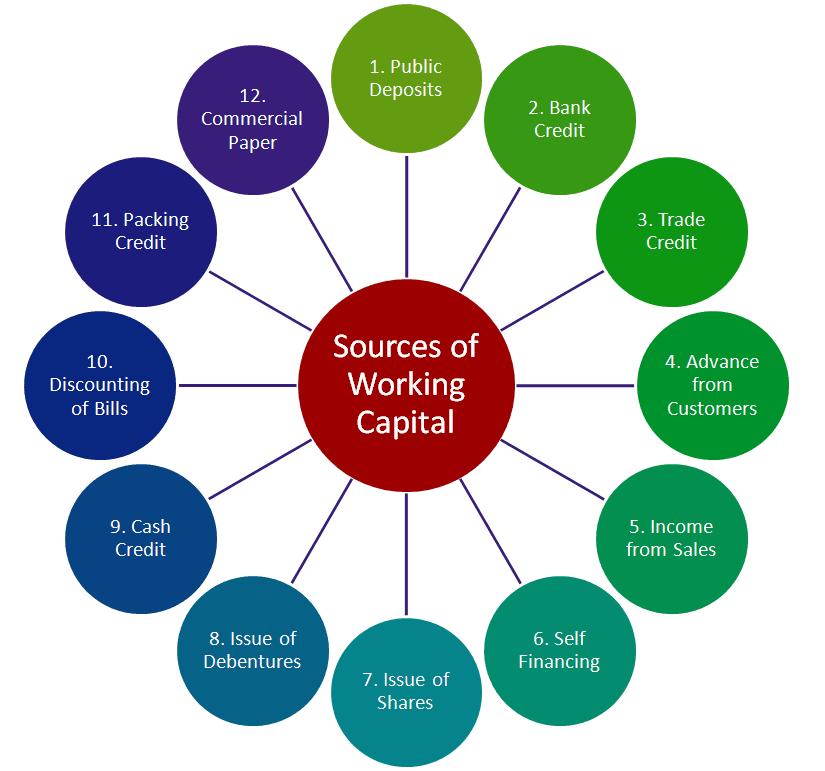

Short-term capital refers to funds that are needed for a company to meet its financial obligations over a period of less than one year. These funds are typically used to cover operating expenses, pay off debt, or finance seasonal fluctuations in business activity. There are several sources of short-term capital that companies can utilize to meet their financial needs.

One source of short-term capital is trade credit, which refers to the credit extended to a company by its suppliers when it purchases goods or services on credit. This is a common practice in the business world, as it allows companies to purchase goods or services without having to pay for them immediately. Trade credit is typically offered on a short-term basis, with payment due within 30 to 90 days.

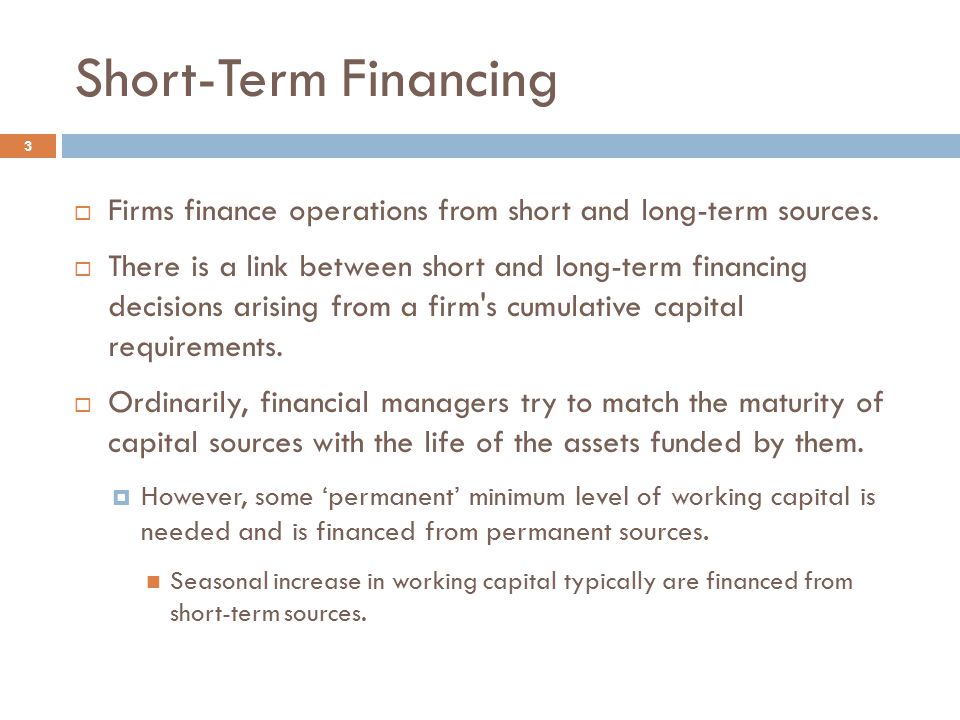

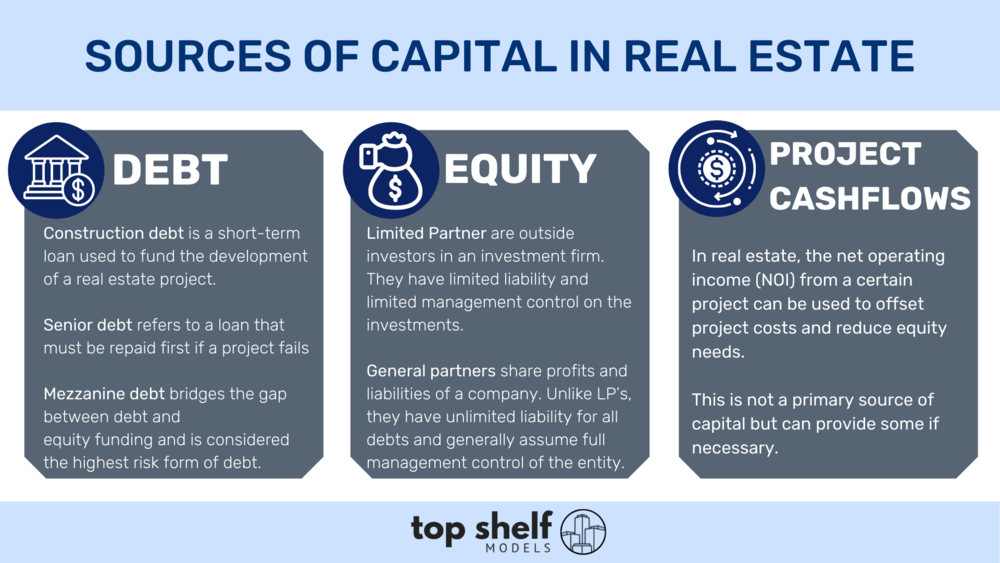

Another source of short-term capital is short-term loans, which are loans that are typically due within one year or less. These loans can be obtained from banks, financial institutions, or other lenders, and are often used to finance seasonal fluctuations in business activity or to meet short-term cash flow needs. Short-term loans can be secured or unsecured, depending on the lender's requirements and the borrower's creditworthiness.

A third source of short-term capital is commercial paper, which is a type of unsecured promissory note issued by a company to raise funds for a short period of time, typically less than 270 days. Commercial paper is typically issued by large, well-established companies with strong credit ratings, and is typically purchased by institutional investors, such as money market mutual funds and pension funds.

Finally, companies can also obtain short-term capital through the sale of assets, such as inventory or equipment. This can be an effective way to raise cash quickly, but it may also result in the company losing valuable resources that it may need in the future.

In conclusion, there are several sources of short-term capital that companies can utilize to meet their financial needs. These include trade credit, short-term loans, commercial paper, and the sale of assets. It is important for companies to carefully consider the pros and cons of each option and choose the one that is most appropriate for their specific needs and financial situation.