Horizontal foreign direct investment (FDI) refers to the investment of a company in a foreign market in order to establish a new branch or subsidiary that produces the same or similar products or services as the company's existing operations. This type of FDI is characterized by the expansion of a company's existing business activities into a new market, rather than the acquisition of a foreign company or the establishment of a joint venture with a local partner.

There are several reasons why a company might choose to engage in horizontal FDI. One reason is to take advantage of lower production costs in a foreign market. By establishing a presence in a country with lower labor and raw material costs, a company can reduce its production costs and increase its competitiveness in the global market. Another reason is to access new customers and markets. By establishing a local presence, a company can better understand the needs and preferences of its foreign customers and tailor its products or services to better meet their needs.

Horizontal FDI can also provide a company with greater control over its supply chain. By producing its products or services directly in a foreign market, a company can reduce its reliance on foreign suppliers and increase its control over the quality and delivery of its products or services. Additionally, horizontal FDI can provide a company with access to local distribution networks and marketing channels, which can help the company reach new customers more effectively.

However, there are also potential risks and challenges associated with horizontal FDI. One risk is the possibility of encountering local competition in the foreign market. If a company's products or services are already available in the foreign market, the company may face competition from established local players. Another risk is the possibility of cultural misunderstandings or differences in business practices, which can lead to difficulties in managing the company's foreign operations.

In conclusion, horizontal FDI refers to the expansion of a company's existing business activities into a foreign market by establishing a new branch or subsidiary that produces the same or similar products or services. This type of FDI can provide a company with access to lower production costs, new customers and markets, and greater control over its supply chain, but it also carries the risk of local competition and cultural misunderstandings.

What Are The Different Types Of FDI?

For instance, Apple was able to conduct FDI into China to assist with the manufacturing of its products. Horizontal foreign direct investment refers to the overseas manufacturing of products and services similar to those the company produces and manufactures in its home market. There are a few reasons for the viability and popularity of FDI; they have helped in overthrowing monopolistic business practices, they can provide control over businesses in foreign countries and they provide a helpful cushion that protects companies in the event of a sudden decline in business due to market fluctuations. As a result, it has created new jobs in the region and boosted trade between the nations. For example, the same coffee company may want to invest in a foreign grocery chain.

Direct Foreign Investment (FDI): What It Is, Types, and Examples

With greenfield investing, a company will build its own, brand new facilities from the ground up. With that said, those countries and regions that have been marred with instability are usually the last to be considered for investment. Having gone through the advantages of foreign direct investment, let us get an overview of the benefits of FDI. This is because it is not reliant on one market. The concept of direct control also distinguishes it from foreign portfolio investment. It covers investment positions for 72 countries. It depicts that FDI is far beyond capital investment.

What Is Horizontal FDI?

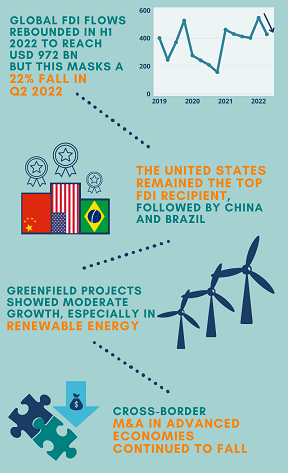

In addition to facilitating business expansion and economic growth, FDI also plays a significant role in building trade relations, creating new employment opportunities, improving managerial expertise, technological advancement and bettering infrastructure. Foreign direct investment has been made thanks to two main factors- globalisation and internationalisation. In 2021, global FDI bounced back by 88%. They are different from foreign portfolio investment where investors passively hold securities from an international company. It further helps to generate tax revenue and the regular tax revenue of the Government.

Sample Essay on Horizontal Foreign Direct Investment

Generally, the term is used to describe a business decision to acquire a substantial stake in a foreign business or to buy it outright to expand operations to a new region. Per the OECD guidelines, a minimum of 10% ownership stake in a foreign-based company will be eligible for a controlling interest. If we couple this with the fact that big corporations often pay above the average to attract the best workers, we can see a spill-over effect. Cierra Murry is an expert in banking, credit cards, investing, loans, mortgages, and real estate. For instance, the camera is made by Sony, which sources its manufacturing in Taiwan. Loss of Domestic Jobs When significant sums of money are transferred to another, it is an investment that would have been used in the home market.

Foreign Direct Investment: Definition, Example, Pros and Cons

How does horizontal integration lead to a monopoly? It often takes the form of joint ventures since the investor has no previous experience in the new industry. This means workers in Japan and South Korea are also affected. Thus, this ensures due control. With this move of creating favorable policies, the government has ensured a constant flow of capital into the economy. For example, a clothing brand based in North America may outsource their manufacturing process to a developing country in Asia, and sell the finished goods in Europe. There are two forms of FDI—horizontal and vertical.

What is a horizontal foreign direct investment?

Tax Incentives Reduced levels of corporation tax can save big businesses billions each and every year. This flow will help build a growing foreign exchange reserve, ultimately stabilising the exchange rates, which the Central Bank maintains. So this is where a firm invests in a foreign company that is further along in the supply chain. In India, FDI is a promising candidate for becoming a spearhead for economic development, since it is a non-debt resource. A foreign direct investment FDI is when a business invests in or owns another company, project, or business entity in another country.