Nike financial ratios. Nike, Inc. margin, revenue and ratios benchmarking 2022-11-08

Nike financial ratios

Rating:

4,2/10

1530

reviews

Nike is a leading global apparel and footwear company with a strong financial performance. The company's financial ratios provide insight into its financial health and operational efficiency.

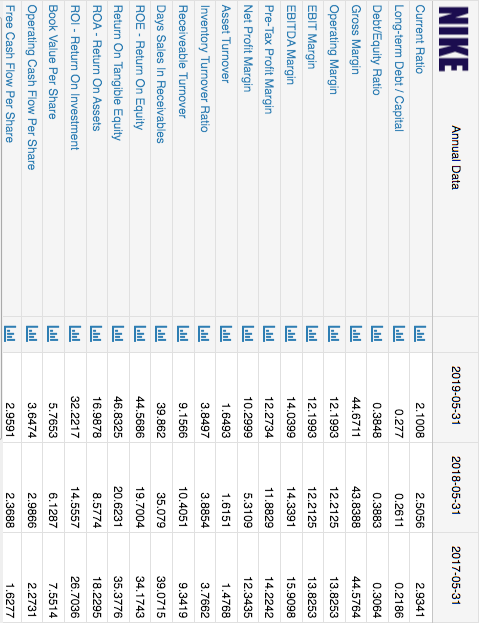

One important financial ratio for Nike is the debt-to-equity ratio. This ratio measures the amount of debt that a company has relative to its equity. A high debt-to-equity ratio can indicate that a company is using a lot of borrowing to finance its operations, which can be risky if the company is unable to pay back its debts. Nike's debt-to-equity ratio has been relatively stable in recent years, hovering around 0.5. This indicates that the company has a moderate level of debt relative to its equity and is not relying heavily on borrowing to finance its operations.

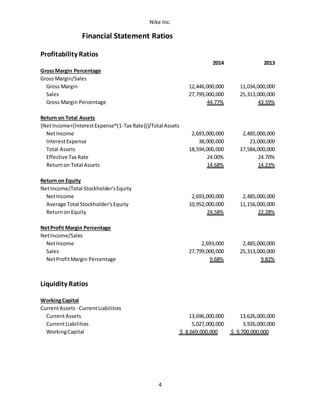

Another key financial ratio for Nike is the return on equity (ROE). This ratio measures the profitability of a company by comparing its net income to its shareholder equity. A high ROE indicates that a company is generating a lot of profit relative to the amount of capital invested by shareholders. Nike's ROE has been consistently high in recent years, ranging from 15% to 25%. This indicates that the company is effectively using its equity to generate profits and is able to return value to its shareholders.

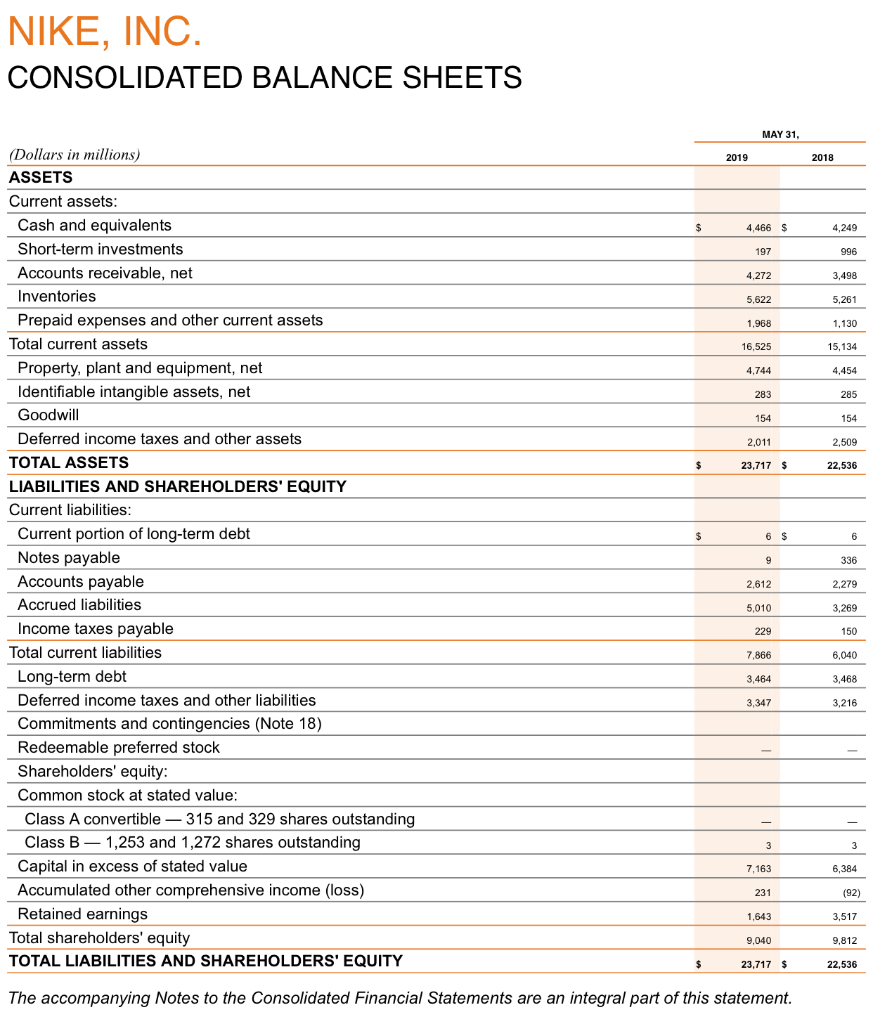

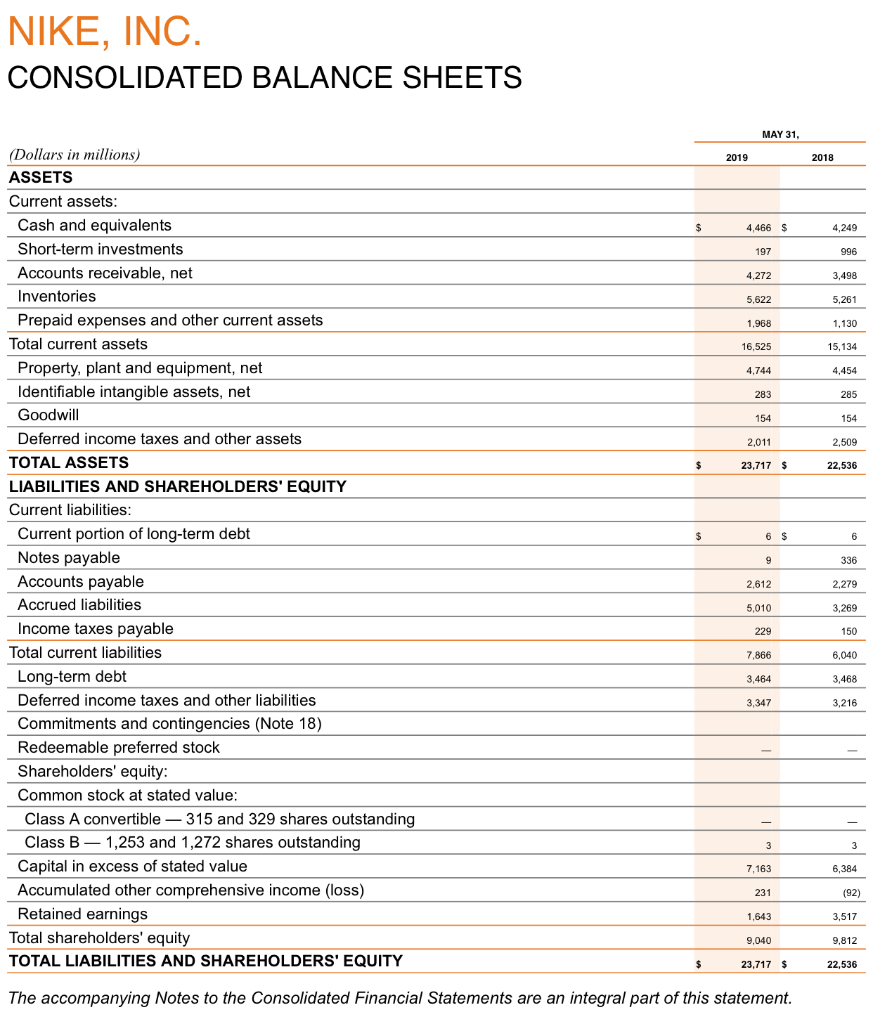

In addition to these ratios, Nike also has a strong financial position with a healthy balance sheet and a solid track record of cash flow generation. The company has a large cash reserve and a low level of debt, which gives it the financial flexibility to invest in growth opportunities and weather economic downturns.

Overall, Nike's financial ratios demonstrate that the company is financially strong and operationally efficient. Its moderate level of debt, high ROE, and strong financial position all contribute to its overall financial health.

NIKE Debt to Equity Ratio 2010

The answer to this question is somewhat complicated because there are probably multiple reasons as to why Nike is outperforming Under Armour. The interesting thing about the return on sales percentage is that it can be used internally to assess how the profitability of a company is compared to previous years. From this, I then discuss and define important balance sheet line items, such as cash, inventory, etc. Therefore, in examining the four companies, one can see that Walmart has a current ratio under one, and Nike has the best current ratio. However, one must consider why they are outperforming Under Armour. Nike has higher values for profitability ratios, namely ROA, ROE, net profit, and gross margins.

Next

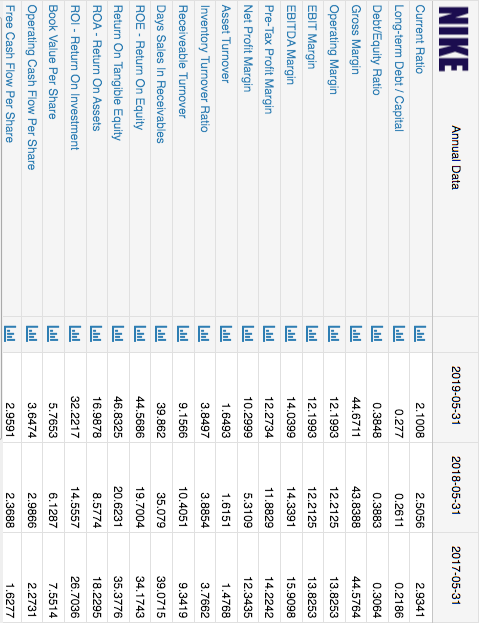

NIKE Inc.: Financial ratios (NKE

The company's products include six key categories: running, NIKE basketball, the Jordan brand, football, training and sportswear sports-inspired lifestyle products. The financial condition of Nike, Inc. Nike's 'swoosh' logo and 'just do it' tagline are widely recognized across the world, while its association with celebrity sportspersons, such as Michael Jordon and Roger Federer as well as top professional and college teams ensures a strong brand recall in the key U. The long-term debt to equity ratio for the industry average is missing but the company has lower values for other debt management ratios. The basic source for these ratios is the company's financial statements that contain figures on assets, liabilities, profits, and losses. According to these financial ratios NIKE Inc.

Next

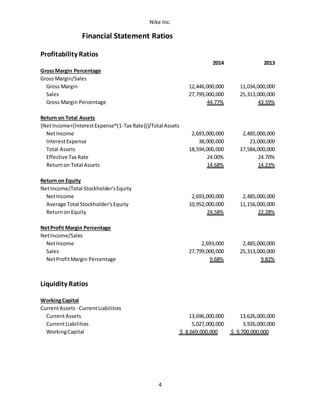

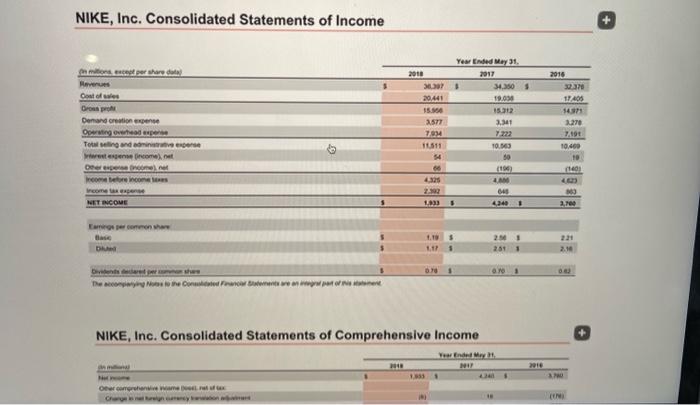

Nike Financial Ratio Analysis

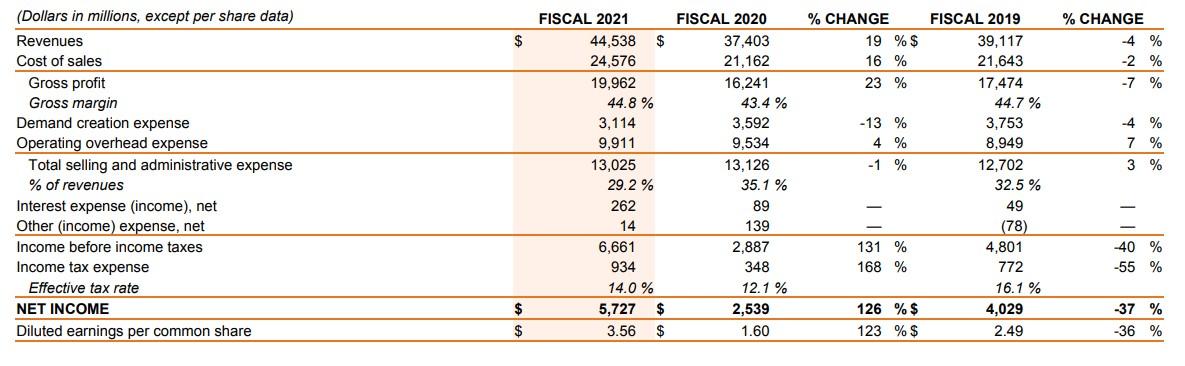

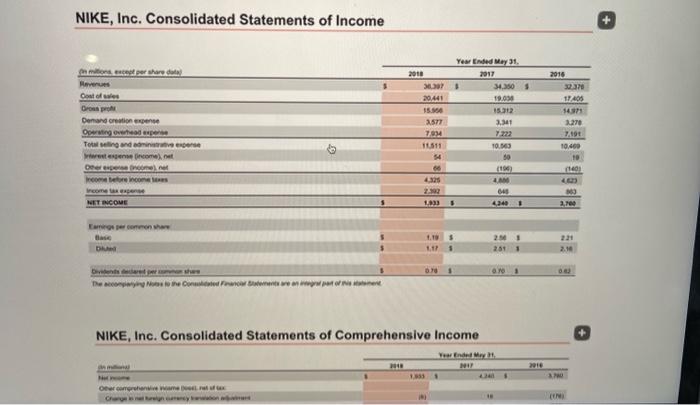

Running, basketball, children's, cross-training and women's shoes are the Company's top-selling product categories. In addition, asset and inventory turnover are higher than average, pointing to better performance in the turnover ratios. Similarly, the firm had a less positive figure of working capital in 1995 compared with 1994 which indicates that the current assets were more than current liabilities in both years. Total asset and inventory turnover ratios declined while receivables and accounts payable turnover ratios increased. Nike Income Statement Analysis Sample In this section of the financial report, I walk you through a broad definition as to what an income statement is and why it is important.

Next

Nike Financial Analysis and Financial Ratios

To draw a conclusion from the analysis the individual scores are weighted equally to get an overall score ranging from -2 and +2. Long-term debt and total debt to equity ratios also recorded an increase but interest coverage declined. Nike's Fixed Asset Turnover Ratio Nike's fixed asset turnover in 2020 was 7. This trend indicates the organization has taken steps to improve its utilization of its fixed assets under management. Nike was more liquid in 1994 than 1995 but it was still able to pay its short-term obligations at a ratio of 2:1 in 1995 as the ratio was more than 1 which represented a margin of safety for the creditors where the higher the ratio the more liquid the firm was and the more confident the creditors were with the firm.

Next

Nike

For a detailed financial analysis please use. As a result of the analysis of the key financial ratios of the company, we have established the following. This information is the basis of our financial report, "Nike's Financial Report," where we offer insights into understanding Nike's financial standing through insightful financial analysis. Liquidity ratios have improved over the three years but the declining ratios outweigh this strength. A current ratio of one or less is not ideal when examining financial performance, because it could indicate that the firm has trouble meeting its financial obligations. If a firm has made a profit, then it will be able to meet its short-term obligations and shareholders will obtain reasonable returns on their investments in form of dividends Meir, 2008: Universalteacher4u. When looking at the data, one can see that Nike is more successful financially than Under Armour is in regards to the data listed in figure 3.

Next

Nike, Inc. financial statements: revenue, assets, liabilities and equity

Return on sales is a measurement or indicator how the profitability of a company. It is always important to consider the why when comparing financial data for multiple reasons. The averages are calculated using the data from financial statements for the year 2021 submitted to the SEC through the Electronic Data Gathering, Analysis, and Retrieval system EDGAR. Capital structure ratios include debt to equity and debt to asset ratios, and liquidity ratios include coverage ratios and solvency ratios. Overall, the company most is improving from year to year, and one should be interested to consider 2017 data also.

Next

Nike Financial Ratios Essay on Financial Ratios, Nike

Do they have to spend less to get the same result than Under Armour? This is just a short list of direct competitors, because essentially any firm that specializes in athletic shoe production is a competitor to Nike. The total debt to equity ratio followed a similar trend, moving from 0. About Financials Ratios Financial ratios are generally ratios of selected values on an enterprise's financial statements. This is an excellent trend from an investor's perspective. Financial ratios are important for determining how financially successful a company is over the courses of its life or how successful it is compared to others in the same industry.

Next

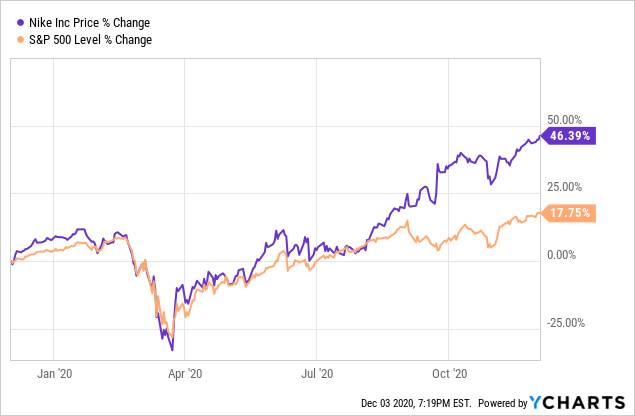

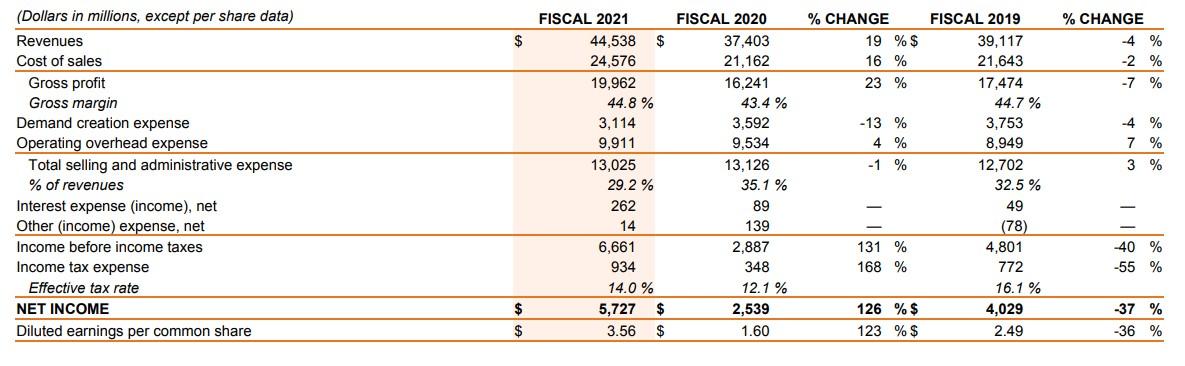

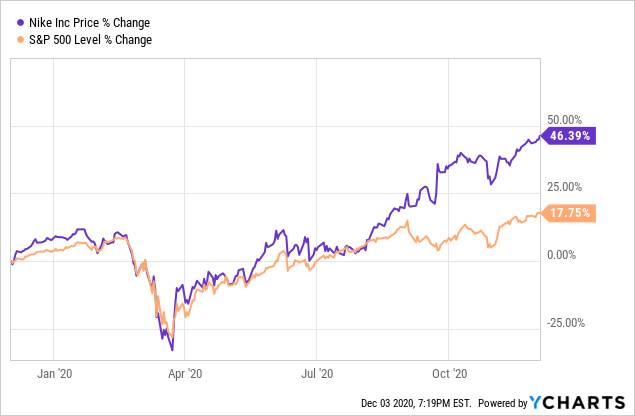

NIKE Current Ratio 2010

Nike outperforms Under Armour in almost every ratio, which is truly phenomenal for Nike. The performance ratios analyzed belong to Nike Company and are for the years 2019, 2020, and 2021. In other words, the organization is continually increasing the utilization of its fixed assets. Net Sales Growth, EBITDA Growth, EBIT Growth. In 2022, their ROE was 39. Therefore, profitability ratios recorded a significant decline in 2020 but have recovered in the current financial year.

Next

Nike Inc. (NYSE:NKE)

The Company creates designs for men, women and children. This neutrality is offset by debt management ratios, book value per share, and profitability ratios that recorded only one improvement against six declines. Security analysts use financial ratios to compare the strengths and weaknesses of various companies. Since compared with industry data, ratios help an individual understand a company's performance relative to that of competitors, and used to trace performance over time Venture Line, 2005. Finally, I offer a summary analysis of the company's important balance sheet line item trends. While inventory turnover shows that stock was turned 5.

Next