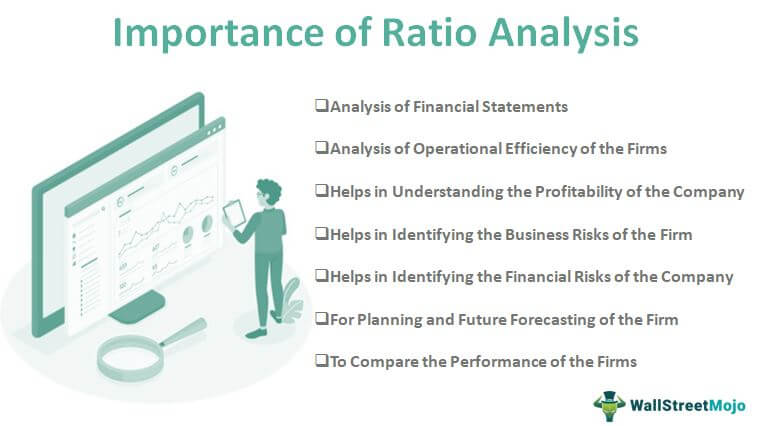

Ratio analysis is a popular financial tool that is widely used by investors, analysts, and managers to evaluate a company's financial performance and position. It involves the calculation and comparison of various financial ratios, which are derived from a company's financial statements, to assess various aspects of the company's operations and financial health. Some common ratios that are used in ratio analysis include the liquidity ratios, solvency ratios, efficiency ratios, and profitability ratios.

One of the main advantages of ratio analysis is that it allows users to quickly and easily compare a company's financial performance and position to industry benchmarks or to its own performance in previous periods. This enables users to identify strengths and weaknesses, and to make informed decisions about the company's future prospects. For example, an investor might use ratio analysis to determine whether a company is generating sufficient cash flow to meet its debt obligations, or to evaluate the company's efficiency in using its assets to generate sales.

Another advantage of ratio analysis is that it can be used to identify trends and patterns in a company's financial performance over time. By comparing ratios from different periods, users can get a sense of how a company's financial position is changing, and whether certain financial trends are emerging. For example, if a company's debt-to-equity ratio is steadily increasing over time, this could be a red flag for investors, as it might indicate that the company is taking on too much debt relative to its equity.

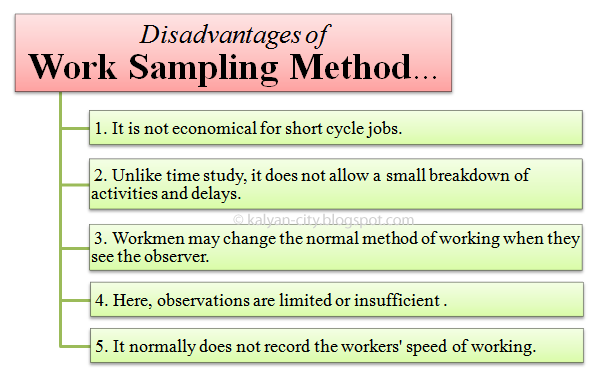

However, there are also some limitations to ratio analysis that users should be aware of. One limitation is that ratios are based on historical data, and do not take into account future events or trends that may affect a company's financial performance. As a result, ratio analysis is generally better suited for evaluating a company's past performance rather than predicting its future prospects.

Another limitation of ratio analysis is that it relies on the accuracy and completeness of the financial data that is used to calculate the ratios. If the financial statements are not prepared in accordance with generally accepted accounting principles (GAAP), or if they contain errors or omissions, the resulting ratios may not be accurate or meaningful.

In addition, ratio analysis does not take into account the specific circumstances or context in which a company operates. For example, a company's liquidity ratio may appear strong compared to industry benchmarks, but this may not be meaningful if the company operates in a highly cyclical industry where cash flow is prone to significant fluctuations.

Overall, ratio analysis is a useful financial tool that can provide valuable insights into a company's financial performance and position. However, it is important for users to be aware of its limitations, and to consider other factors in addition to the financial ratios when evaluating a company.