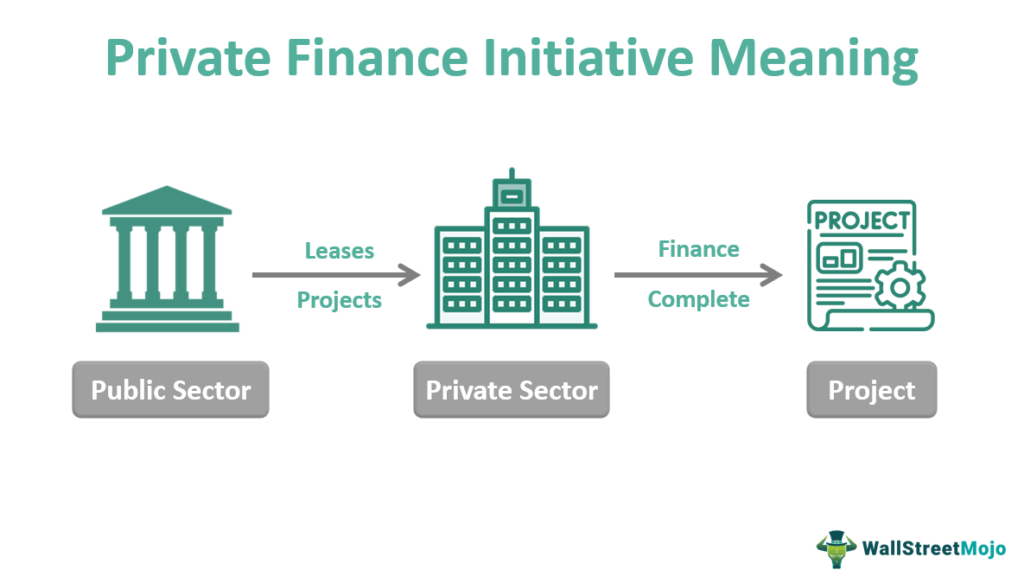

PFI contracts, also known as Private Finance Initiative contracts, are a type of public-private partnership (PPP) used in the United Kingdom to finance and deliver public infrastructure projects. These contracts are designed to transfer the financial and operational risks of a project from the public sector to the private sector.

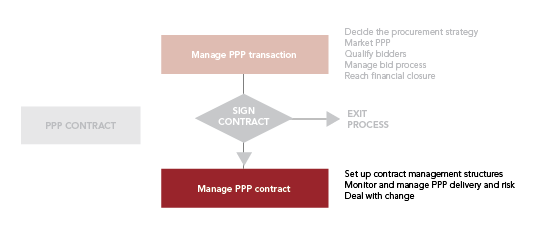

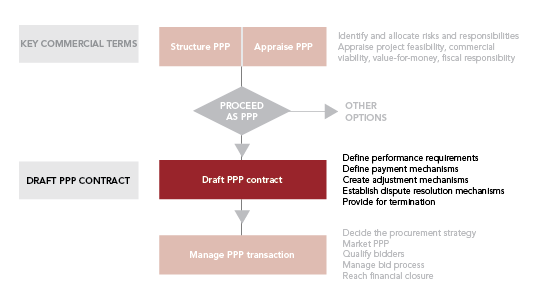

Under a PFI contract, a private sector consortium, known as the PFI contractor, is responsible for designing, building, financing, and maintaining a public infrastructure project. The public sector, typically a government agency or local authority, contracts with the PFI contractor to deliver the project and provides payment for the services provided. The payment is typically made over a long-term period, often spanning several decades.

PFI contracts have been used for a wide range of public infrastructure projects in the UK, including hospitals, schools, roads, and prisons. The private sector is responsible for designing and building the project, as well as providing ongoing maintenance and repair services. The public sector is responsible for paying for the services provided over the duration of the contract.

PFI contracts have been controversial in the UK due to concerns about their cost and the transfer of risk from the public to the private sector. Critics argue that PFI contracts often result in higher costs for the public sector compared to traditional procurement methods, and that the long-term nature of the contracts can create financial risks for the public sector.

Despite these concerns, PFI contracts remain a popular method of financing and delivering public infrastructure projects in the UK. They offer the potential for private sector innovation and efficiencies, and can provide an alternative source of funding for projects that may not be feasible under traditional procurement methods.

In summary, PFI contracts are a type of public-private partnership used in the UK to finance and deliver public infrastructure projects. They transfer financial and operational risks from the public sector to the private sector and are used for a wide range of projects, including hospitals, schools, roads, and prisons. While PFI contracts have been controversial due to concerns about their cost and the transfer of risk, they remain a popular method of financing and delivering public infrastructure projects in the UK.

:max_bytes(150000):strip_icc()/GettyImages-1040649404-fc401fe4b51f45ed9e0b83be89c939ec.jpg)