A financial hardship letter is a written explanation of your current financial situation and how it is affecting your ability to make payments on your debts or bills. This letter is typically written to request a temporary reduction in payments, or to request assistance in finding a solution to your financial problems.

There are several reasons why someone might need to write a financial hardship letter. For example, you may have lost your job or had a significant decrease in income, or you may have experienced an unexpected medical expense or natural disaster that has drained your financial resources. Whatever the reason, it is important to be honest and transparent in your letter, and to provide as much detail as possible about your current situation.

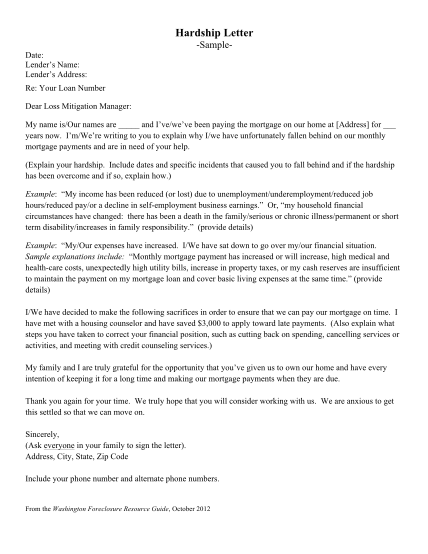

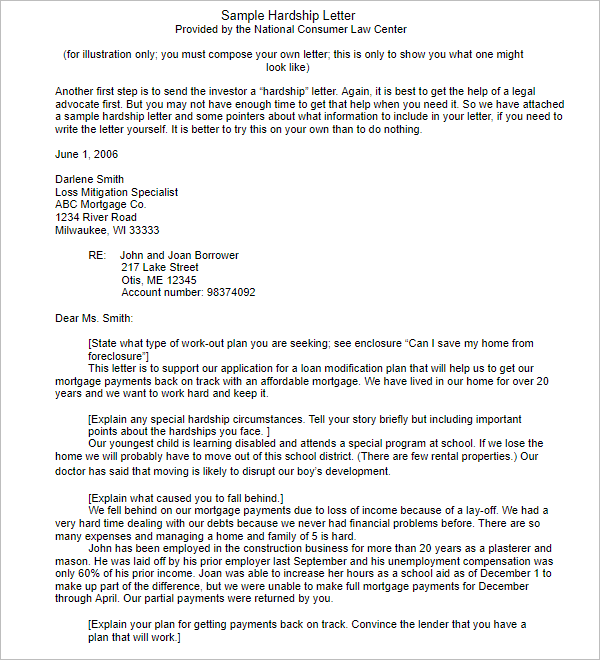

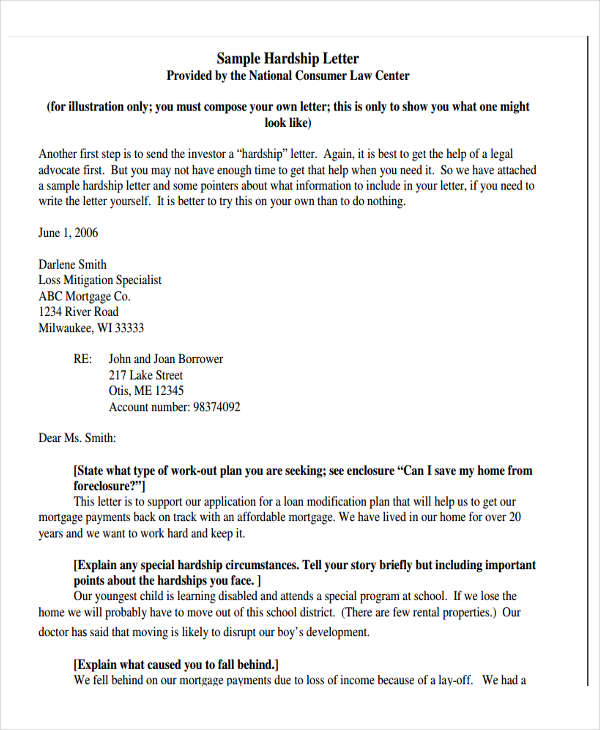

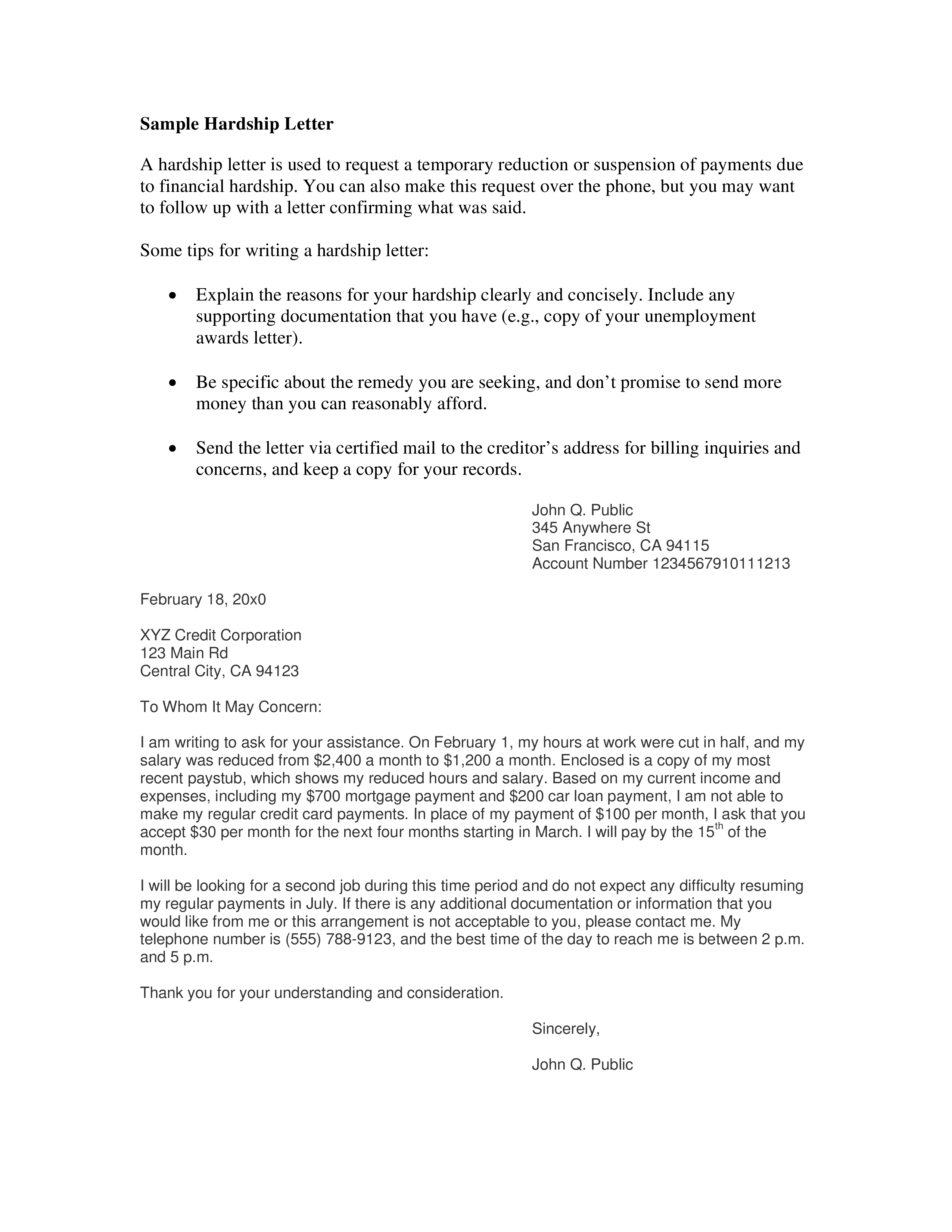

When writing a financial hardship letter, it is important to keep the following things in mind:

Use a formal tone and language: This is not the time to use slang or casual language. Use a formal tone and language to show that you are taking the matter seriously.

Explain your situation in detail: Be sure to provide a thorough explanation of your financial situation, including any specific events or circumstances that have led to your hardship.

Provide documentation: If you have supporting documentation, such as pay stubs or medical bills, be sure to include copies with your letter.

Make a request: Clearly state what you are asking for in your letter. This could be a temporary reduction in payments, a modification of your loan terms, or assistance in finding a solution to your financial problems.

Offer a solution: If you have any ideas for how to resolve your financial hardship, be sure to include them in your letter. For example, you may suggest that you be allowed to make smaller payments until your situation improves.

Here is a sample financial hardship letter:

Dear [Lender],

I am writing to request assistance with my current financial situation. As you are aware, I have been experiencing financial hardship due to [reason for hardship].

I have attached documentation, including [list of supporting documents], to support my request. As a result of this hardship, I am currently unable to make my full monthly payments on my [loan/credit card/etc.].

I am reaching out to you in the hope that we can find a solution to this situation. I am willing to work with you to come up with a plan that will allow me to meet my financial obligations while also addressing my current hardship.

One potential solution I have thought of is to temporarily reduce my payments until my financial situation improves. I would be willing to make smaller payments on a temporary basis, with the understanding that I will return to making my full payments once my situation improves.

I understand that financial hardship can be difficult for both parties involved, and I am committed to working with you to find a solution that is fair and reasonable for both of us.

Thank you for considering my request. I look forward to discussing this matter further with you and finding a resolution that works for everyone involved.

Sincerely,

[Your Name]

BALANCE Financial Fitness Program

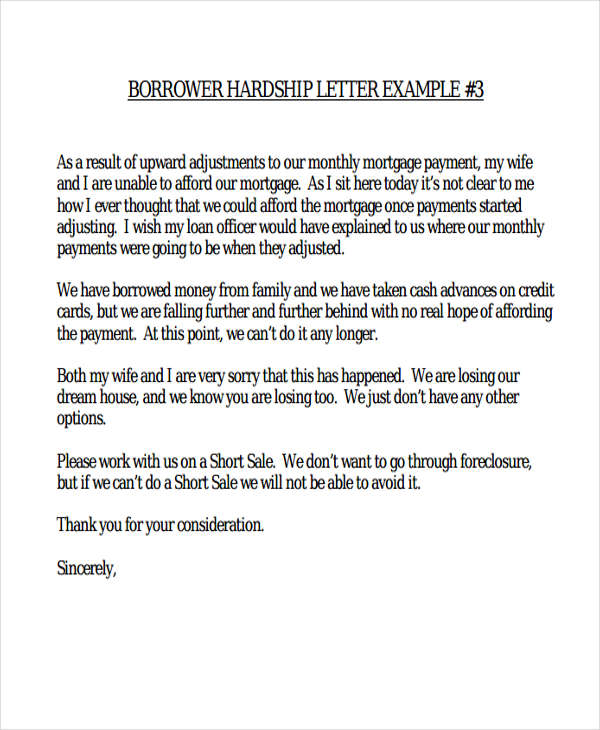

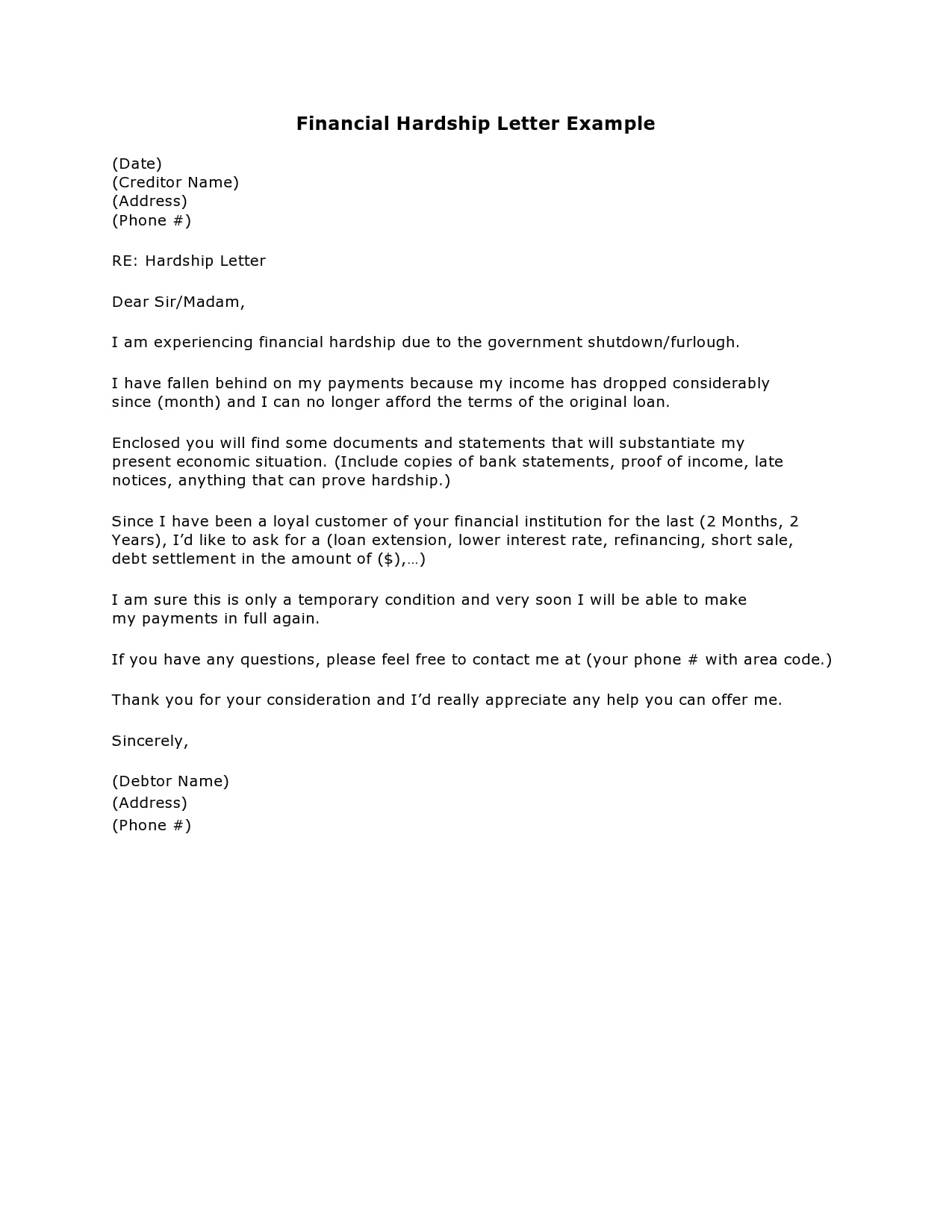

Arriving at a decision where you think you need to hand in a financial hardship letter is nothing to be hesitant about. These days when credit rating is important, you need to find a way to keep up with the payments. This can range from medical bills, to credit card debts, to the foreclosure of a property. The Sender may then request a variation to the repayment structure, and may propose a structure that is more manageable for the Sender. You can make various appeals, such as the temporary suspension of your previous amount dues, interest rate adjustments, loan modification, debt settlement, or the short sale your house. Sadly when it comes to renting or mortgage payments, there is no minimum. If you want to compose an effective financial hardship letter, there are some procedures that you need to follow.

26 Hardship Letters Templates (Financial, for Mortgage, for Loan Modification, etc...)

Step 2: Know What You Want to Request Before you sit down and write your letter, you need to know first what you want to request from your creditor or lender. Your reason should clearly correlate to your inability to pay. That is the high cost of living in the new town, and the cost of relocation, especially if you have kids as this would mean a change of schools. If you want too, you can provide additional details later on. Blaming others may indicate a red flag to lenders indicating that you do not assume responsibility for your actions. With that, attach all the documents you have—medical bills, medical certificates, receipts, final payslip, certificate of employment—that will support your claim regarding your situation.

35 Simple Hardship Letters (Financial, for Mortgage, for Immigration)

The lender can use the letter to decide whether or not they will offer relief either through deferred, suspended or reduced payments. They, too, will find a way to help you make your payments as much as possible. There are solutions that many lenders will accept to help you recover and pay off your debts. For example, if you are unable to make payments due to an accident that limits you from working, you should include when and where the accident happened, the details of your physical injuries, and how long you have not been able to work. Our certified financial coaches will guide you through your credit report, answer questions, and give personalized guidance towards improving your score.

18+ SAMPLE Hardship Letters in PDF

All letters of this type are different since the hardship circumstances vary from person to person. You can look back with a laugh over a coffee-spilled shirt, move on from a shattered trust and learn a lesson or two from a momentous situation, but a financial struggle has a lot at stake. So how do you write a convincing hardship letter that would make hearts bleed while remaining professional? Be specific with your action plan, so the lender knows exactly what you want them to do. This Financial Hardship Letter is for use by a person who is experiencing financial hardship, and who is having difficulty meeting their financial obligations as a result of that hardship the "Sender". I plan to move in with my sister, who will be my caretaker as I continue my chemo treatment. After making sure that your letter successfully addressed all the points you want to get across, then you may already print your letter and send it to your creditor. Thank you for appreciating the situation, and I hope we can both make the best of it.