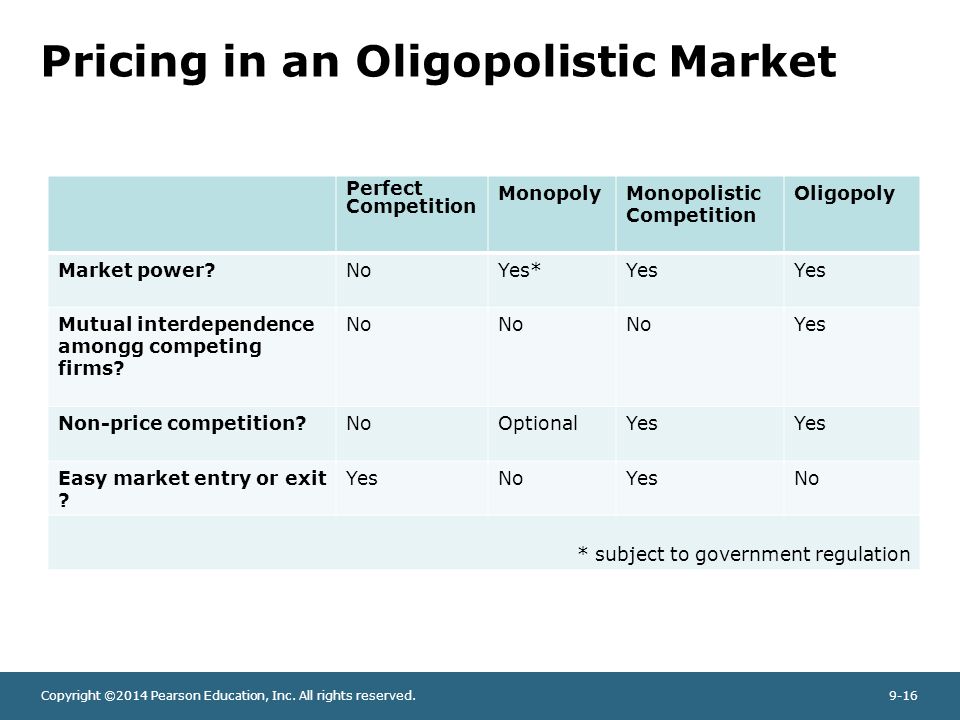

An oligopoly is a market structure characterized by a small number of firms that dominate the industry and have some control over the prices of the products they sell. When firms in an oligopoly compete with each other, they often engage in a price war, in which each firm tries to undercut the prices of its rivals in order to gain market share. Price wars can be intense and destructive, as firms try to outdo each other by constantly lowering their prices, which can lead to reduced profits or even losses.

One of the main reasons firms engage in price wars is to gain an advantage over their competitors. By offering lower prices, a firm can attract more customers and increase its market share. This can be especially tempting for firms that are struggling to keep up with their rivals, as a price war may be seen as a way to level the playing field. However, price wars can also be initiated by firms that are already successful in order to protect their market position or to prevent new entrants from entering the market.

While price wars can be beneficial for consumers, who are able to purchase products at lower prices, they can also have negative consequences. For one, price wars can lead to reduced profits or even losses for the firms involved. In order to compete with their rivals, firms may have to lower their prices below their own cost of production, which can erode their profits or even lead to losses. In addition, price wars can lead to a race to the bottom, in which firms constantly lower their prices in an effort to outdo each other, leading to a situation in which no one is making any money.

Another negative consequence of price wars is that they can lead to a decline in the quality of products. In order to keep their prices low, firms may cut corners and reduce the quality of their products in order to save money. This can lead to a downward spiral in which firms are forced to lower their prices even further in order to stay competitive, leading to even lower quality products.

In conclusion, price wars in oligopoly markets can be intense and destructive, with firms constantly trying to undercut each other in order to gain an advantage. While price wars may benefit consumers in the short term by providing them with lower prices, they can also lead to reduced profits or even losses for the firms involved, as well as a decline in the quality of products.