Money is a medium of exchange, a unit of account, and a store of value. These three functions of money are essential for the operation of a modern economy.

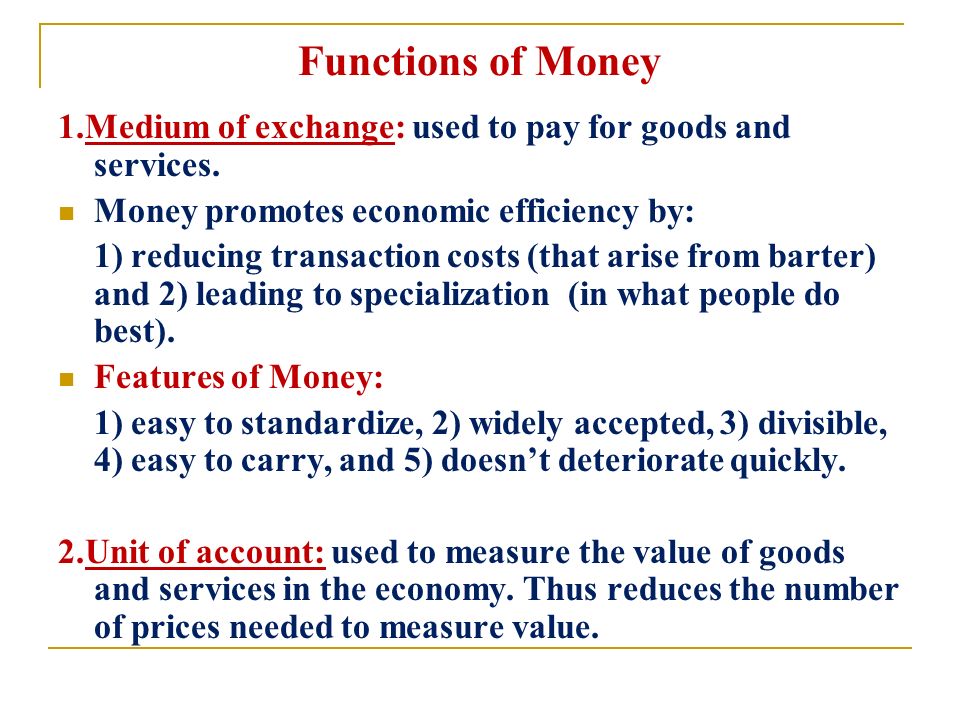

First, money serves as a medium of exchange, which means that it can be used to buy and sell goods and services. Without money, people would have to barter, or trade goods and services directly, which can be inefficient and inconvenient. For example, if you wanted to trade a chicken for a shirt, you would need to find someone who both wanted a chicken and had a shirt to trade. With money, you can simply exchange the chicken for a certain amount of money, and then use that money to buy the shirt from someone else. This makes it much easier to buy and sell goods and services, and helps to facilitate trade and economic activity.

Second, money serves as a unit of account, which means that it is used to measure the value of goods and services. This allows people to compare the prices of different goods and services, and make decisions about what to buy based on their budget. For example, if you know that a shirt costs $20 and a pair of shoes costs $50, you can decide which one to buy based on how much money you have available. This is much easier than trying to compare the value of a shirt to a pair of shoes directly, or trying to figure out how many chickens or sheep you would need to trade to get what you want.

Finally, money serves as a store of value, which means that it can be saved and used at a later time. This is important because it allows people to save up for future purchases, or to prepare for emergencies. For example, if you know that you will need to buy a new car in a few years, you can start saving money now so that you will have enough to pay for it when the time comes. Without a way to store value, people would have to consume all of their resources as soon as they got them, which would make it difficult to plan for the future.

In conclusion, money serves three important functions in a modern economy: it is a medium of exchange, a unit of account, and a store of value. These functions make it easier to buy and sell goods and services, compare prices, and plan for the future, which are all essential for a thriving economy.