Financial leverage is the use of borrowed funds or financial instruments, such as futures contracts or options, to amplify the potential return on an investment. It is an important tool for businesses and investors, as it can increase the potential return on an investment by allowing the use of leverage, or borrowed capital.

There are several types of financial leverage, including using borrowed money to finance the purchase of assets, using financial instruments to speculate on price movements, and using leverage to increase the return on equity. In each case, the goal is to increase the potential return on an investment by using leverage.

One way financial leverage is used is through borrowing money to finance the purchase of assets. For example, a company may borrow money to buy equipment or real estate. The company is then able to use the assets to generate income, and the hope is that the income generated will be sufficient to cover the cost of the borrowed funds and generate a profit. This type of financial leverage is often used by businesses to expand their operations or to make strategic investments.

Financial leverage can also be used by investors to speculate on price movements in financial markets. For example, an investor may use futures contracts or options to speculate on the direction of a particular market. These financial instruments allow investors to control a large position in a market with a relatively small amount of capital. This can be a useful tool for investors who are trying to maximize their returns, but it also carries the risk of significant losses if the market moves against them.

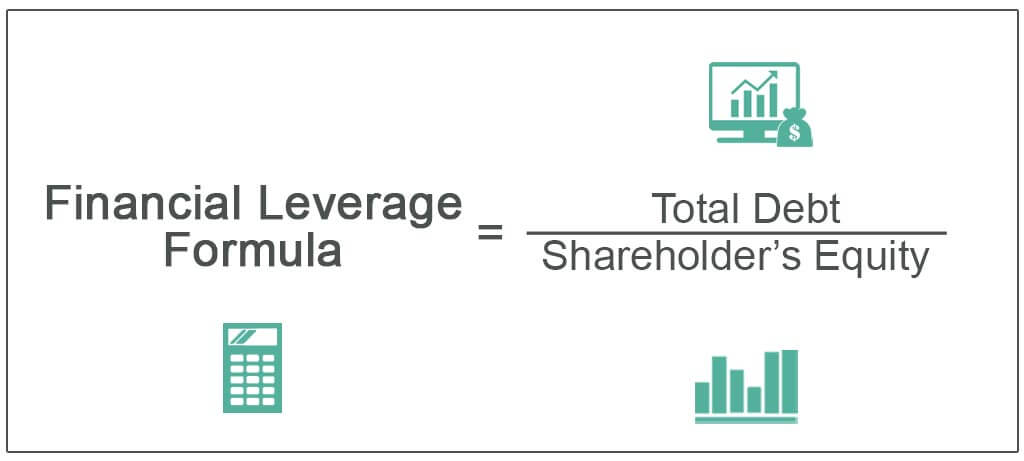

Finally, financial leverage can be used to increase the return on equity for a business. This is often done through the use of debt financing, where a company borrows money and uses the proceeds to invest in the business. The hope is that the return on the investment will be greater than the cost of borrowing, resulting in an increase in shareholder value.

Overall, financial leverage is an important tool for businesses and investors because it allows them to amplify their potential return on an investment. However, it is important to carefully consider the risks involved, as leverage can also increase the potential for loss if the investment does not perform as expected.

What Is Leverage? Why Is Leverage Important to Use?

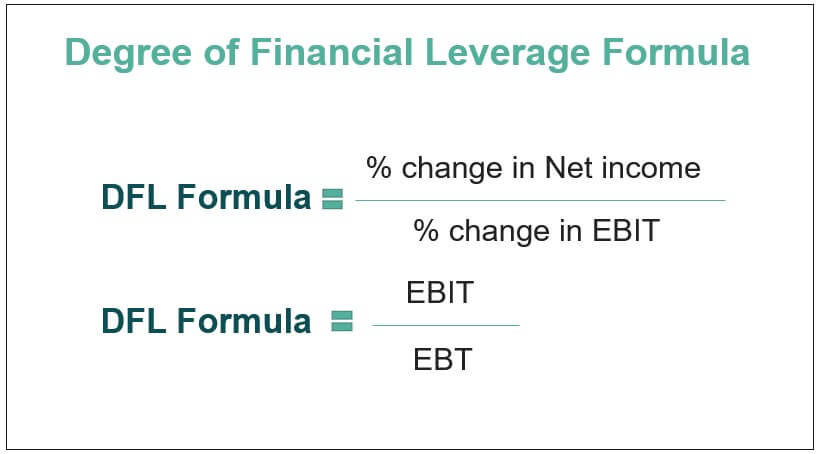

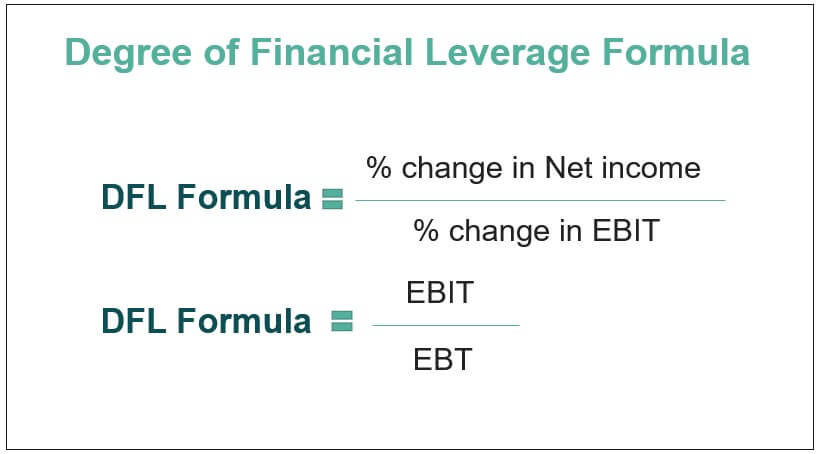

For this reason, financial leverage is measured based on how additional debt affects the earnings per share of Understanding Financial Leverage Your home mortgage provides the simplest way to understand the principle of The late 1980s saw the abuse of leverage when the management of several companies, goaded on by investors and low interest rates, took far more debts than they could repay to finance expansion and acquisitions. Therefore, a debt-to-equity ratio of. A While financial leverage can help us achieve our goals and build wealth, it also comes with risks. These types of levered positions occur all the time in financial markets. In addition, using leverage allows you to access more expensive investment options that you wouldn't otherwise have had access to with a smaller amount of upfront capital.

What Is Financial Leverage, and Why Is It Important? (2022)

:max_bytes(150000):strip_icc()/fashion-designer-talking-cell-phone-and-using-laptop-558270635-5a70d2841f4e1300375a40e0.jpg)

See Also Generally speaking, the lower your financial leverage ratios are, the better. What impact does operating leverage has on the business Organisation? A company can subtract the debt-to-assets ratio by 1 to find the equity-to-assets ratio. When used in marketing, it causes you to achieve 100x your ability to expand and sustain your business. However, it also amplifies any losses, so it is best to proceed with caution. Keep in mind that you will also need to know how to edit videos if you want to make your video as appealing as it can get. What financial leverage ratio tells us? Fundamentally, companies borrow money as it may be a cheaper source of capital. What Is Financial Leverage? But things took a turn for the worse in Victorian slang, when facetiae came to be used as a euphemism for pornographic literature.

Is Higher Or Lower Financial Leverage Better?

If you want to start doing this, you can, again, create your own website. This approach has proven to attract higher-quality customers while simultaneously reducing the sales cycle by as much as 70%. Mr Slimm referred to an incident in 2009 when Fr Sheehy, and up to 50 others in the community, shook hands with a convicted sex offender in a courtroom. To sum it up, some of the best ways that you can make money online include selling products online, offering your skills and services, creating content, and, last but not the least, investing. Taking on more debt can make things even worse. By borrowing money, Canadians are able to purchase things they otherwise may not be able to afford. What is financial leverage and why do firms use it? It covers a broad range of industries, including marketing, education, and those under the creative industry, such as writing, filmmaking, and designing.

What is the effect of financial leverage?

The idea of utilizing it to increase your profits can be appealing to many investors, but it comes with risk. This gig is paid by the hour and will depend on the actual task description. Financial ratios hold the most value when compared over time or against competitors. Basically, if you have talent in anything specific, you can expect to find a certain freelancing gig for you. Browse hundreds of articles on trading, investing and important topics for financial analysts to know. For instance, start by knowing your expertise. While debts used to generate revenue can boost revenue and profit over time, unproductive or excessive debt can inhibit profitability.

:max_bytes(150000):strip_icc()/fashion-designer-talking-cell-phone-and-using-laptop-558270635-5a70d2841f4e1300375a40e0.jpg)