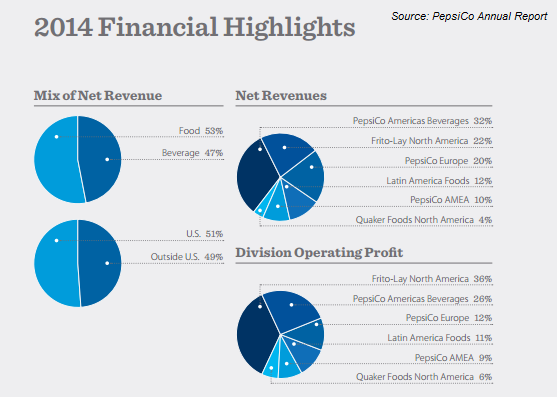

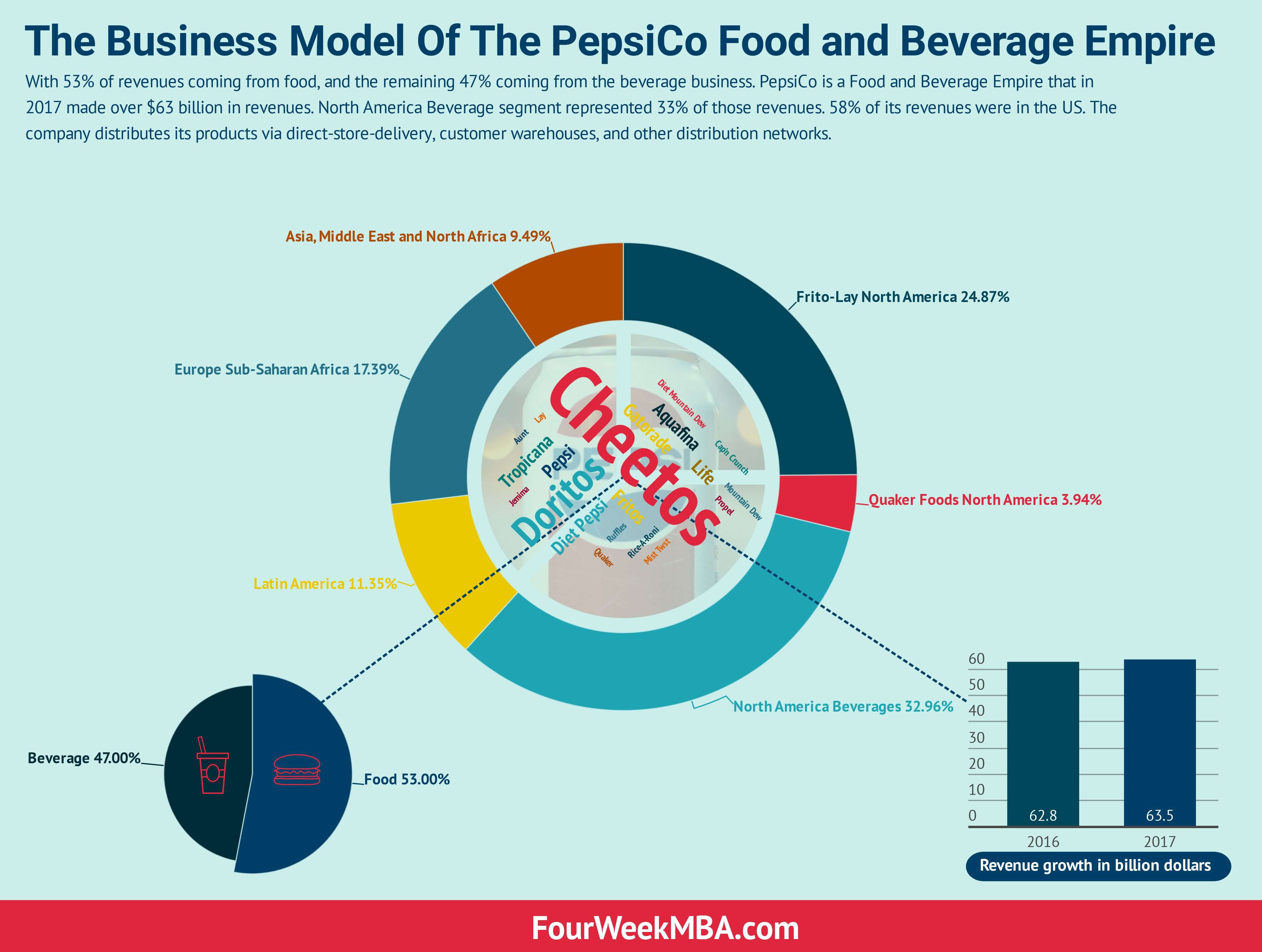

PepsiCo is a multinational food and beverage company that operates in more than 200 countries and territories worldwide. The company was founded in 1965 through the merger of Pepsi-Cola and Frito-Lay, and has since grown to become one of the largest food and beverage companies in the world. PepsiCo's portfolio of brands includes some of the most well-known and respected names in the industry, such as Pepsi, Mountain Dew, Lay's, Gatorade, Tropicana, and Quaker.

In this essay, we will conduct a financial analysis of PepsiCo to understand the company's financial health and performance. To do this, we will examine several key financial metrics and ratios, including the company's revenue and profitability, liquidity and solvency, and valuation.

First, let's look at PepsiCo's revenue and profitability. According to the company's 2021 financial statements, PepsiCo generated total revenue of $67.16 billion in the fiscal year ended December 31, 2021. This represents a modest increase of 1.9% from the previous year. The company's net income for the same period was $7.66 billion, or $5.41 per share, a decrease of 7.4% from the previous year.

Despite the decrease in net income, PepsiCo's profitability remains strong. The company's profit margin, which measures the percentage of revenue that is converted to net income, was 11.4% in 2021. This is a healthy profit margin for a food and beverage company and indicates that the company is able to generate a significant amount of profit from its sales.

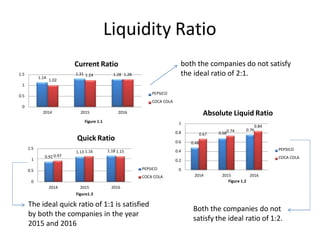

Next, let's examine PepsiCo's liquidity and solvency. Liquidity refers to a company's ability to meet its short-term financial obligations, while solvency refers to its ability to meet its long-term financial obligations. PepsiCo has strong liquidity, with a current ratio of 1.43 in 2021. This means that the company has sufficient current assets to cover its current liabilities. In addition, the company's quick ratio, which excludes inventory from current assets, was 0.91 in 2021, indicating that the company has a strong ability to meet its short-term financial obligations even if it needs to sell off its inventory quickly.

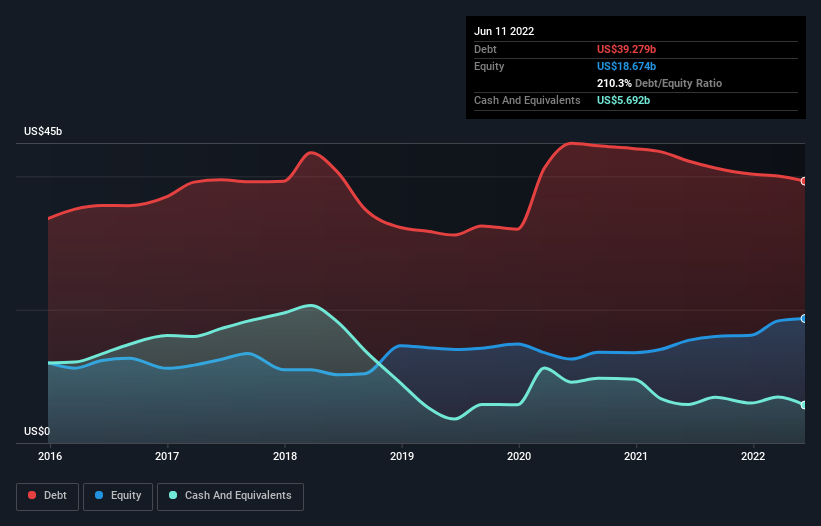

PepsiCo's solvency is also strong, with a debt-to-equity ratio of 1.23 in 2021. This indicates that the company has a good balance between its debt and equity financing, and is able to manage its long-term financial obligations effectively.

Finally, let's consider PepsiCo's valuation. One common way to evaluate a company's valuation is to calculate its price-to-earnings (P/E) ratio, which compares the company's stock price to its earnings per share. As of December 31, 2021, PepsiCo's P/E ratio was 25.9, which is slightly higher than the industry average of 22.6. This suggests that the market is willing to pay a premium for PepsiCo's earnings.

Overall, PepsiCo is a financially strong and well-managed company with a diversified portfolio of brands and a track record of consistent financial performance. The company's strong revenue and profitability, strong liquidity and solvency, and reasonable valuation make it a solid investment opportunity for long-term investors.