What are the disadvantages of commodity money. What are disadvantages Commodity money? 2022-11-07

What are the disadvantages of commodity money

Rating:

4,1/10

307

reviews

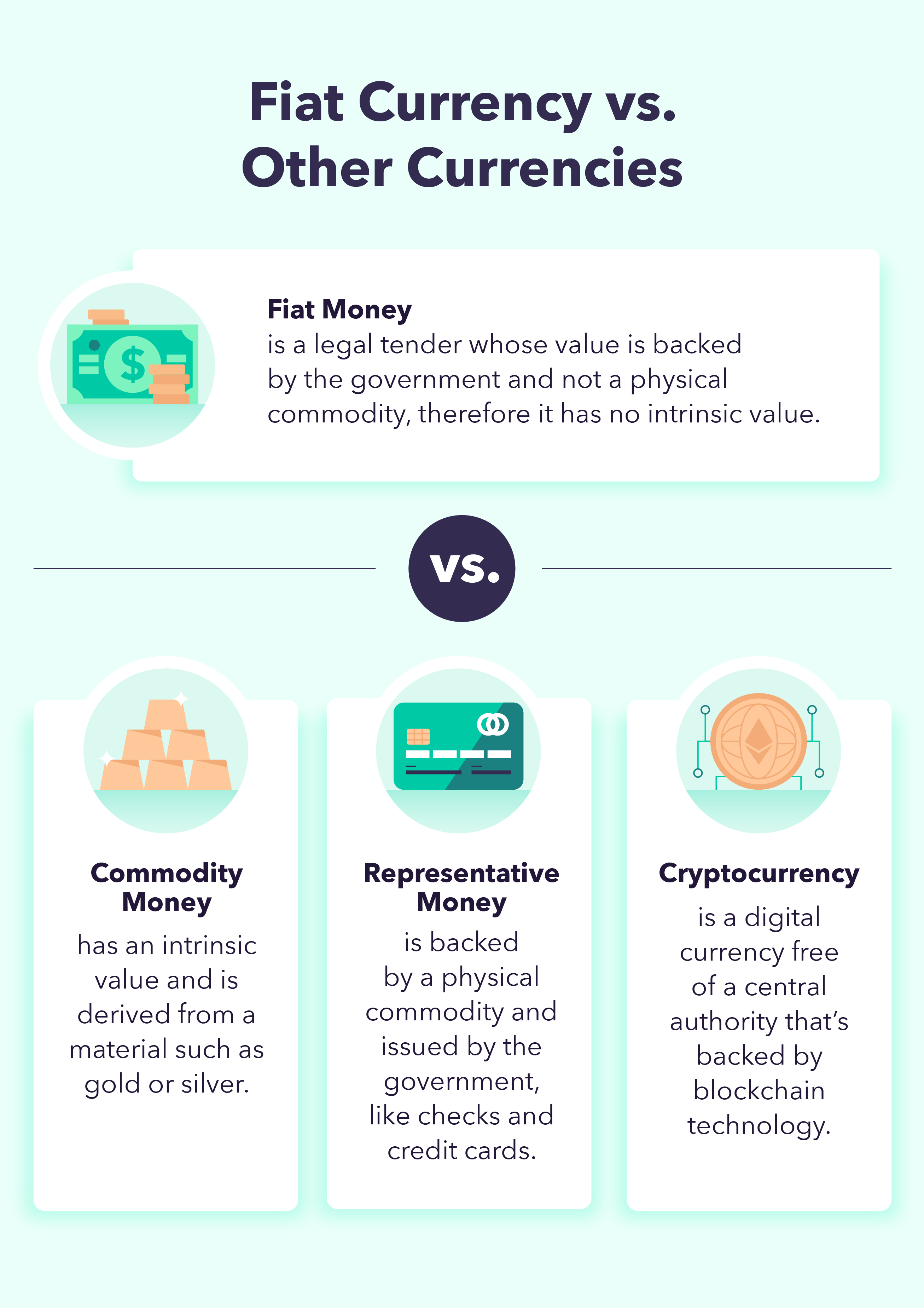

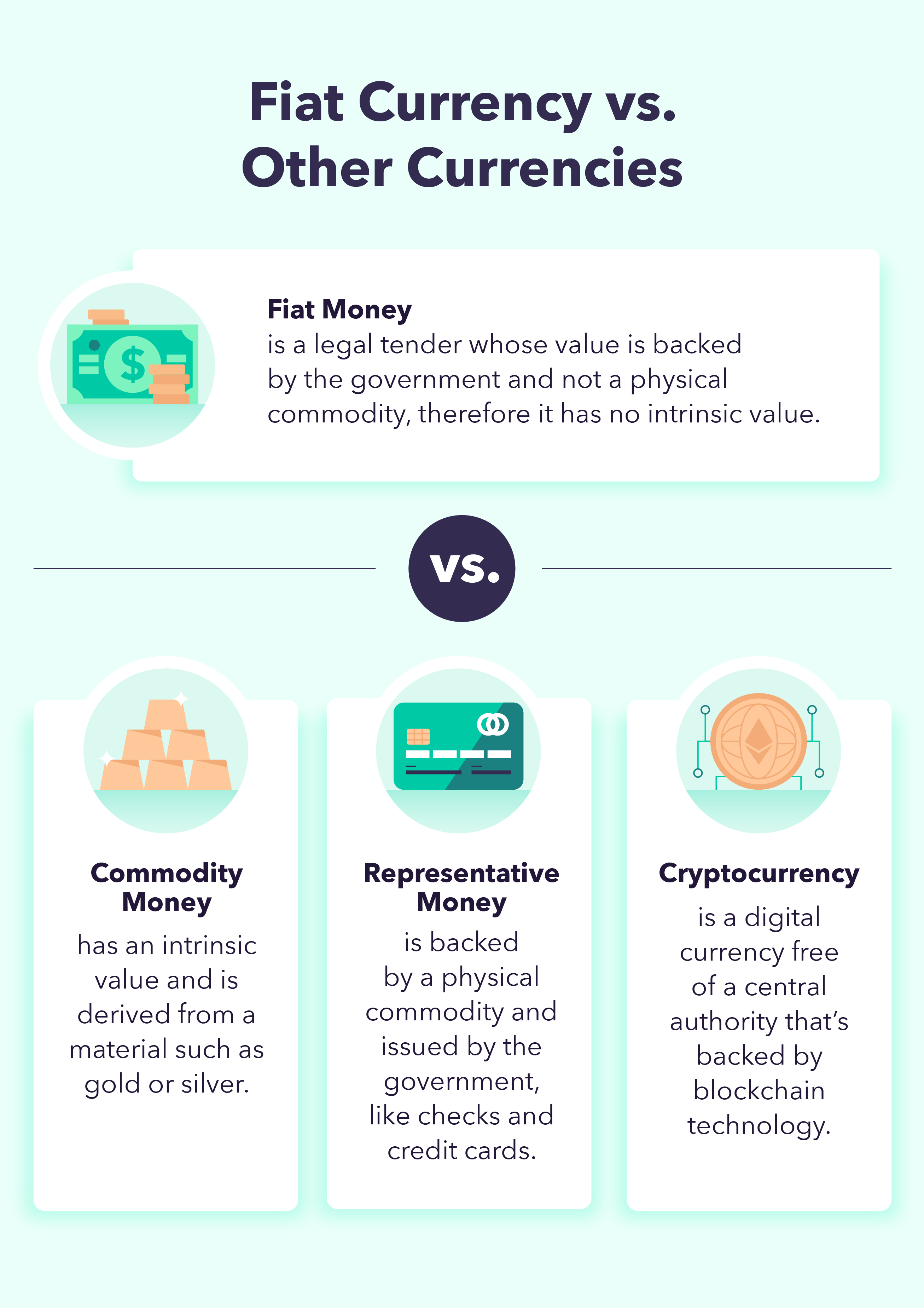

Commodity money refers to a type of money that is physically backed by a valuable commodity, such as gold or silver. While commodity money has been used for centuries, it has several disadvantages that make it less practical than other forms of money.

One disadvantage of commodity money is that it is prone to inflation. When the supply of a commodity increases, the value of the commodity money decreases, resulting in inflation. This can lead to economic instability and reduced purchasing power for the people using the commodity money.

Another disadvantage is that commodity money is often subject to fluctuating market conditions. For example, if the price of gold increases significantly, the value of gold-backed currency will also increase. This can make it difficult for people to predict the value of their money and can make long-term financial planning challenging.

Commodity money is also physically vulnerable and can be lost, stolen, or damaged. For example, gold coins can be melted down or stolen, which means that people using commodity money need to take extra precautions to protect their wealth.

Furthermore, commodity money is not very practical for everyday transactions. It is difficult to carry around large amounts of gold or silver, and it is not very convenient to use for small purchases. This can make it difficult for people to use commodity money in their daily lives.

In conclusion, while commodity money has been used for centuries, it has several disadvantages that make it less practical than other forms of money. It is prone to inflation, subject to fluctuating market conditions, physically vulnerable, and not very practical for everyday transactions. These factors have led to the widespread adoption of fiat money, which is not backed by a physical commodity but is instead backed by the government that issues it.

What are disadvantages Commodity money?

Commodity-backed currencies are dollar bills or other currencies with values backed up by gold or other commodity held at a bank. Risk of Volatility While commodity money typically has less volatility during turbulent economic developments, commodity money can still lose value. The minimum margin for commodity futures may vary but is much lower than stocks. By Deepika Khude The author is a Certified Financial Planner CFP with 5 years experience in Investment Advisory and Financial Planning. What are problems with commodity money? Risk of Volatility While commodity money typically has less volatility during turbulent economic developments, commodity money can still lose value.

Next

What Are the Disadvantages of Commodity Money?

Thus, the risk of volatility still exists with commodity money. While commodity money typically has less volatility during turbulent economic developments, commodity money can still lose value. Individuals tended to use or sell their best products while their poorest products would be offered as commodity money. However, as the table suggests such returns are always given back while at the same time eroding the value of the investment. Commodity Money and Inflation Commodity money has intrinsic value but risks large price fluctuations based on changing commodity prices.

Next

What are the disadvantages of commodity money?

Because commodity money is based on a physical resource, it is less prone to devaluing from inflation. It provides people a convenient way to evade taxes by concealing their income. One of the major problems with commodity money was quality. What are the advantages and disadvantages of commodity money? For example, gold can be turned into jewelry, while cigarettes can be smoked. Does commodity money have volatility? At the same time, since commodities are prerequisites of daily lives, price changes will not affect their demand as they are essential commodities, and consumers are habituated to them, preventing them from looking for alternate means.

Next

Disadvantages of Commodity money?

Examples of commodities that have been used as media of exchange include gold, silver, copper, salt, peppercorns, tea, decorated belts, shells, alcohol, cigarettes, silk, candy, nails, cocoa beans, cowries and barley. What are the disadvantages of coins? Probably the biggest concerns with cryptocurrencies are the problems with scaling that are posed. While commodity money typically has less volatility during turbulent economic developments, commodity money can still lose value. What are disadvantages of metallic money? Supply and demand can significantly affect the price of commodities. Inequality of Income: Money, through its excessive use and inflationary effect, creates and widens the inequalities in the distribution of income and wealth. What are disadvantages of metallic money? The following are the various disadvantages of money: 1.

Next

What are the advantages and disadvantages of commodity money?

What are the disadvantages of trading in commodities? In other words, how can you determine that you are, in fact, getting your money's worth for the purchased item? What are the pros and cons of commodity money? However, commodities perform better when the rate of inflation is rising. That means it has value in and of itself, with people trading it freely in the knowledge that someone will accept it. A great disadvantage of money is that its value does not remain constant which creates instability in the economy. Total dependence or misuse of money may lead to undesirable and harmful results. What are the benefits and challenges of fiat money for the economy? This can also be seen as a disadvantage.

Next

Advantages & Disadvantages of Commodity Trading

The characteristics of money are durability, portability, divisibility, uniformity, limited supply, and acceptability. The drawback of this cyclical nature of commodities is it entices long-term investors who are mesmerised by the size of short-term gains. For example, after a hurricane, the supply of oil may get disrupted, causing the price of oil to rise. Deflation, on the other hand , results in unemployment and hardships to the working class. When everyone leaves a commodity behind, the value drops, along with your investment.

Next

What are the disadvantages of Money?

This gives the holder added options; he can either use or spend the money. Why is commodity money accepted? Over-Capitalization: Easy borrowing and lending facilities, made possible through money, may lead certain industries to use more capital than is required. Money is also the root cause of thefts, murders, frauds and other social evils. Gold is neither commodity nor currency. One is, there can never be more money than there are commodities to cover it. During the 2008 financial crisis, there was a fall in the overall demand, which led to unemployment. All the four are serious problems and can ruin the character of the person from the core and affect his personality.

Next

What were the disadvantages of commodity money?

The main advantage of commodity money is simply that it serves an additional purpose. Growth of monopolies results in the exploitation of the workers, brings misery and degradation to them. Thus the 2008 Global Financial crisis is a case in point that commodities may not be effective for portfolio diversification. Which of the following is not a commodity money? Hence, investors flee to commodity futures to protect their capital from the effects of inflation and maintain their value. What are the five characteristics of commodity money? It also allows for fractional reserve banking, which lets commercial banks multiply the amount of money on hand to meet demand from borrowers.

Next

-2.png)

What are the disadvantages of cryptocurrencies? Oil prices during this crisis fell from a high of Rs 10840 per barrel in July 2008 to a dismal low of Rs 2433 per barrel in February 2009, while LNG prices fell from Rs 1032 to Rs 300. Stocks have produced far significant and outsized returns compared to commodities at lesser volatility. This over-capitalization, in turn, results in over-production and unemployment. The price discovery happens when the price and quantity quoted by the seller and buyer matches perfectly. Misuse of Capital: Money, which is the basis of credit, leads to the creation of more and more credit creation. This can also be seen as a disadvantage. Therefore, during inflation, the prices of the stocks fall.

Next

During such events there is pessimism in the market causing the stock prices to fall drastically. Watch this video to learn how tracking commodity markets can help you make profits in equities. Measuring the exact amounts of value of commodity money is not easy, and therefore, it is difficult to manage your wealth using commodity money. This ultimately leads to a decline in the prices of the stocks. Another problem with commodity money is assessing the value of items purchased with the commodity money. Rising commodity prices increase the cost of production, which reduces the profits, leaving very little for shareholders and reducing the earnings per share.

Next

-2.png)