A banking method is a system or process that is used to manage financial transactions within a bank or financial institution. This method involves the handling of deposits, withdrawals, loans, and other financial transactions that take place within the bank. Banking methods have evolved over time and have become more sophisticated as technology has advanced.

One of the earliest forms of banking was the use of goldsmiths. Goldsmiths would store gold for people in exchange for a fee. They would issue receipts for the gold, which could then be used as a form of currency. This led to the development of banks, which were able to offer a wider range of financial services, such as loans and the ability to transfer money between accounts.

Today, there are many different banking methods in use. One of the most common is the use of online banking, which allows customers to access their account information and perform financial transactions through the internet. This method is convenient for customers, as it allows them to manage their accounts from anywhere with an internet connection. Online banking is also more secure than traditional methods, as it uses advanced security measures to protect against fraud and unauthorized access.

Another common banking method is the use of mobile banking, which allows customers to access their accounts and perform financial transactions using their mobile phones. This method is especially useful for people who are always on the go and may not have access to a computer. Mobile banking is also convenient for customers, as it allows them to manage their accounts from anywhere at any time.

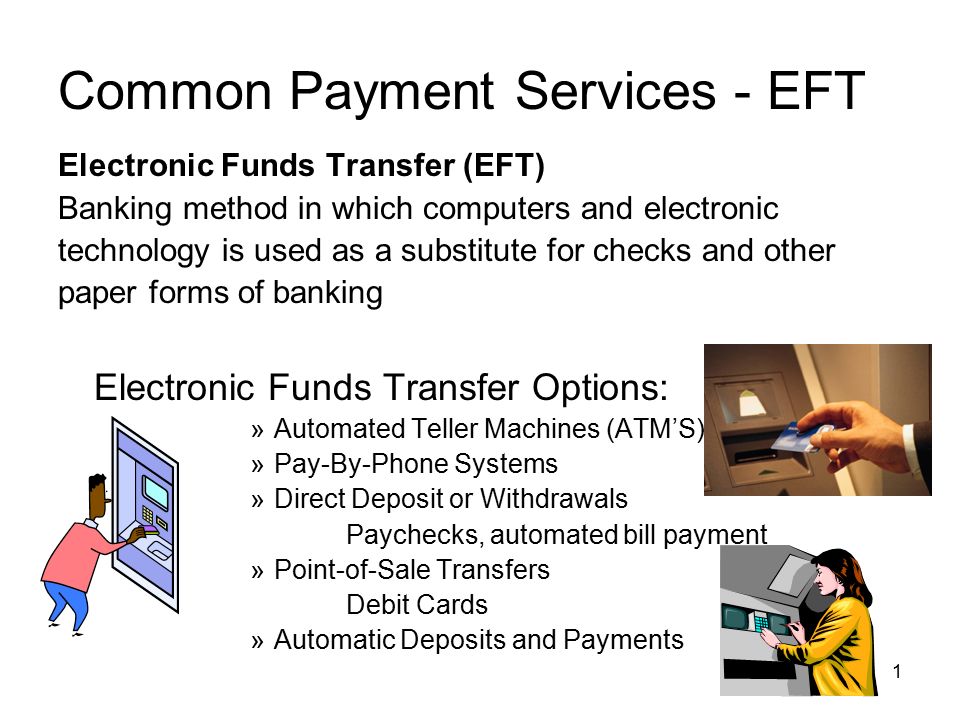

In addition to online and mobile banking, banks also offer a range of other services, such as credit and debit cards, ATMs, and financial planning services. These services are designed to make it easier for customers to manage their money and make financial decisions.

Overall, the banking method is an essential part of the financial system and plays a vital role in the economy. It allows people to securely manage their money, make financial transactions, and access a range of financial services. As technology continues to evolve, it is likely that banking methods will continue to change and improve, making it even easier for people to manage their finances.

Be Your Own Bank: Cash Flow Banking is Appealing, but It's Rarely Practical

Traditionally, credit unions served either residents of a local community, members of a church, employees of a specific company or school, etc. Read on to learn more about what cash flow banking is, how it works -- and whether it's a scam. In that case, it is recommended that you thoroughly read the terms and conditions of any casino that you join, especially when it comes to payment and bonuses. Creating an Account Once you are done with selecting the online casino you will like to join. You should always opt for higher interest rates rather than longer repayment terms.

The High

How To Do The High 5 Banking Method? They provide various services such as providing business loans, accepting deposits, and offering basic investment products to both individuals and private businesses. First, you'll want to shop for a policy that offers dividends, which are payouts from the insurance company's earnings to its policyholders. Most importantly, the Problem Solving Method in education allows students the opportunity to break free of the oppressive, authoritarian nature of the traditional education dynamic. I personally use a credit card to purchase any expenses that I saved for in my short-term goals account. Discover Best Banking Options Based on Your Location Money transactions are what online casinos are built around and you need to keep that money moving. In addition, you can create separate accounts for your checking, savings, retirement, mortgage, student loans, and car loan so that each type of expense gets its own designated space. I personally use Other online-only banks offer great features like no bank fees, high-yield savings accounts, and other saving features to help you save.

The Idea of the "Banking Concept in Education"

Examples: Down payments on new cars, houses. However, you may think that the quality of those shoes is great because they look nice. The average person spends about 30% of their income on bills each month. Before you borrow, you'll need to grow your policy. First, you secure a What type of life insurance policy do you need for cash flow banking? Your five distinct Bills account — Compulsory expenditures — housing costs, debts, utilities, groceries. We Work Hard to Make Your Life Easier Struggling to find online casino payment options that suit your personal banking needs? To gamble online, there are different things you need to note so that you can have a good understanding of how the industry works. Mobile banking requires an internet connection or cellular data coverage, and is used in conjunction with a smartphone or a tablet, which makes it very convenient.

Using ATM's, Mobile & Online Banking: Method & Examples

Banking Options When was the last time you paid a visit to the inside of a bank to make a withdrawal or a deposit? According to PolicyGenius, the The cash flow banking strategy is built upon whole life insurance -- because you can borrow against that type of policy. Where do you put your direct deposit? Each payday moving money into this account helps you create a routine that allows you to still enjoy your life while spending responsibly. It's a long-term play that requires significant expenditures early on in life in order to reap the benefits later on. This helps prevent you from getting distracted when transferring money between different accounts. Further Reading For more detail and information on the banking concept, I would encourage you to go straight to the source and read his book. Here you can find our list of Mastercard Very popular, but quite limited when it comes to payouts. It teaches you to have different accounts for five different expenditures: these include bills, monthly expenses, lifestyle, emergencies, and long-term goals.