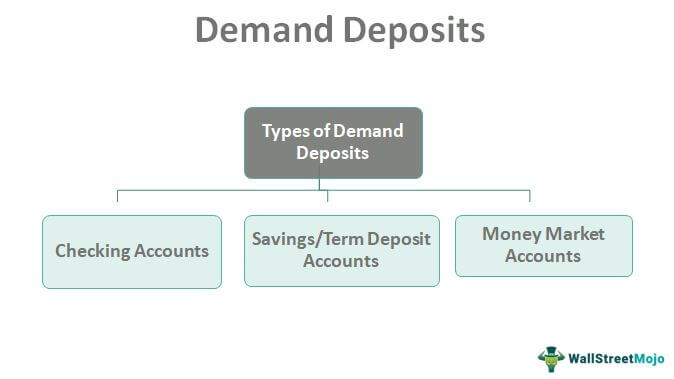

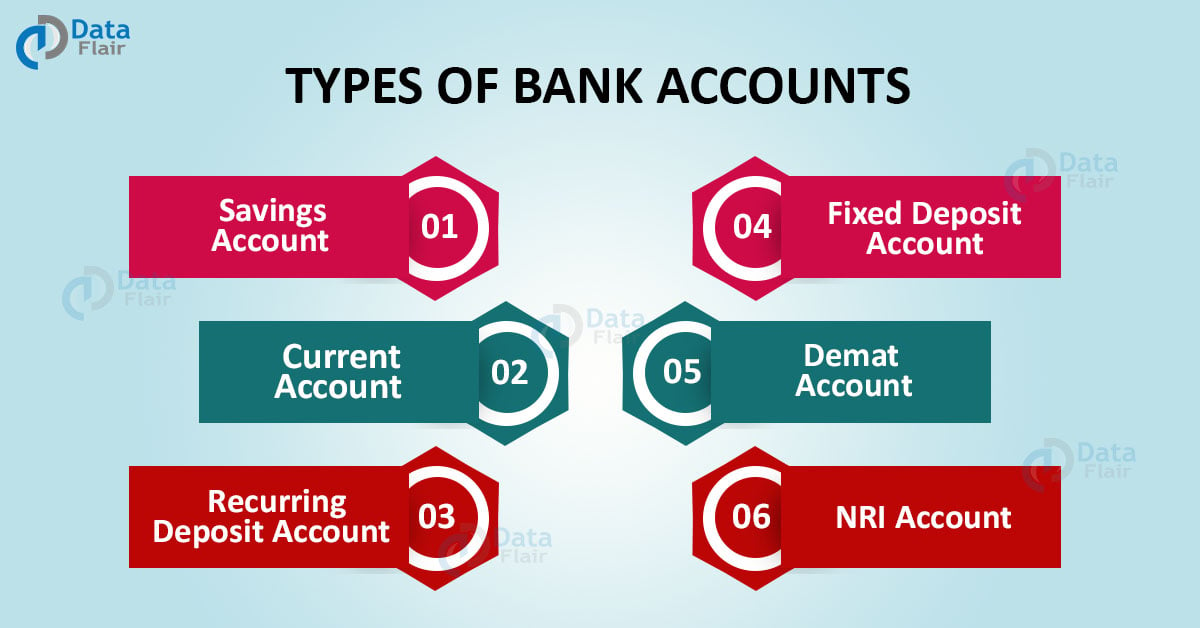

Deposits refer to money placed into a financial institution, such as a bank, credit union, or savings and loan association, for the purpose of saving or investing. There are various types of deposits that individuals and businesses can make, each with its own set of features and benefits.

One type of deposit is a savings account, which is a basic type of account that allows individuals to deposit money and earn interest on their balance. Savings accounts typically offer a lower interest rate than other types of deposits, but they also come with fewer risks and are more liquid, meaning that the money can be easily accessed through the use of a debit card or by making a withdrawal at a bank branch.

Another type of deposit is a certificate of deposit (CD), which is a term deposit that requires the depositor to leave their money with the financial institution for a specific period of time, ranging from a few months to several years. CDs offer a higher interest rate than savings accounts, but the money is not as easily accessible and early withdrawal may result in a penalty. CDs can be a good option for those who have a longer-term savings goal and can afford to leave their money untouched for a set period of time.

Money market accounts are another type of deposit that offer a higher interest rate than a savings account but also have higher balance requirements and may have more restrictions on withdrawals. Money market accounts can be a good option for those who want a higher rate of return on their deposits but still need some access to their funds.

Businesses may also consider making deposits in the form of a business savings account or a business money market account. These types of accounts are similar to personal savings and money market accounts, but they are designed specifically for businesses and often have higher balance requirements and may offer additional features such as check writing privileges.

In addition to traditional deposits at financial institutions, individuals and businesses may also consider making deposits into investment accounts, such as a brokerage account or a retirement account. These types of accounts allow for the deposit of money that can be used to purchase a variety of investments, such as stocks, bonds, and mutual funds. These types of accounts offer the potential for higher returns, but they also come with more risk and may not be as liquid as traditional deposits.

In summary, there are various types of deposits that individuals and businesses can make, each with its own set of features and benefits. It is important to carefully consider one's financial goals and risk tolerance when deciding which type of deposit is right for them.

:max_bytes(150000):strip_icc()/mostcommontypesofbanks-52d431e6e01f41cfb845113a16cd36c6.png)