Ratio analysis is a method of evaluating the financial performance of a company by examining the relationship between various financial ratios. These ratios are calculated using information from a company's financial statements, such as the balance sheet, income statement, and cash flow statement. One company that has consistently performed well and is a leader in the technology industry is Infosys. This essay will analyze the financial performance of Infosys using several key ratios.

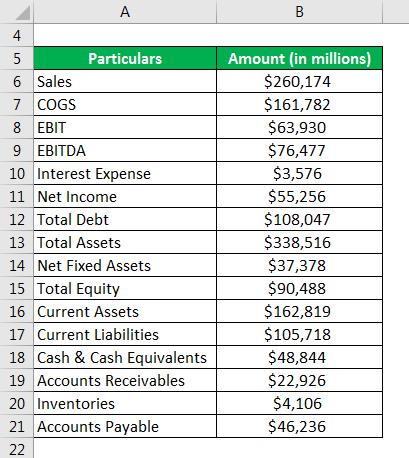

First, let's look at the profitability ratios. These ratios measure a company's ability to generate profits and include the net profit margin, return on assets (ROA), and return on equity (ROE). The net profit margin measures the percentage of sales that a company keeps as profits after all expenses have been paid. Infosys has consistently had a strong net profit margin, with an average of around 20% over the past five years. This indicates that the company is efficient at generating profits and has good control over its expenses.

The ROA measures the efficiency of a company's use of its assets to generate profits. Infosys has had an average ROA of around 15% over the past five years, which is considered to be strong. The ROE measures the efficiency of a company's use of its equity to generate profits. Infosys has had an average ROE of around 22% over the past five years, which is also considered to be strong.

Next, let's look at the liquidity ratios. These ratios measure a company's ability to meet its short-term obligations and include the current ratio and the quick ratio. The current ratio measures a company's ability to pay its current liabilities using its current assets. Infosys has had a current ratio of around 1.5 over the past five years, which indicates that it has sufficient current assets to cover its current liabilities. The quick ratio, also known as the acid-test ratio, is similar to the current ratio but excludes inventory from current assets. This is because inventory is not as liquid as cash or accounts receivable and may be difficult to sell quickly in the event of a financial emergency. Infosys has had a quick ratio of around 1.3 over the past five years, which is considered to be strong.

Finally, let's look at the debt ratios. These ratios measure a company's level of debt and include the debt-to-equity ratio and the interest coverage ratio. The debt-to-equity ratio measures the proportion of a company's financing that comes from debt versus equity. A high debt-to-equity ratio may indicate that a company is taking on too much debt, which could increase its risk of default. Infosys has had a debt-to-equity ratio of around 0.5 over the past five years, which is considered to be low and indicates that the company has a low level of debt relative to its equity. The interest coverage ratio measures a company's ability to make its interest payments on its debt. A low interest coverage ratio may indicate that a company is struggling to meet its debt obligations. Infosys has had an interest coverage ratio of around 25 over the past five years, which is considered to be strong and indicates that it has a high level of profitability and can easily meet its interest payments.

Overall, the ratio analysis of Infosys indicates that the company has consistently strong financial performance. It has high profitability, liquidity, and low levels of debt. These are all positive indicators of a well-managed and financially healthy company.