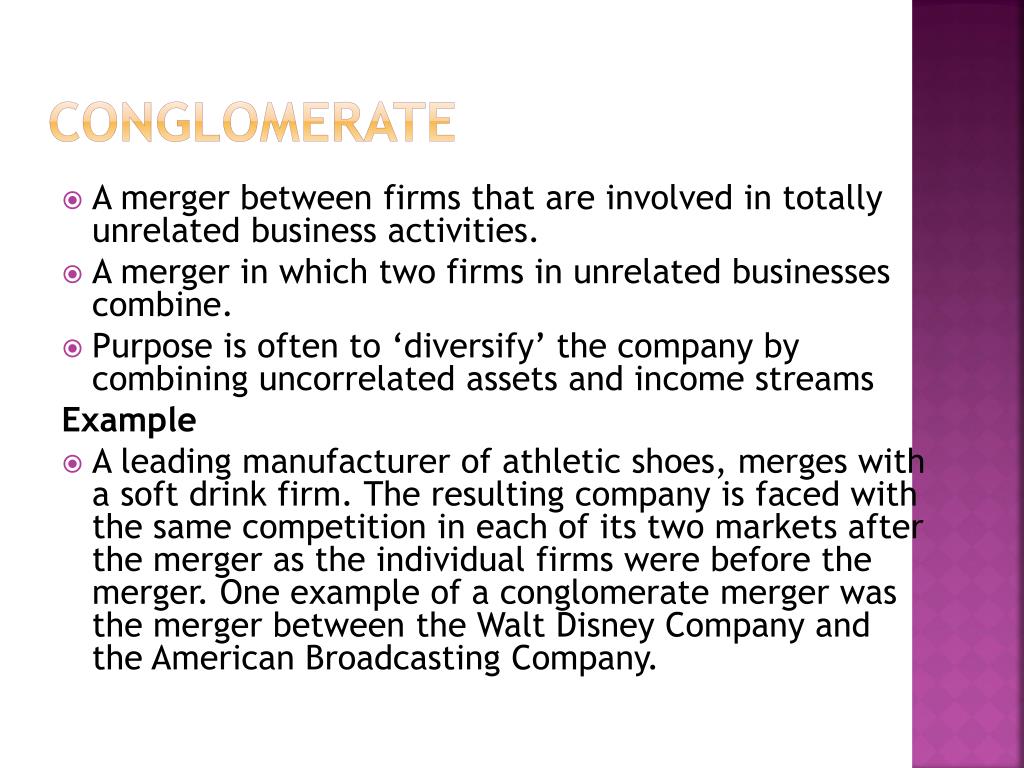

A conglomerate acquisition is when a company acquires businesses outside of its primary industry. This type of acquisition can be motivated by a variety of factors, including the desire to diversify the company's portfolio, enter new markets, or take advantage of synergies between the acquired company and the acquiring company.

One example of a conglomerate acquisition is when General Electric (GE) acquired NBCUniversal, a media and entertainment company, in 2011. GE, a multinational conglomerate with operations in various industries such as aviation, healthcare, and renewable energy, saw an opportunity to expand its media and entertainment portfolio through the acquisition of NBCUniversal. The acquisition allowed GE to leverage its financial and operational expertise to help NBCUniversal grow and expand, while also providing GE with a new source of revenue and access to new markets.

Another example of a conglomerate acquisition is when Berkshire Hathaway, a multinational conglomerate led by investor Warren Buffett, acquired Duracell, a manufacturer of batteries and other portable power products, in 2016. Berkshire Hathaway, which has operations in a variety of industries such as insurance, finance, and retail, saw an opportunity to diversify its portfolio through the acquisition of Duracell. The acquisition allowed Berkshire Hathaway to enter the battery market and take advantage of Duracell's strong brand recognition and distribution network.

While conglomerate acquisitions can bring many benefits, they can also be risky. Integrating businesses from different industries can be challenging, and it can be difficult to achieve the desired synergies between the acquiring company and the acquired company. In addition, conglomerate acquisitions can be expensive, and there is always the risk that the acquired company may not perform as well as expected.

Overall, conglomerate acquisitions can be a strategic way for companies to diversify their portfolios, enter new markets, and take advantage of synergies. However, it is important for companies to carefully consider the risks and potential challenges before embarking on this type of acquisition.

:max_bytes(150000):strip_icc()/Mergers_and_Acquisitions_MA-b5ff09c3b79047e78e8d940bdc9f2760.png)