How the valuation principle is used by financial managers. Principles of Financial Management 2022-10-27

How the valuation principle is used by financial managers

Rating:

4,3/10

197

reviews

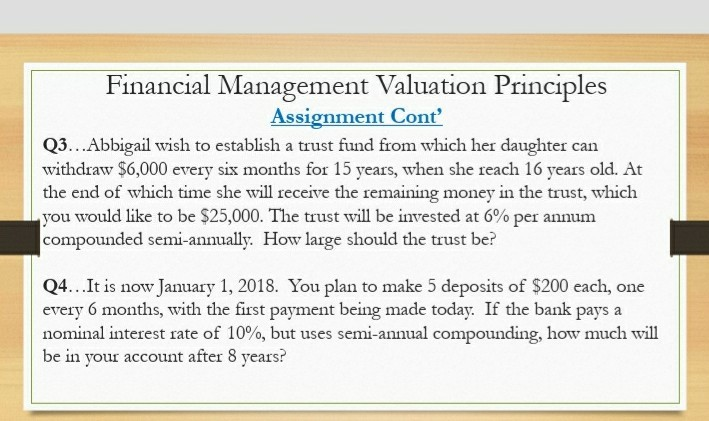

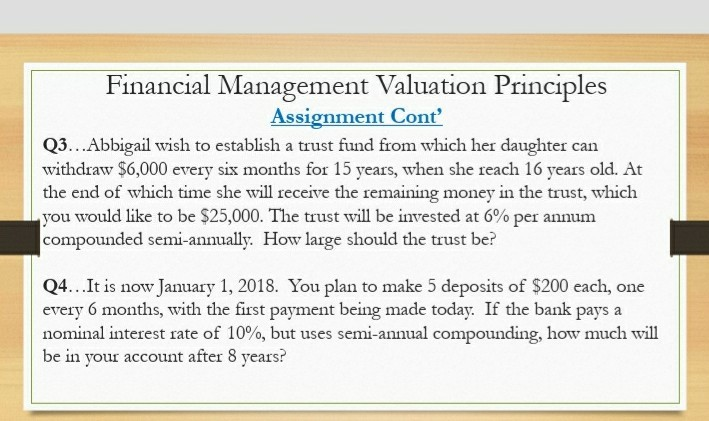

The valuation principle is a key concept in finance that is used by financial managers to determine the value of an asset or liability. This principle is based on the idea that the value of an asset or liability is equal to the present value of its expected future cash flows.

There are several methods that financial managers can use to apply the valuation principle in their decision making. One common method is the discounted cash flow (DCF) analysis, which involves estimating the future cash flows that an asset or liability is expected to generate, and then discounting those cash flows back to the present using an appropriate discount rate. The result of this calculation is the present value of the asset or liability, which represents its value in today's dollars.

Another method that financial managers may use to apply the valuation principle is the comparables approach, which involves comparing the value of an asset or liability to similar assets or liabilities in the market. This approach can be useful when there is limited information available about the expected future cash flows of an asset or liability, or when the asset or liability has unique characteristics that make it difficult to accurately estimate its future cash flows.

In addition to these methods, financial managers may also use other financial tools and techniques, such as sensitivity analysis, to help them make informed decisions about the value of an asset or liability. For example, they may use sensitivity analysis to assess how changes in the discount rate or expected future cash flows would impact the value of an asset or liability.

Overall, the valuation principle is an important tool for financial managers, as it allows them to assess the value of an asset or liability and make informed decisions about whether to buy, sell, or hold onto it. By using this principle and other financial tools and techniques, financial managers can maximize the value of their company's assets and minimize its liabilities, ultimately helping to improve the overall financial performance of the organization.

How is the valuation principle is used by financial managers?

How do you use LBO for valuation? Your required rate of return is based on the risk-free rate plus an extra cushion for inflation and risk of return. Risk is a core principle in financial management In financial management, the risk is the possibility of loss. Managers are concern about the impact of their decision on profit. Finally we use what we learned to make the purchase or sale decision. These 10 basic principles are organizing your finances, spending less and saving more, understanding the time value of money, spending on income-producing assets, self-improvement and education, taking note of risks associated with investments, diversifying your income sources, knowing the tax implications of every investment, preparing for uncertainties, and having the right insurance plan. This statement should be simple, direct, attainable, and include measurable goals.

Next

How does the valuation principle help a financial manager... Free Essays

Or consider an investment in a new plant. Risk can come in different forms, such as credit risk, market risk, and investment risk. Declines in the growth rates of the money supply proceed business contractions by an average of 20 months. Companies with new technologies, product development ideas, defensible positions in fast-growing markets, or access to potential new markets own valuable opportunities. This starts the Cash Flow Register when you enter your initial investment. Because of the complexity and importance of valuing common stocks, various techniques for getting this task done have been wanted over time: discounted cash valuation and relative valuation techniques.

Next

Principles of Financial Management

Self-improvement and education If you are reading this to improve your financial knowledge and help you make good decisions in terms of finances, then this is a good principle of financial management. The head of the financial operations is called the chief financial officer CFO. You are being asked to contribute funds in exchange for an equity interest in the venture. ECF therefore requires more support or, at a minimum, more inputs from corporate financial and capital-budgeting systems. Risk in financial management should be considered in terms of probability, severity, and impact. Valuations Intro An investment is giving up funds for a period of time to receive a rate of return. A combination of factors—big, active competitors, uncertainties that do not fit neat probability distributions, and the sheer number of relevant variables—makes it impractical to analyze real opportunities formally.

Next

Valuation Principles

That means when you spend, you will actually record what you spent money on, the amount you spend, and the reasons. Romeo is overcome with love and it makes him impulsive and rash. The opportunity cost is the return a company or its owners could expect to earn on an alternative investment entailing the same risk. Such insight is available only from ECF or its variations. Then, we set the table by talking about some valuation basics. The role of accountant and financial manager are similar in several ways and often times they work closely together on various projects.

Next

Principles of financial management

Another special rule evaluates strategic opportunities off-line, outside the routine DCF system. Macro Factors Security markets reflect what is going on in an economy because the value of an investment is determined by its expected cash flows and required rate of return. After that, the opportunity may be gone. What are the three basic valuation approaches? The absence of a formal valuation procedure often gives rise to personal, informal procedures that can become highly politicized. That is precisely the problem at which traditional DCF methods are aimed.

Next

What’s It Worth?: A General Manager’s Guide to Valuation

Take current annual revenues, multiply them by a figure such as 0. Different sectors react to these changes at different points in the cycle. Shareholders get to keep the residual value. Companies that might be heavy users of this tool will want to adapt it to the particular kind of business or transactions they engage in most frequently. One effect of that drop in cost is that companies do a lot more analysis.

Next

How the valuation principle is used by financial managers?

The formulaic rules amount to an assumption that borrowers will not really walk away from the debt even when it is in their best interests to do so. Many executives are eager to see those systems improved, even if it means learning more finance. In this section, we will talk about the major statements. Principles of finance Conclusion There are three fundamental principles of financial management that you should always keep in mind when working with your money. The best principle to apply in this case is to spend less. Such divergence is especially common in transactions that produce or anticipate substantial changes in the business or its organization—in mergers, acquisitions, and restructurings, for example.

Next

This intuitive process lets a manager create a two-dimensional map, which is much easier than creating one with five variables. Three complementary tools—one for each type of valuation problem—will outperform the single tool WACC-based DCF that most companies now use as their workhorse valuation methodology. In each case, whether the operation in question is large or small, whether it is a whole business or only a part of one, the corporation either has already invested in the activity or is deciding now whether to do so. But if the business runs into serious trouble, it will be worth less than the loan amount, so the borrower will default. This can be applied in business; when a customer pays for goods immediately, the company can use the money to purchase any needed item or even invest more.

Next

:max_bytes(150000):strip_icc()/FundamentalAnalysis_Final_4195918-32754f1a44284f28842e304e9cf1858d.png)

This approach is most often called adjusted present value, or APV. New Valuation Practices Are on the Way Valuation practices are changing already. In considering opportunities, cash, time value, and risk all still matter, but each of those factors enters the analysis in two ways. Indeed, if DCF and option pricing are set up as mutually exclusive rivals—you pick one or the other, but not both—option pricing will lose, for now. Although studies have found a relationship between the money supply and stock prices, the timing of the relationship differed. Though executives estimate value in many different ways, the past 25 years has seen a clear trend toward methods that are more formal, explicit, and institutionalized. What is more difficult is the application of this tool to corporate problems, as opposed to simple puts and calls.

Next

A common approach is not to value them formally until they mature to the point where an investment decision can no longer be deferred. On this page, we will kick off the discussion with a run through of financial statement Then, we will set the table by talking about some valuation basics. This means putting your money into things that will provide you with a return on investment ROI. What is decision making? Values for fairly illiquid or one-of-a-kind assets real estate, for example are often benchmarked against values of assets or transactions regarded as comparable but not identical. It is also important to set aside money each month so that you have funds available when you need them.

Next

:max_bytes(150000):strip_icc()/FundamentalAnalysis_Final_4195918-32754f1a44284f28842e304e9cf1858d.png)