Variable costing, also known as direct costing, is a method of costing that only includes the variable costs of production in the cost of goods sold (COGS) on the income statement. Variable costs are those that vary in direct proportion to the volume of production, such as the cost of raw materials and direct labor. Fixed costs, on the other hand, are those that do not vary with the volume of production and include expenses such as rent, insurance, and property taxes. Under variable costing, fixed costs are not included in the COGS and are instead treated as period costs and expensed in the period in which they are incurred.

Absorption costing, on the other hand, includes both variable and fixed costs in the COGS. This means that the full cost of producing a product, including both the direct and indirect costs, is recognized in the income statement. Indirect costs, also known as overhead, are those costs that cannot be directly traced to a specific product or unit of production and include expenses such as indirect materials and indirect labor.

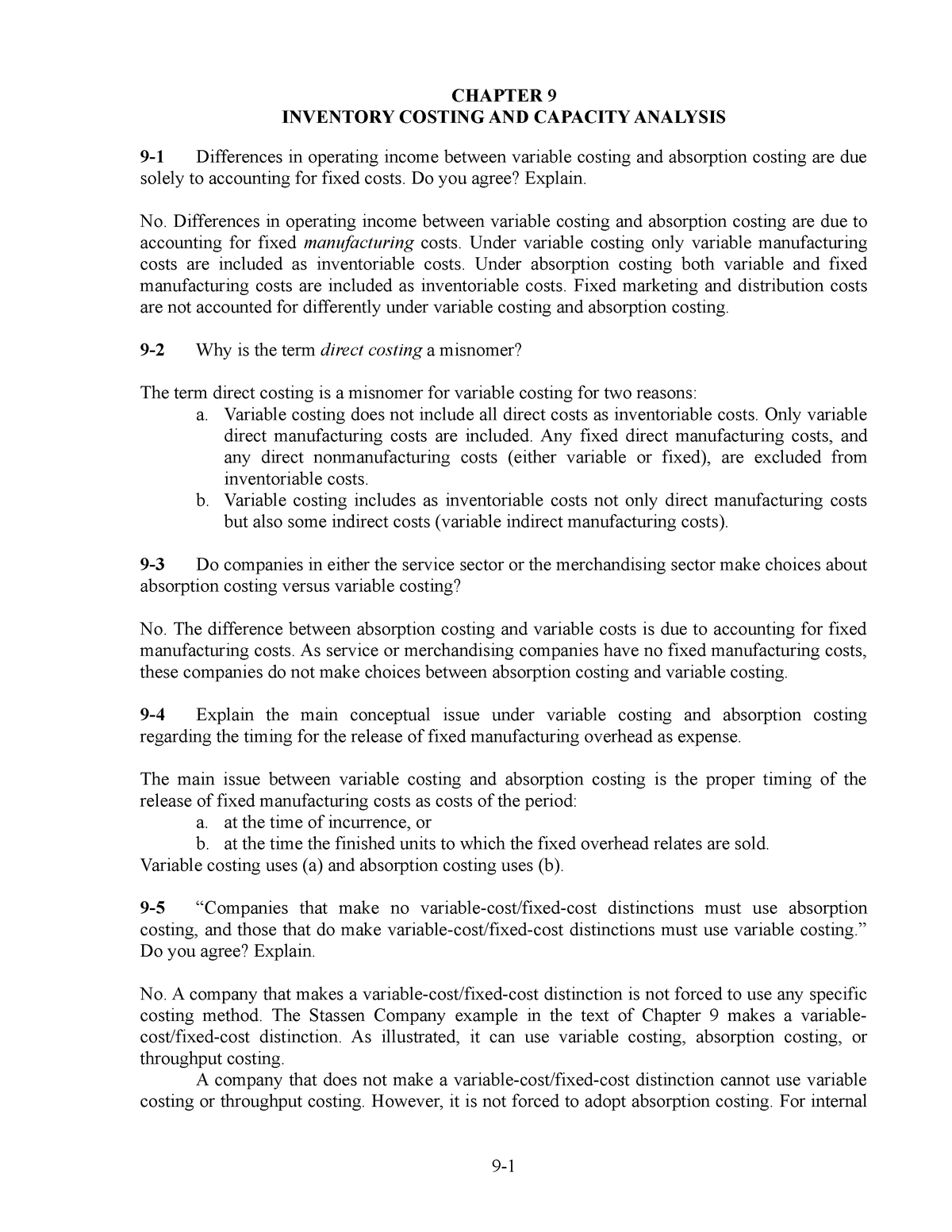

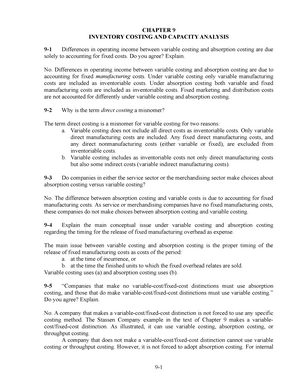

The main difference between the two methods is how they treat fixed costs. Under variable costing, fixed costs are not included in the COGS and are expensed as they are incurred. This means that operating income is higher under variable costing because it does not include the fixed costs in the COGS. Under absorption costing, fixed costs are included in the COGS and are therefore recognized as an expense in the income statement. This results in a lower operating income compared to variable costing because the fixed costs are recognized as an expense in the income statement.

There are several factors to consider when choosing between the two methods. One of the main advantages of variable costing is that it provides a better indication of the contribution margin, which is the amount of revenue remaining after the variable costs have been subtracted. This can be useful for decision-making purposes, as it allows managers to see the impact of changes in volume on profitability. Additionally, variable costing is simpler to calculate and understand because it only includes the variable costs in the COGS.

However, absorption costing has several advantages as well. One of the main advantages is that it provides a more accurate representation of the true cost of production. By including both variable and fixed costs in the COGS, absorption costing recognizes the full cost of producing a product and provides a more accurate picture of the company's profitability. This can be useful for external reporting purposes, as it provides a more accurate representation of the company's financial performance.

In conclusion, variable and absorption costing are two different methods of costing that are used to calculate the cost of goods sold on the income statement. The main difference between the two methods is how they treat fixed costs, with variable costing expensing fixed costs as they are incurred and absorption costing including them in the COGS. Both methods have their own advantages and disadvantages and the choice between the two will depend on the specific needs and goals of the company.

:max_bytes(150000):strip_icc()/Absorptioncosting_final-8f4a2ad294fb4793aebe8f8d27efd763.png)