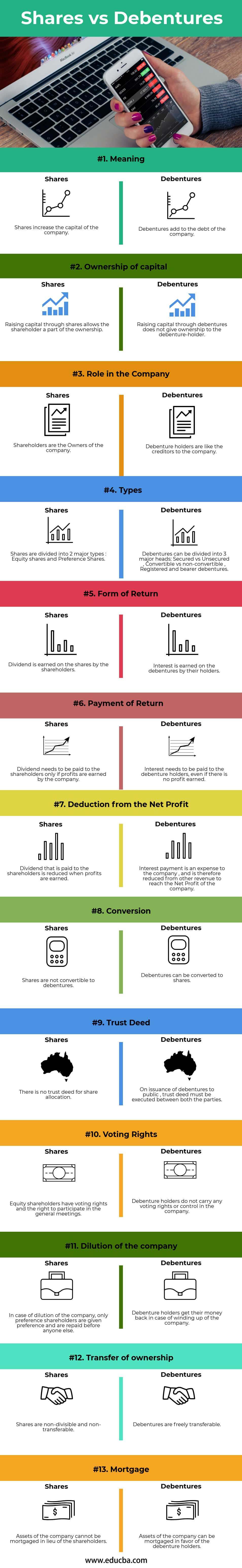

Equity shares, preference shares, and debentures are all types of securities that represent ownership in a company or the right to receive future payments. However, they differ in the rights and privileges that they provide to the holders.

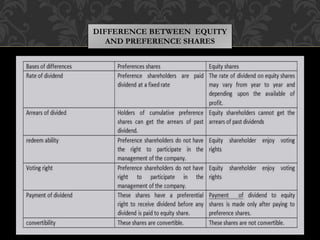

Equity shares, also known as common shares, represent ownership in a company. Equity shareholders are the owners of the company and have the right to vote in shareholder meetings and receive dividends. The dividends are paid out of the company's profits and are not guaranteed. The value of equity shares fluctuates based on the performance of the company and the overall market conditions.

Preference shares, also known as preferred shares, are a type of hybrid security that combines features of both equity and debt. Preference shareholders have the right to receive a fixed dividend, which is paid before dividends are paid to the equity shareholders. However, preference shareholders do not have the right to vote in shareholder meetings. The value of preference shares is generally more stable than that of equity shares, but it is not immune to market fluctuations.

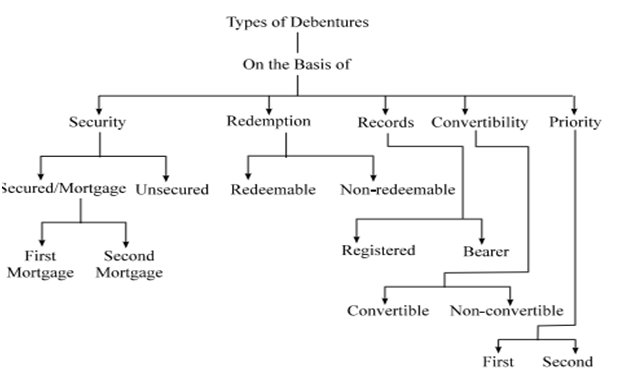

Debentures are a type of long-term debt instrument that is issued by a company to raise capital. Debenture holders are creditors of the company and do not have any ownership rights. They are entitled to receive periodic interest payments and the principal amount at the time of maturity. Debentures are secured by a charge on the company's assets, which means that the debenture holders have a claim on the company's assets in the event of default.

In summary, equity shares represent ownership in a company, preference shares combine features of equity and debt, and debentures are a type of long-term debt instrument. Each type of security has its own set of rights and privileges and carries a different level of risk. It is important for investors to carefully consider the terms and conditions of the securities before making an investment decision.