A credit and status enquiry letter is a formal request for information about an individual's credit history and financial status. This type of letter is often used by lenders, landlords, and other businesses when considering a potential borrower or tenant for a loan, rental agreement, or other financial transaction.

The purpose of a credit and status enquiry letter is to gather information about an individual's creditworthiness and financial stability. Lenders, landlords, and other businesses use this information to assess the risk of providing a loan or entering into a financial agreement with the individual. For example, a lender may use a credit and status enquiry letter to request information about an individual's credit score, outstanding debts, and income in order to determine whether they are likely to default on a loan.

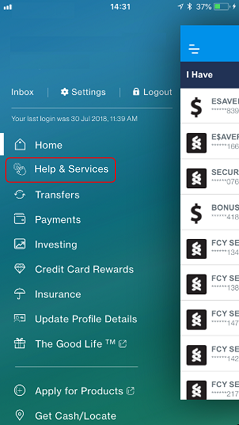

There are several different sources of information that can be included in a credit and status enquiry letter, including credit bureaus, banks, and other financial institutions. Credit bureaus, such as Experian and Equifax, maintain extensive records of an individual's credit history, including information about their credit scores, outstanding debts, and payment history. Banks and other financial institutions may also have information about an individual's financial status, including information about their savings and checking accounts, loans, and other financial transactions.

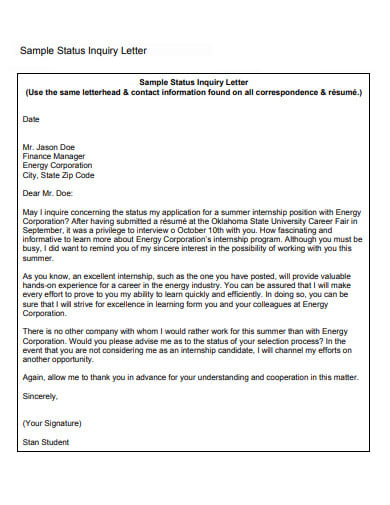

In order to request information about an individual's credit and financial status, a credit and status enquiry letter must be properly formatted and include all necessary information. This includes the name and contact information of the individual being inquired about, as well as the name and contact information of the person or business making the request. The letter should also specify the specific information being requested and the purpose for which it will be used.

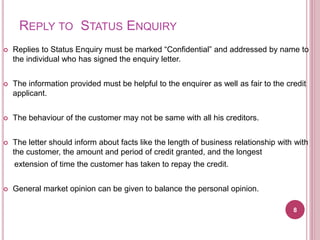

It is important to note that an individual has the right to request a copy of their credit report and to dispute any errors or inaccuracies that they may find. Therefore, it is important for businesses to carefully review and verify the information that they receive in response to a credit and status enquiry letter.

In summary, a credit and status enquiry letter is a formal request for information about an individual's credit history and financial status. This type of letter is used by lenders, landlords, and other businesses to assess the risk of providing a loan or entering into a financial agreement with an individual. It is important to properly format and include all necessary information in a credit and status enquiry letter, and to carefully review and verify the information that is received in response.

:max_bytes(150000):strip_icc()/GettyImages-483598699-58829a555f9b58bdb31ed9ff.jpg)