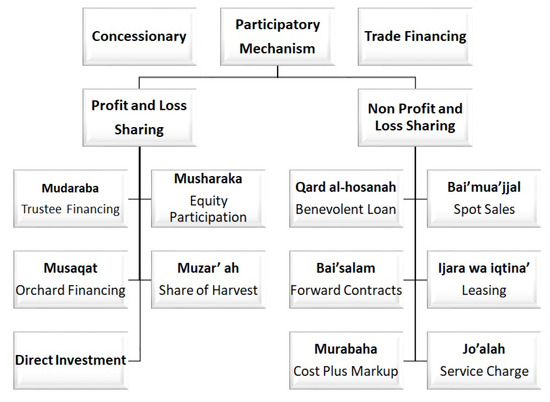

Leasing is a financial arrangement in which a company or individual obtains the use of an asset, such as a vehicle or piece of equipment, for a specified period of time in exchange for regular payments. Leasing is a common practice in many industries and is undertaken for a variety of purposes.

One primary purpose of leasing is to obtain the use of an asset without incurring the full cost of purchasing it outright. This can be especially beneficial for companies or individuals with limited capital or those who only need the asset for a short period of time. For example, a small business might lease a copy machine for a year rather than purchasing one upfront, which would require a larger upfront investment.

Another reason for leasing is to conserve working capital. By leasing an asset, a company can free up cash that would have been used to purchase the asset, which can then be used for other purposes such as expanding the business or investing in other areas. This can be especially important for businesses that are just starting out or that are experiencing cash flow issues.

Leasing can also provide companies with flexibility and the ability to upgrade to newer models more frequently. For example, a company that leases a fleet of vehicles can choose to upgrade to newer models every few years, rather than being stuck with older models that may require more maintenance and repair. This can help the company stay competitive and keep its employees and customers satisfied.

In addition, leasing can offer tax advantages for both businesses and individuals. Depending on the nature of the lease and the asset being leased, the lessee may be able to claim certain tax deductions or credits.

Overall, leasing is undertaken for a variety of purposes, including obtaining the use of an asset without incurring the full cost of purchase, conserving working capital, providing flexibility and the ability to upgrade, and potentially offering tax advantages. It is an important financial tool that is used by many companies and individuals in a variety of industries.

Lease Accounting

. Navallez and his team has begun analyzing these changes that are affecting his business. The short answer is no. It may be noted that external and internal environment provides a context to the company to establish and review its missions, concerns, and multiple objectives which, in turn, shape its corporate strategy. Finance companies often operate as a subsidiary of banks or other large financial institutions, and because of that, depending on the purposes of the valuation, it is needed to analyze to what extent the cost and conditions of financing for the company are affected by being part of the larger financial institution. The mission of the CERs and the capital budgeting process at striker is to standardize and formalize the capital budgeting process. Similarly, they cannot include a bargain purchase option.

Leasing: Definition, Types of Leasing, and How Do Leases Work?

Submitted By ikiesa Words 925 Pages 4 Capital Budgeting Process These are the six steps that organizations use when they are issuing bonds. In such a case, there is no achievement of the objective of wealth maximization for shareholders. The different methods available to the finance officer have increased and become more accurate and centred upon the goal of maximizing wealth. Both parties are bound by the terms of the contract, and there is a consequence if either fails to meet the Common Types of Leases Leases differ broadly, but there are some that are common in the 1. Most, if not all, organizations have limited financial resources and must decide how to invest the financial resources for the best advantage of the organization. While leasing can be good in the short run it can cost you more in the long run. A tenant who breaks a lease without prior negotiation with the landlord faces a civil lawsuit, a derogatory mark on their Some leases have early termination clauses that allow tenants to terminate the contracts under a specific set of conditions job-related relocation, divorce-induced hardship or when their landlords do not fulfill their contractual obligations.

Capital Budgeting Process

The absolute type is common in single-tenant systems, where the property owner builds housing units to suit the needs of a tenant. . . A subsequent definition of lease types is mentioned in the next section. Some states also allow renters, especially older adults, to terminate a lease early due to disability, health conditions, or medical crises that make living in the current home untenable. The CERs made it easier for the company to keep track of the expenditures that were made in each division.

Leasing and Speciality Finance Companies Part I: An Introduction to Leasing and Lending

Updated December 13, 2022 What is a lease? Capital budgeting analysis evaluates projects that will have cash flows for longer than a year. . Department of the Treasury. If the guidelines are not followed, the company can charge penalties, which are paid at the end of the lease. Capital budgeting decisions establish strategic priorities, allocate managers to assemble and communicate information across traditional organizational boundaries, for example, marketing, engineering, production, and accounting. Equally, there is a huge benefit for both property owners and tenants if they engage real estate experts during such agreements. Words: 946 - Pages: 4 Premium Essay Capital Budgeting.