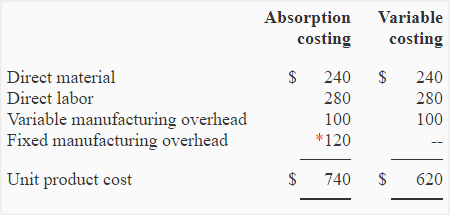

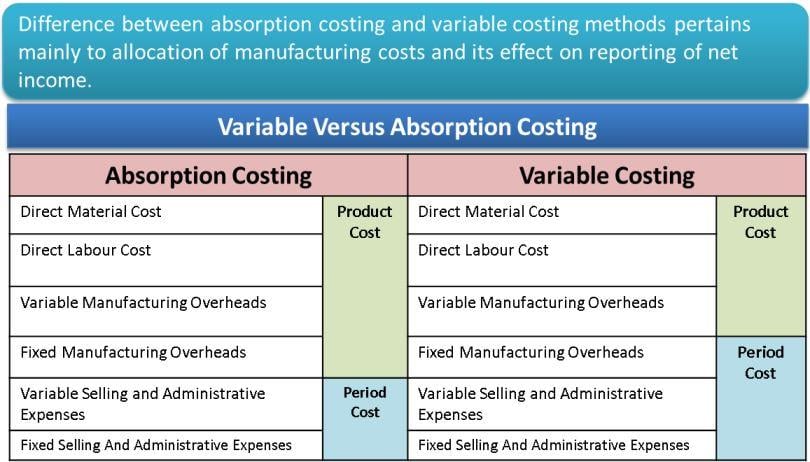

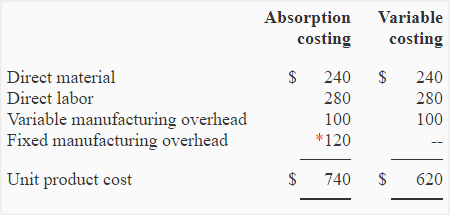

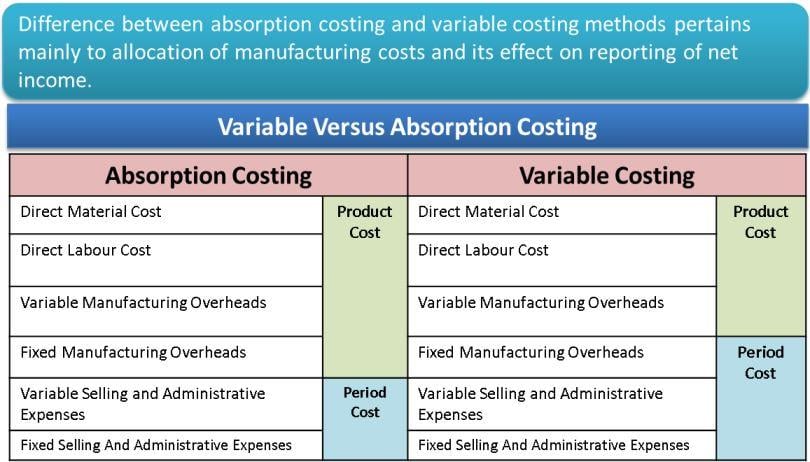

Absorption costing is a method of product costing that includes all of the costs associated with producing a product, including both direct and indirect costs. This method is used to determine the total cost of producing each unit of a product, which is then used to set prices, evaluate profitability, and make other business decisions.

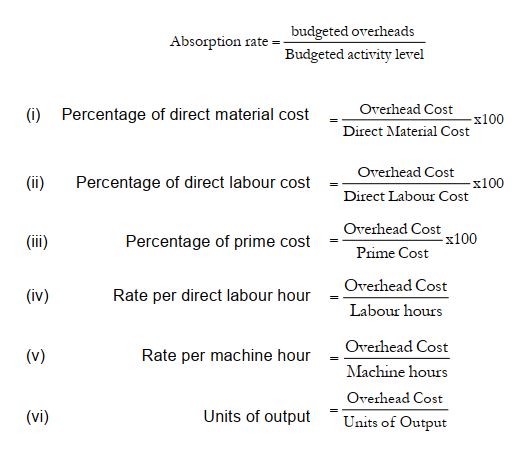

The absorption costing formula is used to calculate the total cost of a product by adding together the direct costs, such as raw materials and direct labor, and the indirect costs, such as factory overhead and administrative expenses. These indirect costs are also known as fixed costs, as they do not vary with the level of production.

The formula for absorption costing is:

Total cost per unit = (Direct materials + Direct labor + Factory overhead) / Number of units produced

The direct materials cost is the cost of the raw materials used to produce the product, such as wood for a table or steel for a car. The direct labor cost is the cost of the labor required to produce the product, such as the wages of factory workers or assembly line workers. Factory overhead includes indirect costs such as utilities, rent, and depreciation of factory equipment.

Once the total cost per unit is calculated using the absorption costing formula, it can be used to set the selling price of the product. The selling price must be set high enough to cover the total cost per unit and generate a profit for the company.

Absorption costing is an important tool for businesses to understand the true cost of producing a product and make informed pricing and production decisions. It helps companies accurately allocate their costs and ensure that they are covering all of their expenses while still being able to generate a profit.

In conclusion, the absorption costing formula is a useful tool for businesses to determine the total cost of producing a product and make informed decisions about pricing and production. It includes both direct and indirect costs and helps companies understand the true cost of producing each unit of a product.

Product Costing

Public companies cannot adopt marginal costing against compliance rules. This option is typically used in organizations that use a two-step receiving process, or in scenarios where you must register a batch or serial number, for example, on the items that you're receiving. Mathematically, it is represented as, Solution: From the above list, depreciation, salaries of managers, factory rent and property tax fall in the category of manufacturing overhead. The formula is given below: Suitability: This method is suitable: 1 When material cost forms the major part of total cost; 2 When the price of material does not fluctuate; ADVERTISEMENTS: 2 The information is readily available to calculate the rate. What happens to sales order returns during the inventory close? Some fixed costs are direct product costs as well. Basic It bases on each product design and feature. On the other hand, setting too low cost will put too much pressure on them to archive the result which will never happen.

Variable Costing Formula

In general, we recommend that you avoid allowing your inventory to go physically negative. Item is typically selected to indicate that the item is tangible, whereas Service is typically selected to indicate that the item is intangible. Those costs include direct costs, variable overhead costs, and fixed overhead costs. Type of Standard Costing Ideal, Perfect or Theoretical standards This type of standard costing believes the perfect condition when there is no interruption and wastage during production. Although you can create a service item to represent a resource and assign a cost to increase the cost calculation for a finished good, we don't typically recommend this approach. But other costing experts object to such a procedure because, it makes a direct cost into an overhead item. Similarly, We have calculated for all the data.

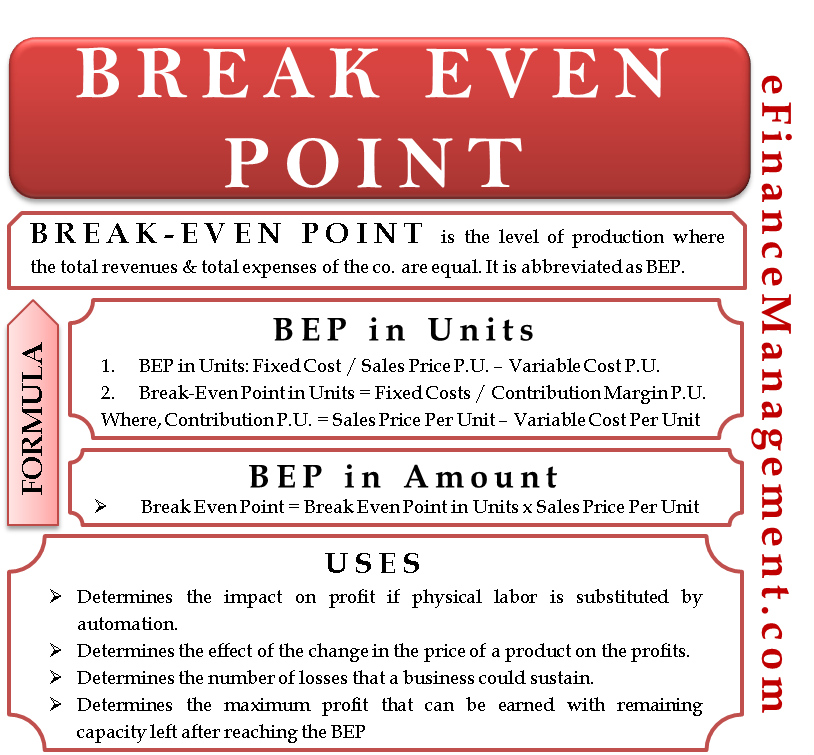

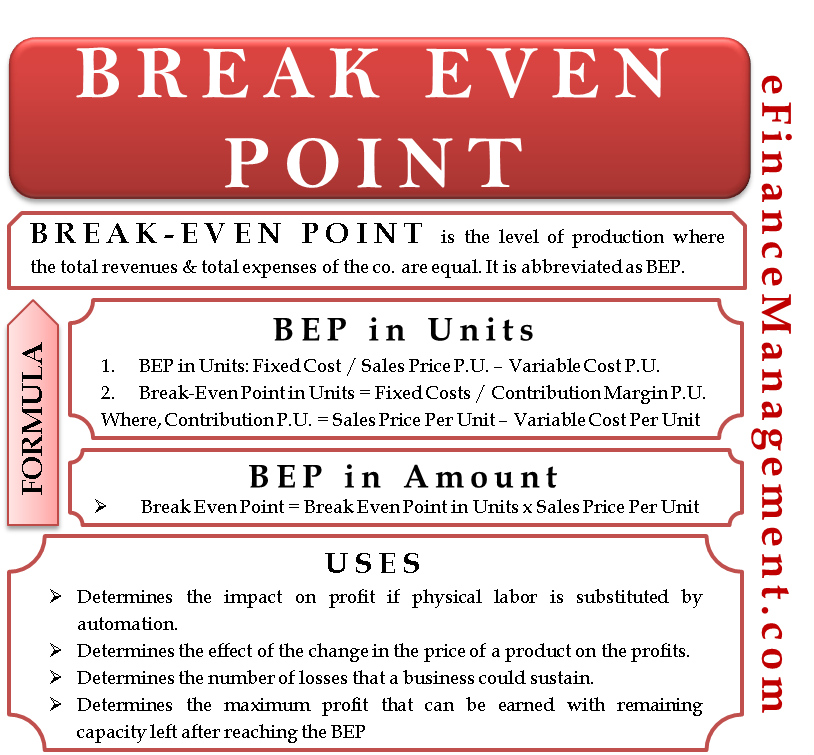

Absorption Costing: Definition, Formula, Calculation, and Example

Alternatively, the consumption might be estimated instead of precise, so that the consumption exceeds the amount in a specific location, such as a tank. Therefore, the production will be able to maximize their capacity which almost impossible to happen in real life. If an item has transactions that have been physically received and financially issued, the quantities and values are summed independently. If no default price is specified for the item, the system will issue the inventory with a value of 0 zero. Break-even points in units are fixed cost divided by sales price per unit minus variable cost per unit. You use the Post to Deferred Revenue Account on Sales Delivery option to indicate whether you want to recognize revenue in the general ledger when you post a packing slip for a sales order. Compare the standard cost and actual cost We need to compare the estimated cost with actual result.

Income Statement Under Absorption Costing? (All You Need to Know)

. Step 2: Next is to determine the weight of each of the asset in the portfolio on the basis of the current market trading price of it. Normal standards The normal cost will be used over a period of time, usually the business cycle of the company. There is no specific guidance about the amount of time that the close should take to run. Here is a certain predefined set of procedure to calculate the expected return formula for a portfolio. Step 4: Finally, the formula for a one-sample t-test can be derived using the observed sample mean step 1 , the theoretical population means step 1 , sample standard deviation step 2 , and sample size step 3 , as shown below. Can I separate variances that are the result of currency exchange rates from other types of variances? On the other hand, if a buyer chosen at random has purchased peanut butter, then there is a 75% chance that he has also purchased brown bread.

Variable Costing

You should select the best option, based on your reporting, reconciliation, and operational requirements. If you enable the Financial value option for a dimension in a storage or tracking dimension group, you can select the View or Total option for the dimension in the inventory value report configuration. Specifically, the close process can be longer when you enter a high number in the Maximum number of iterations allowed per item field or a low number in the Minimum amount allowed field for the Close inventory process. You can view the settlements for an inventory transaction by selecting Settlements or Cost explorer on the Inventory tab on the Action Pane of the Inventory transaction or Inventory transaction details page. If you select Manual, a user must manually pick materials, or record the time in a job or route card journal.