Book building is a process through which a company raises capital by inviting bids from potential investors, with the final price being determined by the demand for the shares. The Securities and Exchange Board of India (SEBI) is the regulator for the capital markets in India, and it has laid down certain guidelines for the book building process in order to ensure transparency and fairness.

According to SEBI guidelines, the book building process should be carried out through a lead manager, who is responsible for ensuring that the process is conducted in a fair and transparent manner. The lead manager is required to publish a prospectus, which contains information about the company, the terms of the issue, and the risks associated with investing in the company.

One of the key features of the book building process is the price discovery mechanism. This is a process through which the final price of the shares is determined based on the demand from potential investors. The lead manager is required to maintain a record of the bids received during the book building process, and the final price is determined based on the highest price at which a minimum number of shares can be sold.

In order to ensure transparency and fairness, SEBI guidelines require the lead manager to disclose the details of the bids received during the book building process on a daily basis. This includes the number of bids received, the price at which the bids were made, and the number of shares offered in each bid.

Another important aspect of the book building process is the allocation of shares. SEBI guidelines require the lead manager to allocate shares in a fair and transparent manner, taking into account the demand from different categories of investors. This includes allocation to retail investors, institutional investors, and employees of the company.

In conclusion, SEBI guidelines for book building are in place to ensure that the process is conducted in a fair and transparent manner, and to protect the interests of investors. These guidelines help to ensure that the final price of the shares reflects the true demand for the shares, and that the allocation of shares is done in a fair and equitable manner.

SEBI GUIDELINES FOR BOOK BUILDING

Further, not less than 25% of the Net Issue to Public or 19,75,000 equity shares was to be available for allocation on a proportionate than basis to Non- Institutional Bidders and not less than 25% of the Net Issue to Public or 19,75,000 equity shares was to be available for allocation on a proportionate basis to Non-Institutional Bidders and not less than 25% of the Net Issue to Public or 19,75,000 equity shares was to be available for allocation on a proportionate basis to Retail Bidders, subject to valid Bids being received at or above the Issue Price. Guidelines to Development Financial Institutions for Disclosure and Investor Protection. Case Study: Tata Consultancy Services TCS : Green Shoe Amount Will Be Used To Stabilise Price : Tata Consultancy Services TCS initial public offering comes with a green shoe option of up to 8,317,880 equity shares. The accounting ratios disclosed in the offer document shall be calculated after giving effect to the consequent increase of capital on account of compulsory conversions outstanding, as well as on the assumption that the options outstanding, if any, to subscribe for additional capital shall be exercised. Amount of investment should exceed Rs. Limitations of the Book Building: The book building method is still at a nascent stage and not without limitations 1 The book building process adopted in India is quite different from that of USA wherein road shows are held and the issue price is arrived at a few hours before the issue opens. The Issue would constitute 25.

book building process for issue of shares

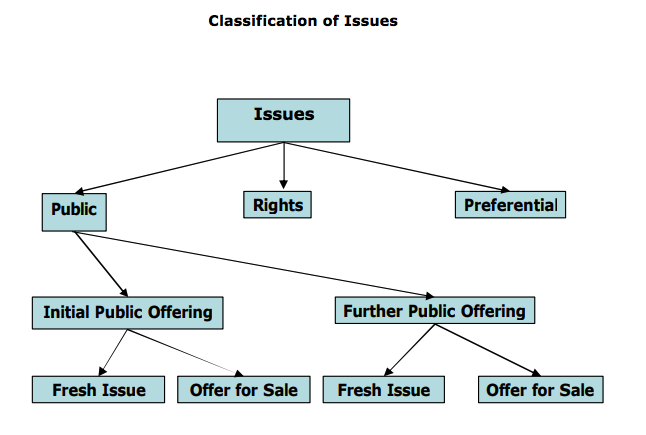

Initial Public Offerings IPO 3. They are liable for any default, if any, made by their clients, who have applied through them. The shares allocated to the successful applicants are being credited to their beneficiary accounts, subject to validation of the account details with the depositories concerned. Consider the following: Book-Building Method Recent Changes in Book-Building Process: On March 29, 2005, SEBI announced the changes in the IPO works as: i Allocation for retail investors has been increased from 25% to 35%; ADVERTISEMENTS: ii The market regulator has allowed retail investors to apply up to Rs. Offer to Public through Book-Building Process New Guidelines w. However, the entire exercise will be for demat shares, while for holders of physical certificates, the offer will be kept open for a period of 15 days from the final settlement for shareholders to lodge certificates with custodians specified by the merchant banker.

Book Building Method of Issuing Shares (With Journal Entries)

Regulations on Insider Trading by the SEBI The SEBI Prohibition of Insider Trading Regulation, 2015, enacts new Insider Trading Regulations and provisions making trading illegal. This increases the chances of negotiated deals. SEBI guidelines To increase transparency in stock exchanges such as the NSE, BSE, and others, SEBI introduces various SEBI Guidelines for IPO SEBI ICDR has established certain guidelines for filing a company as an IPO, discussed further below. After reading this article you will learn about: 1. Price Band : It sets up the lower and upper limit for the price of a share and it is related to Book-building process regaining the issue of shares to the public.