Mae Mobley, the protagonist of Kathryn Stockett's novel "The Help," has come a long way since the events of the book. Set in the early 1960s in Jackson, Mississippi, the story follows Mae Mobley as she navigates the challenges of growing up in a racially divided society.

As a young child, Mae Mobley is fiercely independent and curious, constantly asking questions and seeking answers about the world around her. She is also fiercely loyal to those she loves, including her mother, Miss Skeeter, and her nanny, Aibileen. Despite the challenges she faces, Mae Mobley remains determined and resilient, ultimately emerging as a strong and confident young woman.

It is difficult to say exactly what Mae Mobley is doing now, as the novel is set in the past and the character is fictional. However, it is likely that Mae Mobley has continued to grow and evolve over the years. She may have gone on to attend college or pursue other interests, and may have even started a family of her own.

Regardless of what path Mae Mobley may have taken, it is clear that she has learned valuable lessons about friendship, loyalty, and standing up for what is right. These lessons will surely have served her well as she has navigated the ups and downs of life.

In conclusion, Mae Mobley has come a long way since the events of "The Help," and it is likely that she has continued to grow and thrive in the years since the novel was set. Though it is impossible to know exactly what Mae Mobley is doing now, it is clear that she has learned valuable lessons that have helped shape her into the strong and confident woman she has become.

Contingency planning definition — AccountingTools

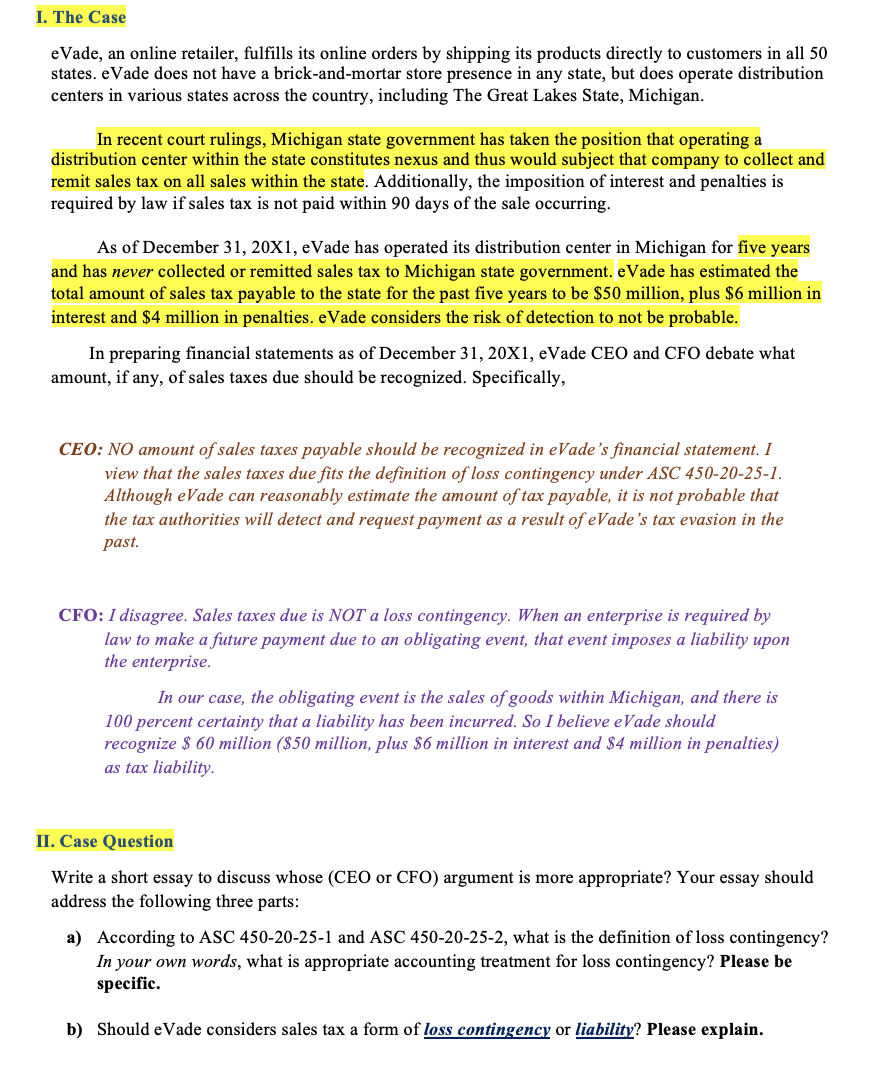

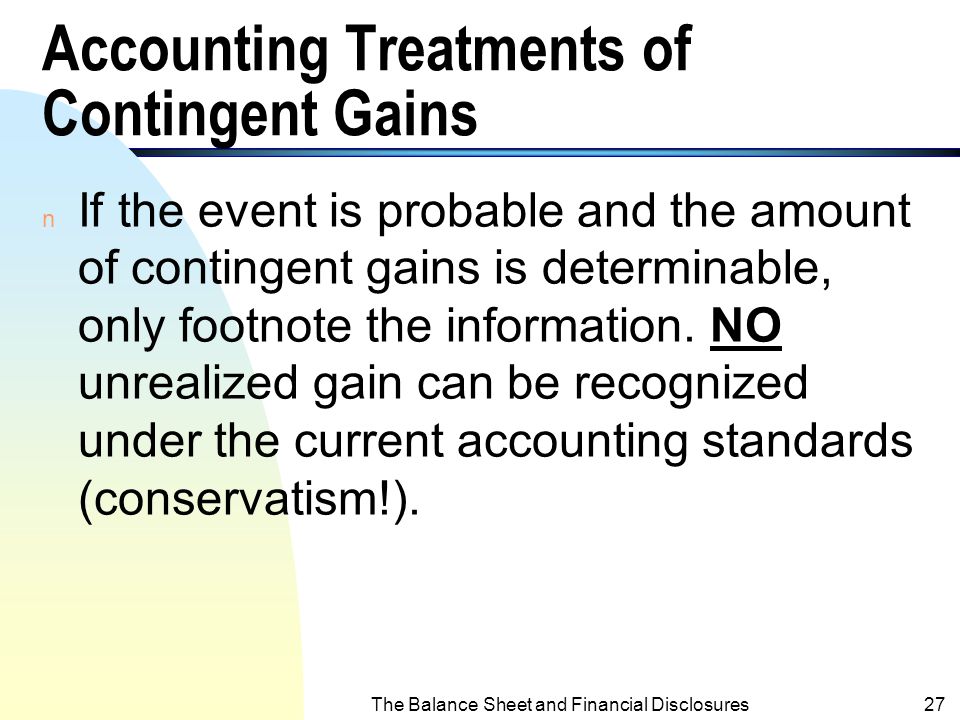

Determining the amount of contingency is a balancing act. If there is a probable future outflow of economic benefits and the company can form a reliable estimate, then that amount must be recognized. Contingent liabilities should be analyzed with a serious and skeptical eye, since, depending on the specific situation, they can sometimes cost a company several millions of dollars. However, if fraud, either purposely or through gross negligence, has occurred, amounts reported in prior years are restated. Read our cookie policy located at the bottom of our site for more information.

Accounting Guidelines for Contingent Liabilities

The gain, which was received on August 15, 20X0, was a gain contingency on June 30, 20X0. A template outlining the contingency planning process is highlighted below: Steps in Creating a Contingency Plan An effective contingency plan should be well researched and enhanced with employee and stakeholder collaboration. If the best estimate of the amount of the loss is within a range, accrue whichever amount appears to be a better estimate than the other estimates in the range. When bookkeeping, accountants should only include gain contingencies if they are certain to happen and it is possible to accurately predict the cost of the gain. But she has a question.

Accounting for Contingencies (Portfolio 5165)

GAAP recognizes that contingencies are estimates, and if the estimate is based on all available information known and knowable at the time the estimate is made, changes in estimates are recognized prospectively. In an organization, the analysis is referred to as a contingency plan. Since the company was reimbursed for an amount in excess of the carrying amount of the building there was no loss to record on June 30, 20X0. The second type of contingency is liability contingencies, or things likely to happen in the future that will affect the company's bottom line in a negative way. These types of contingencies are used mainly in guaranteed maximum price GMP contracts. Otherwise, deciding how to manage unspent contingencies could create some headaches.