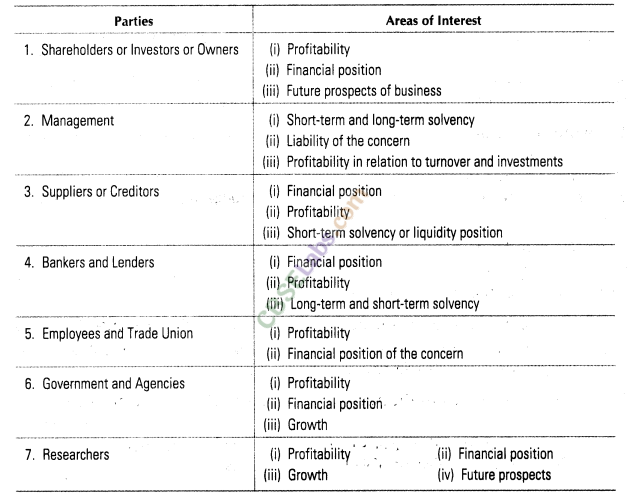

A balance sheet and an income statement are two important financial statements that provide a snapshot of a company's financial health and performance. Together, these statements give investors, creditors, and other stakeholders a clear understanding of the company's assets, liabilities, and financial activities.

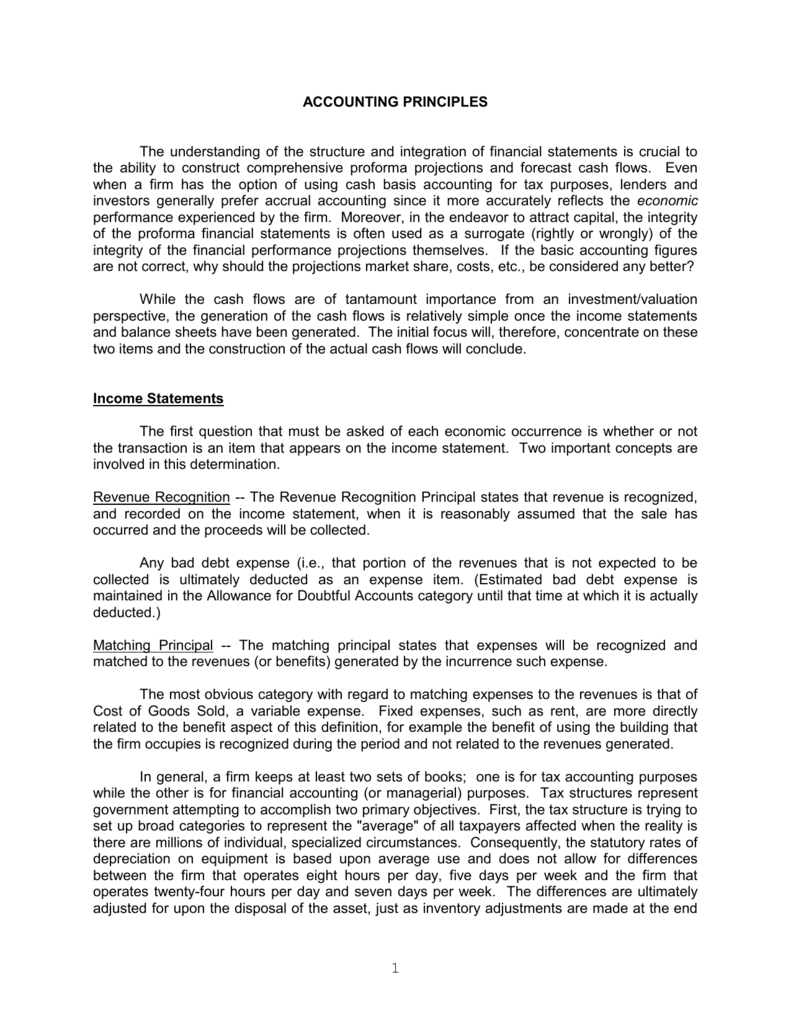

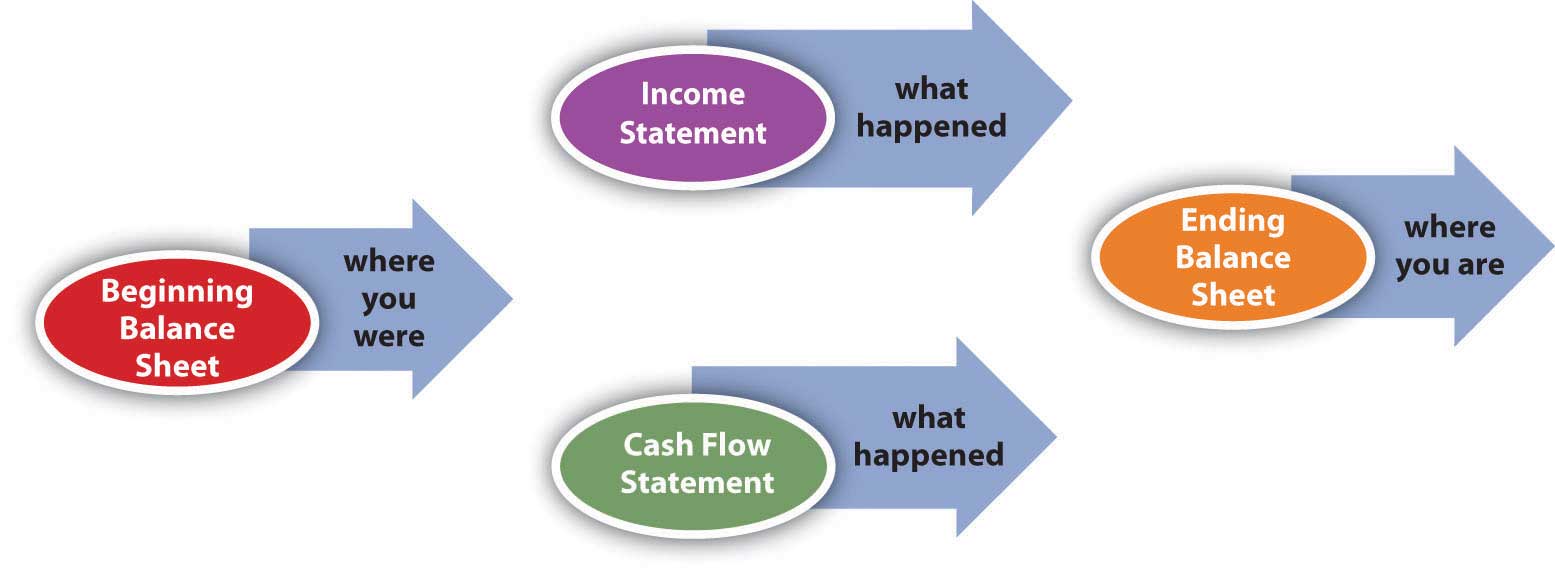

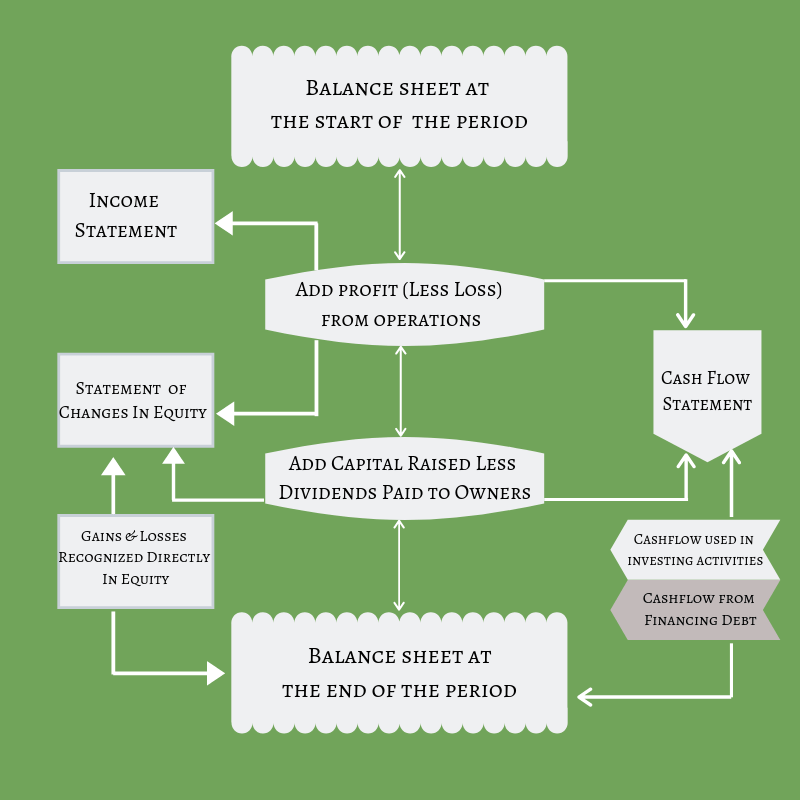

The balance sheet, also known as the statement of financial position, shows the company's financial position at a specific point in time. It lists all of the company's assets, including cash, investments, property, and equipment, and all of the company's liabilities, such as loans, mortgages, and accounts payable. The balance sheet also includes the company's equity, which is the difference between the company's assets and liabilities. By comparing the company's assets and liabilities, the balance sheet helps investors and creditors determine the company's net worth and its ability to pay its debts.

The income statement, also known as the profit and loss statement, shows the company's financial performance over a specific period of time, such as a month, quarter, or year. It lists the company's revenues, expenses, and net income or loss. The income statement provides information about the company's operating performance, including how well it is generating sales and managing costs. It also helps investors and creditors evaluate the company's ability to generate profits and cash flow.

Both the balance sheet and the income statement are important tools for understanding a company's financial health and performance. Together, they provide a comprehensive view of the company's assets, liabilities, revenues, expenses, and net income or loss. They are essential for investors and creditors when making informed decisions about whether to invest in or lend money to a company.

In conclusion, the balance sheet and income statement are important financial statements that provide valuable information about a company's financial position and performance. They help investors and creditors make informed decisions about the company's financial health and its ability to generate profits and cash flow.

Balance Sheet vs Income Statement: Everything You Need to Know

Steve Albrecht, 2002 References Albrecht, Steve W. Typically, an income statement will represent events taking place over the course of the year, but this can vary by circumstance. . Investors scrutinize the balance sheet for indications of the effectiveness of management in utilizing debt and assets to generate revenue that gets carried over to the income statement. These costs include rent, insurance, salaries, advertising, office supplies, utilities and other expenses related to overhead. The difference between liabilities and expenses is that liability factor in future money owed. The balance sheet is used to establish if the firm has adequate assets to satisfy its financial commitments.

Balance Sheet vs Income Statement: What's The Difference?

Equity Equity refers to money that belongs to the business owners. Revenues are not the same as receipts. The primary limitation of the balance sheet is that it does not reflect the current value or worth of a company. The revenue generated by retailers, manufacturers, wholesalers, and distributors from their primary activities is called sales revenue. The income statement provides revenue and costs, whereas the balance sheet reports assets, liabilities, and equity. Source: Bookstime Assets Assets are items that the company owns that can be converted into cash, sold, or consumed.

Importance of Income Statement and Balance Sheet

The five most common types of financial statements are the balance sheet, income statement, statement of cash flow, statement of changes in equity, and statement of financial position. Source: Corporate Finance Institute Components of an Income Statement The components of an income statement may differ from one company to another depending on the regulatory requirements and the type of operations or business conducted. You should consult your own tax, legal and accounting advisors before engaging in any transaction. The simple balance sheet is useful for getting a quick snapshot of company assets and equity versus its debts and financial obligations. This template is more comprehensive so that you can understand the split among assets, liabilities, and equity in more detail. On top of the financial statement templates which are pretty useful and can help you keep an eye on your business finances , Using Wise, you can easily manage international payments with your Get account details in 10 currencies, including IBAN, sort code, and more to get paid like a local. Like an individual person has, a corporation has a net income figure that is calculated after taxes, but it also includes the expenses it takes to run a business.