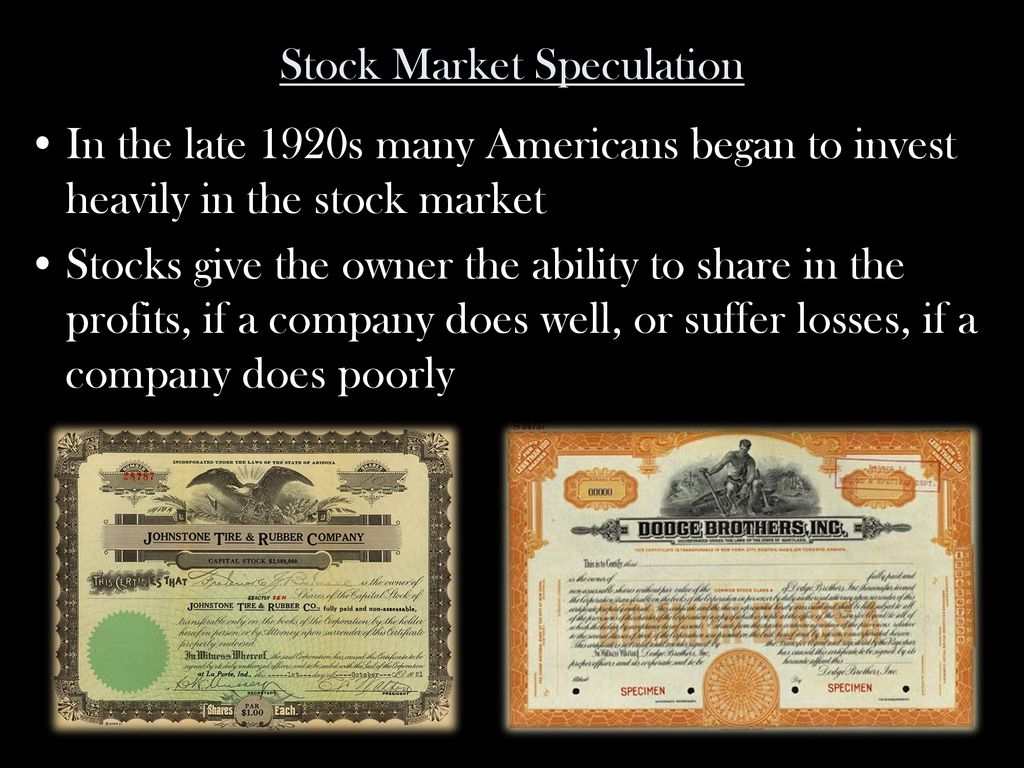

The stock market speculation of the 1920s was a period of intense speculation and financial speculation in the United States. This period was characterized by a rapid expansion of the stock market and a significant increase in the number of people investing in the stock market.

During the 1920s, the stock market experienced significant growth due to a number of economic and political factors. The United States had emerged from World War I as one of the dominant economic powers in the world, and the country was experiencing a period of rapid economic growth and prosperity. This economic growth was fueled by a number of factors, including the expansion of international trade, the development of new technologies and industries, and the growth of the service sector.

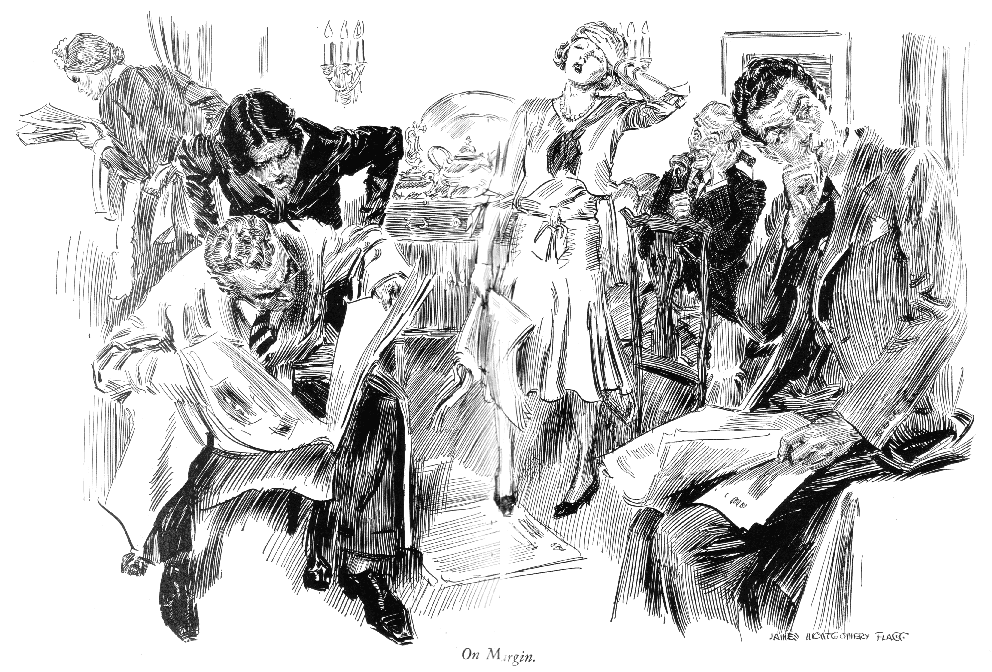

The growth of the stock market in the 1920s was also fueled by a number of other factors. One of the key drivers of the stock market speculation was the development of new financial instruments and practices, such as the use of margin trading. Margin trading allowed investors to purchase stocks with a smaller amount of money upfront, and to borrow the rest from the broker. This made it easier for people to enter the stock market and to speculate on the price movements of different stocks.

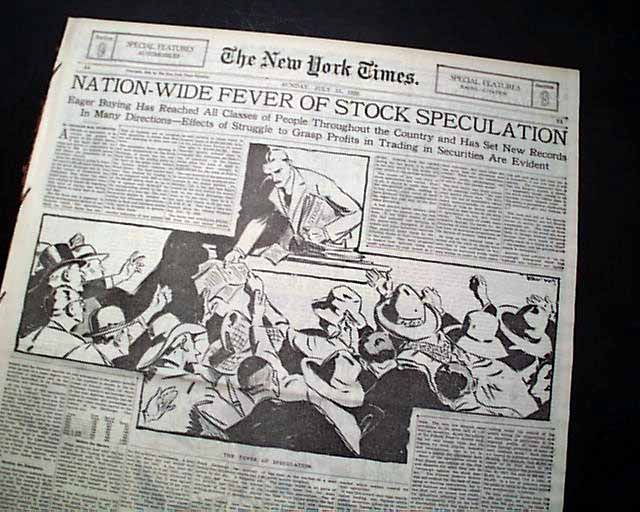

Another factor that contributed to the stock market speculation of the 1920s was the widespread optimism and confidence in the economy. Many people believed that the stock market would continue to rise indefinitely, and they were willing to take significant risks in order to capitalize on this perceived opportunity. This optimism and confidence was further fueled by the media, which often portrayed the stock market as a surefire way to make money.

However, the stock market speculation of the 1920s ultimately ended in disaster. The stock market crash of 1929, which is often referred to as the Great Crash, marked the end of this period of speculation and financial excess. The crash was caused by a number of factors, including overvaluation of stocks, excessive leverage, and a lack of regulation in the financial markets. The crash led to widespread economic turmoil, and it ultimately contributed to the onset of the Great Depression.

In conclusion, the stock market speculation of the 1920s was a period of intense financial speculation and risk-taking in the United States. While the stock market experienced significant growth during this period, it ultimately ended in disaster with the crash of 1929 and the onset of the Great Depression.

Stock Market Crash of 1929

From 1926 to 1929, the number of people flying in planes increased from 6,000 to 173,000. Although it was risky, investors paid high prices for stocks and then resold; the market plunged. What was one way in which the approaches of Hoover and Roosevelt in response to the depression differ? The Roaring Twenties roared loudest and longest on the New York Stock Exchange. Since the 1929 stock market crash, we had a housing bubble, a crash in 1987, and the flash crashes of 2010 and 2015. Many investors became convinced that stocks were a sure thing and borrowed heavily to invest more money in the market. In the 1920s, millions of Americans invested their savings or placed their money, in the rising stock market. There was a boom and bust in the market.

Stock Market Crash: 1929 & Black Tuesday

After World War I, the country achieved global respect for the very first time. During the 1920s, the U. Two signs of weaknesses in the American economy were wealth distribution and credit and the stock market. It was caused by stock brokers who called in the loans they had made to stock investors. During the 1920s, there were a number of changes to the way that shares were bought and sold. Chart 1: Dow Jones Industrial Average Index daily closing price, January 2, 1920, to December 31, 1954.

The Stock Market in the 1920s

If prices are manipulated we are no longer operating in competitive market. Their conclusions concerning these events are cited by many economists, including members of the Federal Reserve Board of Governors such as Ben Bernanke, Donald Kohn and Frederic Mishkin. In most cases, the stocks were bought and sold on stock exchanges, the one being the New York Stock Exchange, located in the heart of Manhattan. The Great Depression was an economic crisis that began with the stock market crash of 1929 and lasted for nearly a decade. To stop speculation, the Fed raised the discount rate from 3. The stock market crash of 1929 was not the sole cause of the Great Depression, but it did act to accelerate the global economic collapse of which it was also a symptom. In the 1920s, many speculators people who hoped to make a lot of money on the stock market bought stocks on margin.

Why did the stock market boom in the 1920s?

Automobiles, telephones, and other new technologies proliferated. The slide continued through the summer of 1932, when the Dow closed at 41. On Black Monday, October 28, 1929, the Dow declined nearly 13 percent. By mid-November, the Dow had lost almost half of its value. The sudden surges strained banks. To begin to grasp why so many people invested in the stock market in the 1920s, let's describe the era. What Caused The Great Depression Quizlet? Governments and states emerged as rulers gained control over larger areas and more resources, often using writing and religion to maintain social hierarchies and consolidate power over larger areas and populations.