The objective of financial accounting. Financial Accounting 2022-10-29

The objective of financial accounting

Rating:

4,3/10

1464

reviews

Financial accounting is the process of preparing, classifying, and summarizing financial information in the form of financial statements. The objective of financial accounting is to provide relevant, reliable, and useful financial information to the users of financial statements, such as shareholders, investors, creditors, and regulators.

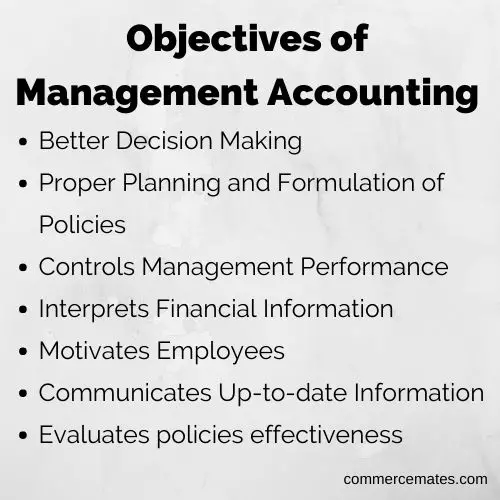

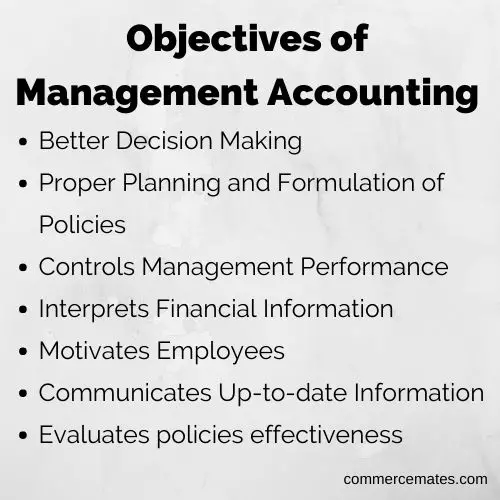

There are several key objectives of financial accounting, including:

To provide information that is useful for making economic decisions: Financial statements provide information about a company's financial performance, financial position, and cash flows, which can be used by external users to make informed decisions about investing, lending, or doing business with the company.

To serve as a basis for preparing tax returns: Financial statements provide the necessary information for preparing tax returns and complying with tax laws and regulations.

To help stakeholders assess the financial health of the company: Financial statements provide a snapshot of a company's financial condition, including its assets, liabilities, and equity. This information can help stakeholders, such as shareholders and creditors, assess the financial health of the company and the risks and opportunities it faces.

To facilitate the comparison of financial performance between companies: Financial statements allow users to compare the financial performance and position of different companies, which can be useful for investment and business decisions.

To meet legal and regulatory requirements: Financial statements must comply with generally accepted accounting principles (GAAP) and other financial reporting standards, which are established to ensure the transparency and reliability of financial information.

In summary, the objective of financial accounting is to provide relevant, reliable, and useful financial information to the users of financial statements, which helps stakeholders make informed economic decisions and meets legal and regulatory requirements.

What are the Objectives of Financial Accounting?

Organizations need to measure their key performance indicators regularly and reliably to improve themselves by making valid comparisons against their past performance. A statement of cash flow is used by managed to better understand how cash is being spent and received. Decision Regarding Business operations You can use accounting to make better decisions about your general day-to-day operations. Financial accounting is known as the process of recording, compiling, and reporting the numerous transactions occurring from corporate operations throughout time. Knowing the objectives of financial accounting can make the difference between just being a bean-counter and really understanding what your business is doing.

Next

Objectives of Accounting

The three most common varieties of financial statements are the balance sheet, income statement, and statement of cash flow. It also shows the availability of resources by the company for future growth. Financial accounting is a branch of accounting which records each financial information and analyse it to determine the financial position of a business. When the company does the work in the following month, no journal entry is recorded because the transaction will have been recorded in full in the month prior. Law requires organizations to maintain a precise accounting record and then report their financial results to stakeholders such as tax authorities, shareholders, and regulators on a timely basis. When the invoice is paid, the credit is cleared.

Next

Objectives of Financial Accounting (Definition)

Of course earning Profits. Tax accounting is in charge of supervising and recording the operations of a company with Thus, the criteria of tax accounting will vary according to the place where the company operates, but it is always of great importance for the preservation of the business heritage as well as its public Administrative accounting Administrative accounting reports the financial situation of the company. With financial reporting, a company wishes to be prepared for tax season, avoiding any legal penalties as they respect the GAAP Generally Accepted Accounting Principles set by the FASB Financial Accounting Standards Board and be eligible for investors and creditors. In short, efforts must be made to prepare Financial Accounts in an easy way to know wherever possible. Some reasons why earnings management is done may include the following: Reasons for Upward Earnings Management Reasons for Downward Earnings Management Bonuses are given out in relation to net income Reduction in taxes Meeting debt covenants Increase the chances of obtaining government assistance Enhancing the perception of the company i.

Next

What are the Top 10 Objectives of Accounting? [With PDF]

Objectives of Financial Accounting 1 — Compliance with Statutory Requirements One of the objectives is to ensure compliance with local laws related to taxation, the Companies Act and other statutory requirements relevant to the country where the business undertakes. It indicates that the entity will conduct its business with ease. Buy-side analysts create investment strategies for companies, while sell-side analysts provide advice to agents selling investments. All financial strength and weakness of business are determined by preparation of financial statements. Keeping a full history of all business transactions helps to avoid the possibility of omission and fraud. Compliance with Statutory Requirements One of the objectives is to ensure compliance with local laws related to taxation, the companies Act and other statutory requirements relevant to the country where the business undertakes. It is to ensure that your assets are never wrongfully affected to the point it creates a butterfly effect.

Next

Top 10 Objectives of Financial Accounting

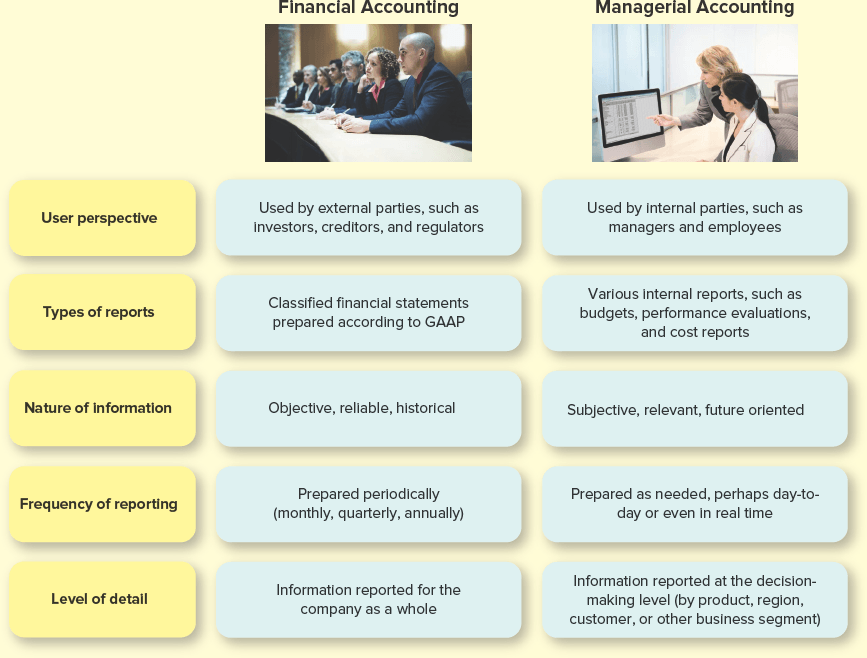

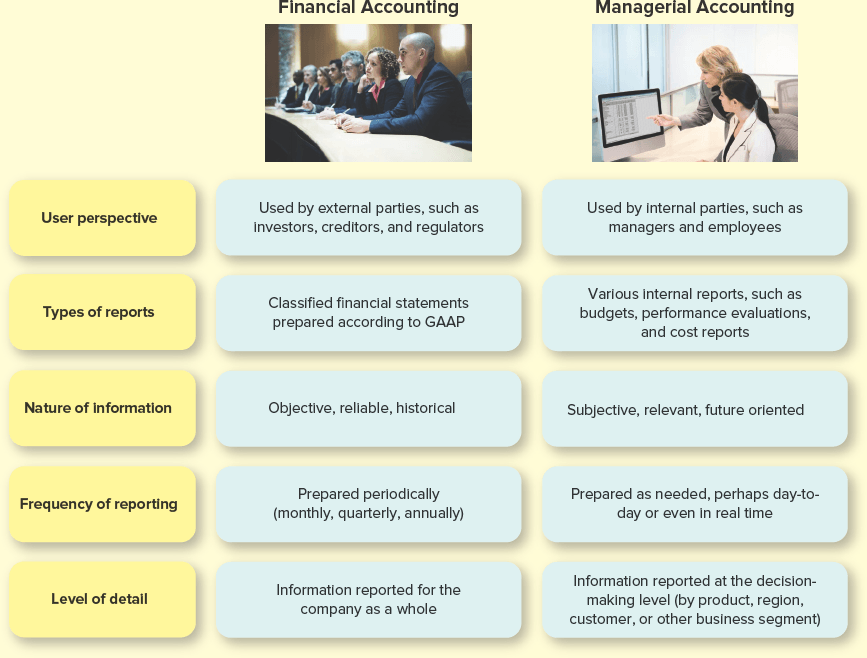

This knowledge can be acquired through a The Purpose of Financial Accounting Two well-known types of accounting are financial and managerial. For this purpose, such Accounting should represent a faithful representation of transactions and events undertaken by the business, should be represented in their actual substance and economic reality perspective. To be relevant, information must also be current. It is the ultimate result of this system that every Why the Cash for the Business Does Not Equal to the Profit The purpose of this essay is to demonstrate the understanding of the accounting double entry system and how these transactions appear on an income statement and a balance sheet as well as to interpret reasons why the cash position for the business does not equal to the profit for the period. For this purpose, all business transactions are first recorded in the journal and subsidiary books and then further posted into the ledger.

Next

Financial Accounting: Nature, Scope, and Objective

:max_bytes(150000):strip_icc()/accounting-40ae49d71fd0426789adc827e053780c.jpg)

Various financial records and books of accounts are also used for various needs of the company. It simplifies the accounting information so that it is well understood by persons having limited or no knowledge of accounting subject. Accounting fulfills the information needs of a diverse group of stakeholders, each with its information requirement. That means that it must help a financial statement reader to make decisions about the financial well-being of the company. These financial statements are prepared on a routine basis by companies and presented to all its stakeholders.

Next

What Are the Objectives of Financial Accounting?

Accounting is also a legal requirement for most businesses. Keeping a record of all financial transactions is the primary function of any accounting department. When a company has a Bank account in SBI, all the transactions of the bank Cash withdrawals, Cash Deposits,Bank Charges etc for each and every month are to be recorded from 1 st to 31 st of every month by preparing Bank Book. Decisions related to Investments Investors who purchase shares in a limited company by shares can receive dividends from your profits. It act as a guideline to the Board in developing accounting standards , yet is. A personal financial advisor can provide advice about a home purchase, estate planning, and family planning, among other goals. This implies summarizing, analyzing and reporting on the matter to both the general public and the shareholders of a company or government agencies dedicated to fiscal supervision, and based on this information, strategic decisions are usually made within the organization.

Next

Financial Accounting Meaning, Principles, and Why It Matters

Accounting is a set of procedures business entities use to record their financial transactions. Accounting data provide you with information about where your money is being spent, so you can make informed decisions. While all of them are built on the same foundation and technical knowledge of the profession, they each have a specific purpose and utilization. It could take the form of bad financial management, wrong customer service, performance issues, technological difficulties, which are the main contributing factors of a decline. Accounting will ensure that the incidence of fraud is virtually eliminated by bringing transparency into the transactions of the firm.

Next

What is the Objective of Financial Accounting? (10 Main Objective You Should Know)

If the company is earning the right amount of profits and the profit is also increasing from the previous year, then this shows that the company is efficiently working and growing. Consistency Consistency is another secondary quality of financial information. Financial Analyst Financial analysts evaluate historical and current financial data and recommend investments or efficiency improvements. In financial reporting, we commonly encounter a phenomenon called information asymmetry. While tracking of incomes, Accrued incomes shall also be recorded like Accrued Rent. For this purpose, such Accounting should represent a faithful representation of transactions and events undertaken by the business, represented in their actual substance and economic reality perspective. Accounting helps businesses reduce the risk of bankruptcy by timely detecting potential bottlenecks by managing cash flows so that companies always have sufficient liquid funds available to pay for their financial commitments.

Next

Financial Accounting Theory

Accounting information can help you determine if your business has enough cash to fund its own ventures or if it needs to borrow money to do so. It is done in accordance with rules provided by GAAP or IFRS. Employment of financial managers is expected to grow 17% from 2020 to 2030, compared with 8% for all occupations, according to the BLS. In order to evaluate a business, one must go beyond simply determining its profit or loss. Advertisements 8 Filing taxation Tax liability is dependent on the profit earned by the business. Example There is a company A ltd.

Next

:max_bytes(150000):strip_icc()/accounting-40ae49d71fd0426789adc827e053780c.jpg)