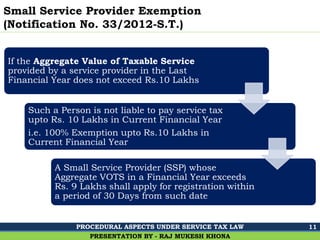

Service tax is a tax levied on the provision of certain services in India. Small service providers, such as sole proprietors or small businesses, may be required to pay service tax if they provide certain taxable services.

There are several considerations that small service providers should keep in mind when it comes to service tax. Firstly, it is important to determine whether the services being provided are taxable or not. The Central Board of Excise and Customs (CBEC) maintains a list of taxable services, and it is the responsibility of the service provider to determine whether their services are subject to service tax.

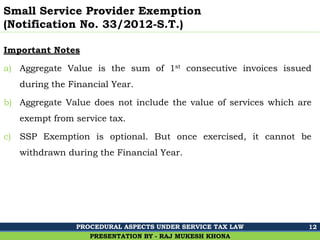

If the services being provided are taxable, the small service provider will need to register for service tax. This involves obtaining a Service Tax Registration Certificate (STRC) and obtaining a Permanent Account Number (PAN) for the business. The small service provider will also need to keep accurate records of all services provided and the corresponding service tax due.

In addition to registering for service tax, small service providers will need to file service tax returns on a regular basis. The frequency of these returns will depend on the volume of services provided, with higher volume service providers required to file returns on a monthly basis and lower volume service providers required to file returns on a quarterly basis.

It is important for small service providers to understand their obligations under the service tax regime, as failure to comply with these obligations can result in penalties and interest being levied on the business.

In conclusion, small service providers in India may be required to pay service tax if they provide certain taxable services. It is important for these businesses to understand their obligations under the service tax regime, including the need to register for service tax, keep accurate records, and file regular returns. Failure to comply with these obligations can result in penalties and interest being levied on the business.