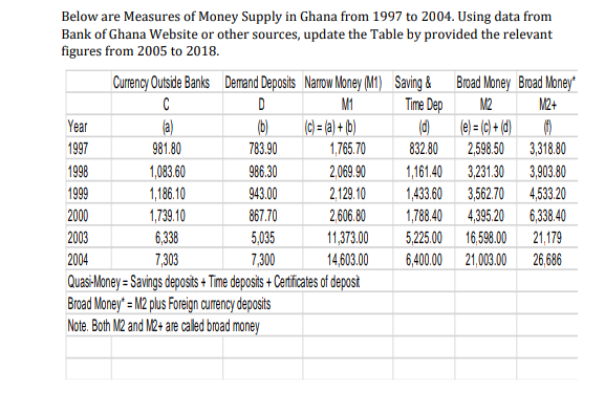

The money supply refers to the total amount of money available in an economy at a given point in time. This includes physical currency (such as coins and paper bills) as well as various forms of electronic money, such as bank deposits and electronic payments. The sources of money supply in an economy can be divided into three main categories: central banks, commercial banks, and non-banking financial institutions.

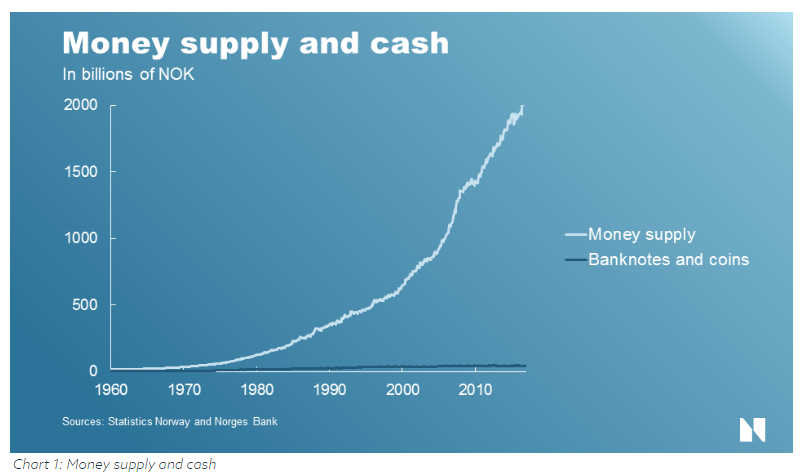

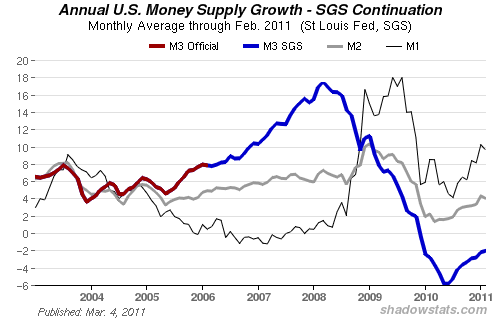

Central banks are responsible for managing the money supply in an economy and implementing monetary policy. They can do this through a number of different tools, such as setting interest rates, buying and selling government securities, and regulating the supply of money in the economy. One of the main ways that central banks can affect the money supply is through the process of printing and distributing physical currency. For example, the Federal Reserve (the central bank of the United States) can increase the money supply by printing more paper bills and distributing them to commercial banks, which can then lend them out to businesses and individuals.

Commercial banks are another important source of money supply in an economy. They play a key role in the process of creating money through the practice of fractional reserve banking. Essentially, commercial banks are able to lend out more money than they actually have on hand by keeping only a fraction of their deposits in reserve. For example, if a commercial bank has $100 in deposits and a reserve requirement of 10%, it can lend out up to $90 to borrowers. This creates new money that didn't previously exist, and it increases the overall money supply in the economy.

Non-banking financial institutions, such as investment banks, insurance companies, and pension funds, can also contribute to the money supply in an economy. These institutions can lend money to businesses and individuals, and they can also invest in financial instruments such as stocks, bonds, and other securities. This can increase the overall supply of money in the economy, as these financial instruments can be traded and exchanged for cash.

In summary, the money supply in an economy is created and managed by a variety of sources, including central banks, commercial banks, and non-banking financial institutions. These sources can affect the money supply through a number of different channels, including printing and distributing physical currency, lending and investing, and regulating the supply of money in the economy through monetary policy.