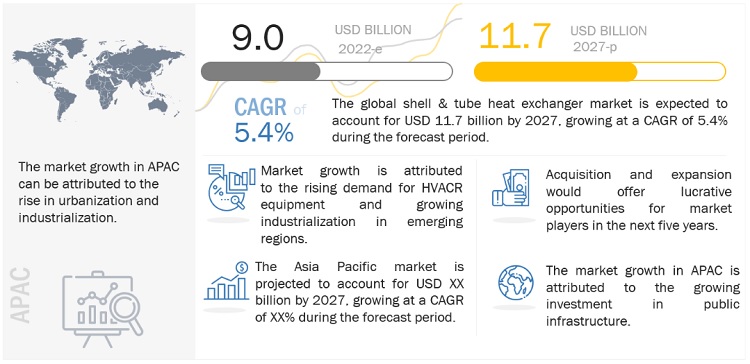

A shell business is a company that has a business structure but does not have any ongoing business operations or significant assets. These types of businesses are often used as holding companies or for mergers and acquisitions. The performance of a shell business is therefore not based on the traditional factors that are used to evaluate the performance of an operating business, such as revenue, profitability, and market share. Instead, the performance of a shell business is largely determined by its ability to effectively manage its financial resources and generate value for its shareholders through strategic decisions.

One key factor that can affect the performance of a shell business is its financial management. This includes how the company manages its cash flow, how it uses its available capital, and how it structures its debt and equity financing. Effective financial management can help a shell business to maximize its value and minimize its risk, which can improve its performance over time.

Another factor that can impact the performance of a shell business is its strategic decision-making. This includes the decisions the company makes about how to use its resources, such as investing in new assets or pursuing acquisitions or divestitures. Good strategic decision-making can help a shell business to create value for its shareholders, while poor strategic decisions can lead to value destruction.

The quality of the company's management team is also an important factor in the performance of a shell business. A strong management team can help to ensure that the company is well-positioned to make good strategic decisions and effectively manage its financial resources. A weak management team, on the other hand, can hinder the company's ability to achieve its goals and create value for its shareholders.

Finally, the regulatory environment in which a shell business operates can also impact its performance. Changes in laws and regulations can affect the company's ability to conduct business and generate value, so it is important for a shell business to stay informed about developments in the regulatory landscape and to be proactive in adapting to any changes.

In conclusion, the performance of a shell business is determined by a combination of financial management, strategic decision-making, management team quality, and the regulatory environment in which it operates. By effectively managing these factors, a shell business can improve its performance and create value for its shareholders.