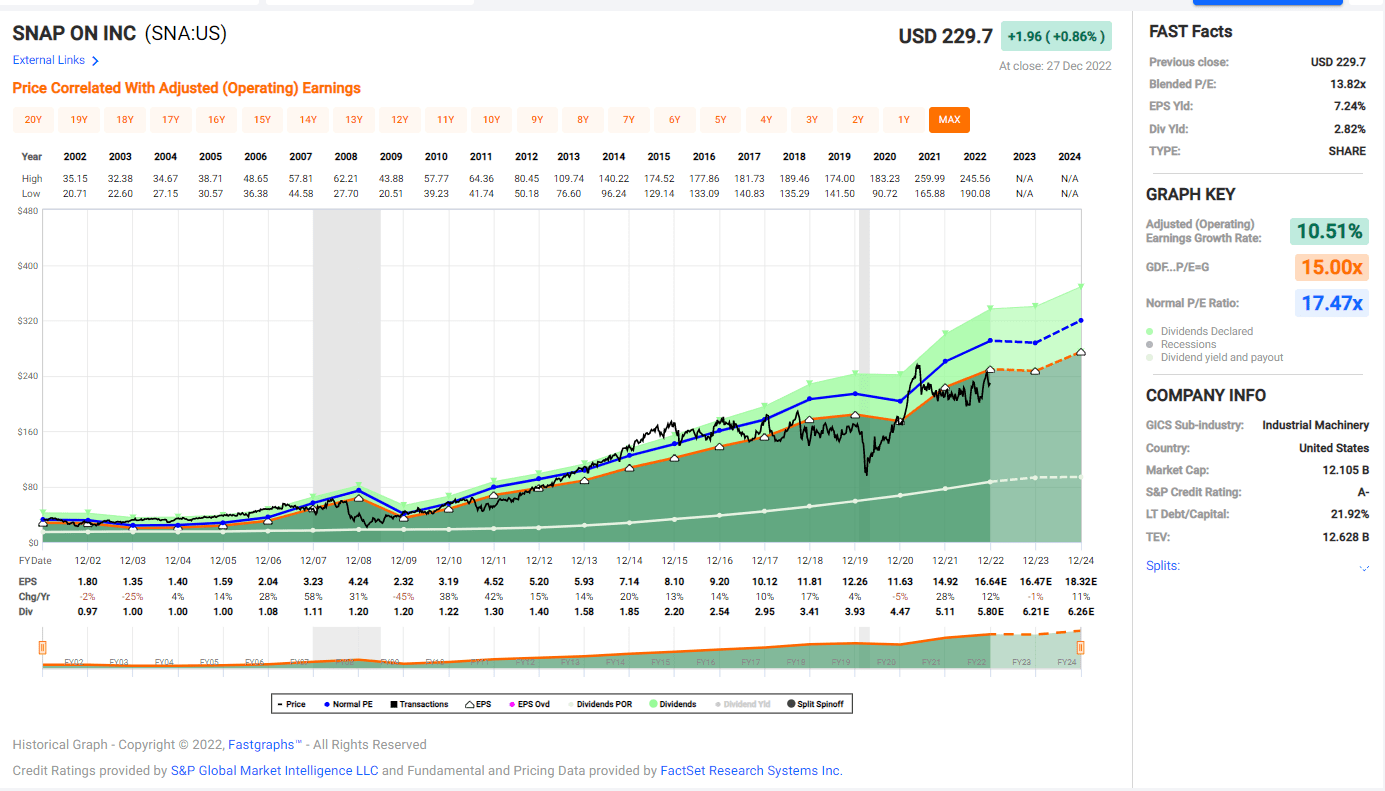

Snap-on interest rate refers to the rate of interest charged on loans or credit extended by Snap-on Inc., a global manufacturer and distributor of tools, equipment, and diagnostic software for professional use. Snap-on provides a variety of financing options for its customers, including financing for the purchase of its products through its Snap-on Credit division.

Interest rates on loans or credit extended by Snap-on Credit may vary depending on a number of factors, including the creditworthiness of the borrower, the type of loan or credit product being offered, and the term of the loan. Snap-on Credit may offer different interest rates for different types of loans or credit products, such as installment loans, revolving credit lines, or leases.

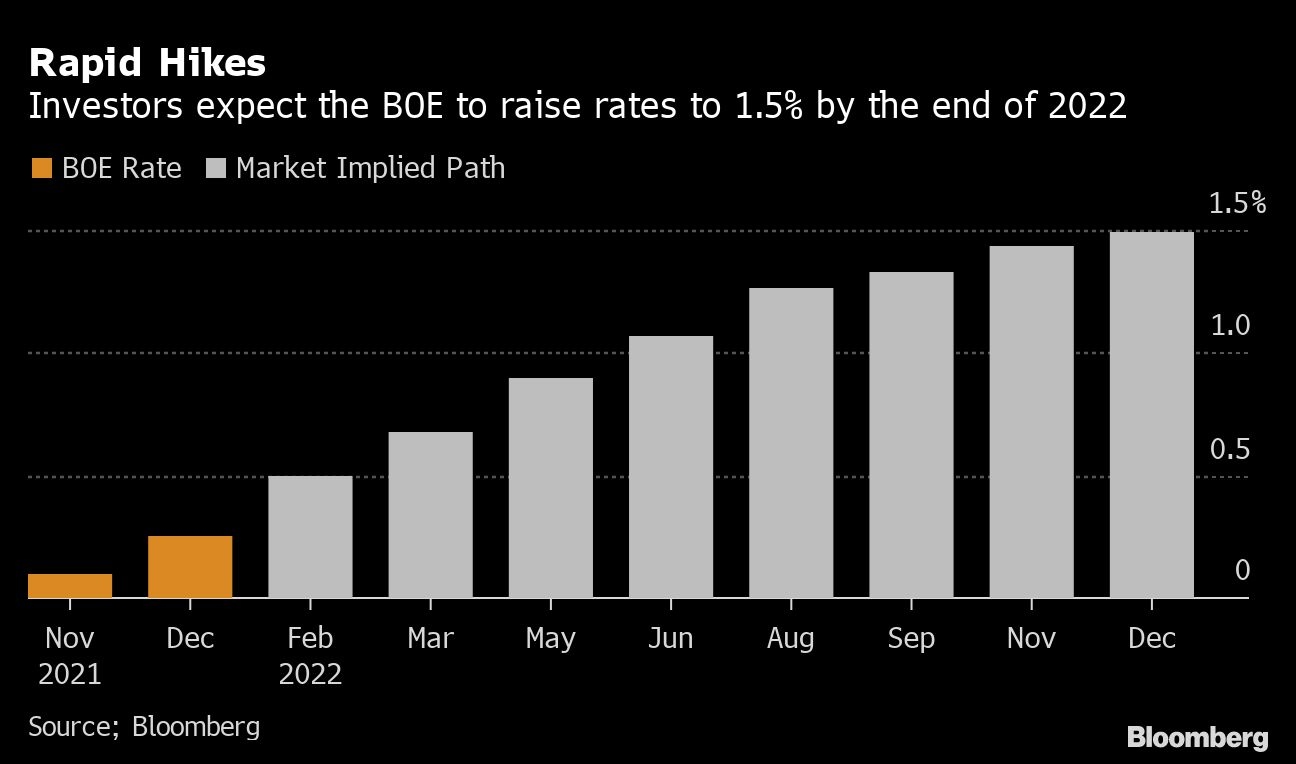

The interest rate on a loan or credit product offered by Snap-on Credit may also be influenced by economic conditions, such as the general level of interest rates in the economy or the level of demand for credit. For example, if the general level of interest rates in the economy is high, Snap-on Credit may charge a higher interest rate on its loans or credit products in order to compensate for the increased cost of borrowing. On the other hand, if the general level of interest rates in the economy is low, Snap-on Credit may be able to offer a lower interest rate on its loans or credit products.

In addition to the interest rate, Snap-on Credit may also charge other fees and charges on its loans or credit products, such as origination fees, application fees, or late payment fees. It is important for borrowers to carefully review the terms and conditions of any loan or credit product offered by Snap-on Credit in order to understand the full costs of borrowing.

Overall, the snap-on interest rate is an important factor to consider when borrowing from Snap-on Credit or any other lender. By carefully researching and comparing the interest rates and other terms and conditions offered by different lenders, borrowers can make informed decisions about the best financing options for their needs.