Westpac is one of the major banks in Australia, with a long history dating back to the early 19th century. As a publicly listed company, Westpac is required to disclose its financial performance through financial statements, which provide information about the bank's financial position, performance, and cash flow. In this essay, we will delve into the key components of Westpac's financial statements and discuss their significance in understanding the bank's financial health.

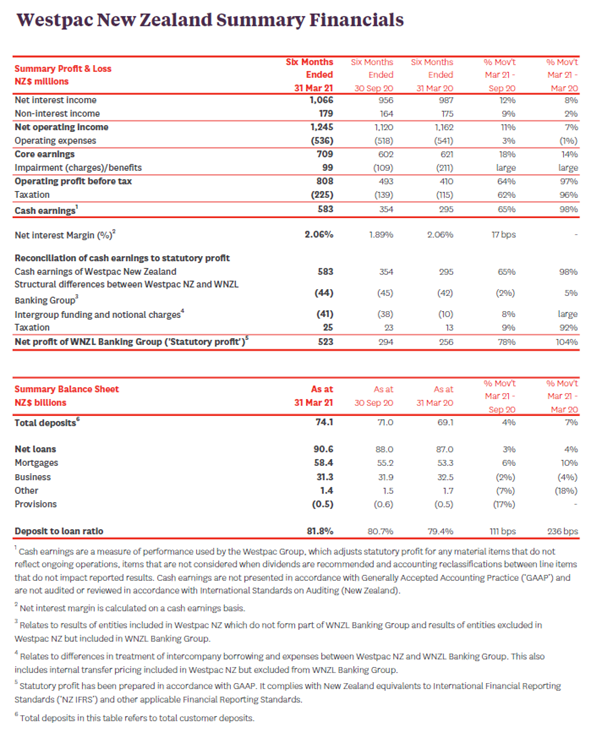

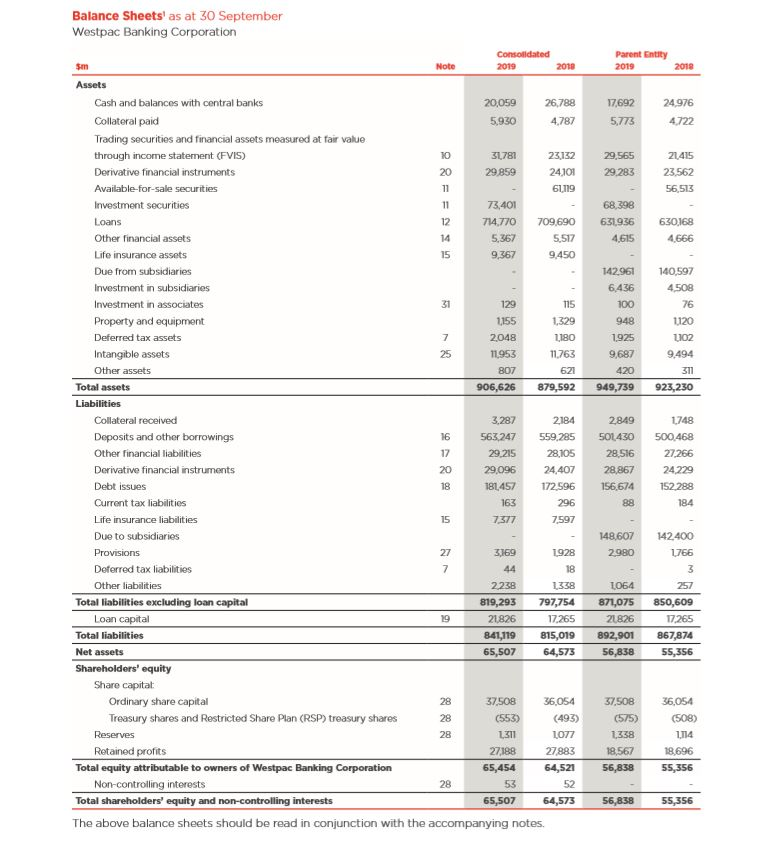

The first component of Westpac's financial statements is the balance sheet, which provides a snapshot of the bank's financial position at a specific point in time. The balance sheet consists of two main sections: assets and liabilities. Assets refer to the resources owned by the bank, such as cash, investments, and property, while liabilities refer to the debts and obligations owed by the bank, such as loans and deposits from customers. The balance sheet also includes equity, which represents the residual interest in the assets of the bank after liabilities are deducted.

The income statement is another important component of Westpac's financial statements, as it provides information about the bank's financial performance over a specific period of time. The income statement includes revenue, which represents the bank's income from operations, as well as expenses, which represent the costs incurred in generating that income. The difference between revenue and expenses is the net income or net loss of the bank for the period.

Westpac's financial statements also include the statement of cash flows, which provides information about the bank's cash inflows and outflows over a specific period of time. The statement of cash flows is divided into three main sections: operating activities, investing activities, and financing activities. Operating activities refer to the cash flows resulting from the bank's core business operations, such as interest and fees earned on loans and deposits. Investing activities refer to the cash flows resulting from the bank's investments in assets, such as property or securities. Financing activities refer to the cash flows resulting from the bank's financing activities, such as issuing new shares or borrowing money.

Finally, Westpac's financial statements include the statement of changes in equity, which shows the changes in the bank's equity over a specific period of time. This statement includes the net income or loss for the period, as well as any changes in equity resulting from transactions with owners, such as the issuance of new shares or the payment of dividends.

In conclusion, Westpac's financial statements provide a comprehensive overview of the bank's financial position, performance, and cash flow. By analyzing these statements, stakeholders can gain a better understanding of the bank's financial health and make informed decisions about their investments or dealings with the bank.