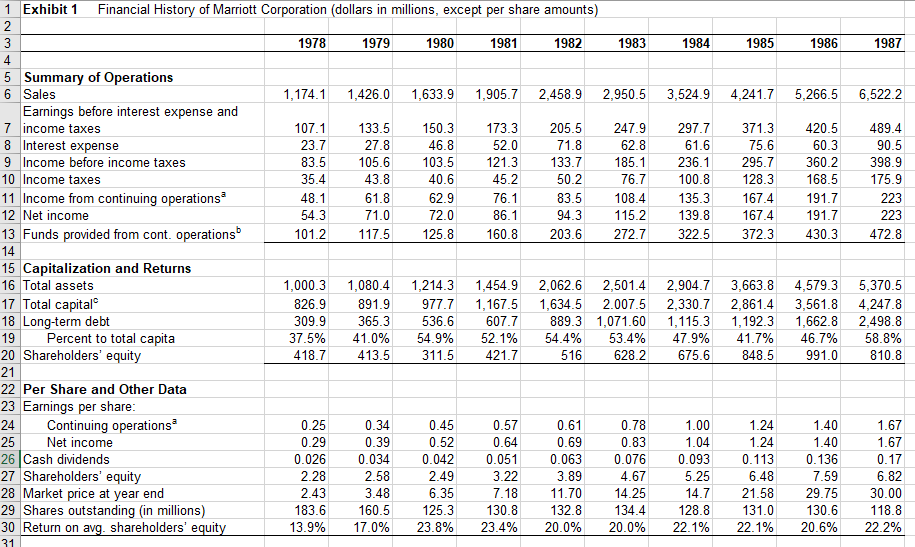

Marriott Corporation: The Cost of Capital is a case study that examines the challenges faced by the Marriott Corporation, a large multinational hotel chain, in determining the appropriate cost of capital for its various business segments. The case study highlights the importance of accurately determining the cost of capital, as it plays a critical role in the company's investment decisions and overall financial performance.

The cost of capital is the required rate of return that a company must earn on its investments in order to generate an acceptable level of return for its shareholders. It is used to evaluate the profitability of a company's investments and to determine the feasibility of new projects. The cost of capital is a key factor in the decision-making process, as it represents the minimum return that must be earned in order for a project to be considered viable.

The Marriott Corporation faced several challenges in determining the appropriate cost of capital for its various business segments. One of the main challenges was the diversity of the company's operations, which included hotels, restaurants, and contract services. Each of these segments had different risks, growth potential, and investment needs, making it difficult to determine a single cost of capital for the entire company.

To address this challenge, the Marriott Corporation used a combination of different methods to determine the cost of capital for each business segment. For example, the company used the capital asset pricing model (CAPM) to determine the cost of equity for its hotel segment, and the weighted average cost of capital (WACC) to determine the overall cost of capital for the company.

Another challenge faced by the Marriott Corporation was the impact of market conditions on the cost of capital. The company operated in a highly competitive and rapidly changing industry, and market conditions such as economic downturns and shifts in consumer demand could significantly affect the company's financial performance. As a result, the Marriott Corporation had to be proactive in managing its cost of capital to ensure that it remained competitive and aligned with market conditions.

To manage the impact of market conditions on the cost of capital, the Marriott Corporation used a number of strategies. These included diversifying its portfolio of investments, leveraging its strong brand and reputation, and adopting a flexible and agile approach to business operations.

Overall, the Marriott Corporation's experience illustrates the importance of accurately determining the cost of capital and how it can impact a company's investment decisions and financial performance. By using a combination of different methods and strategies, the company was able to effectively manage the challenges it faced in determining the appropriate cost of capital for its various business segments and navigate the dynamic market conditions of the hotel industry.