A partnership firm is a business entity formed by two or more individuals who come together to carry out a business activity with the aim of earning a profit. Partners in a partnership firm contribute capital, labor, and skills to the business and share the profits and losses equally or in the proportion agreed upon.

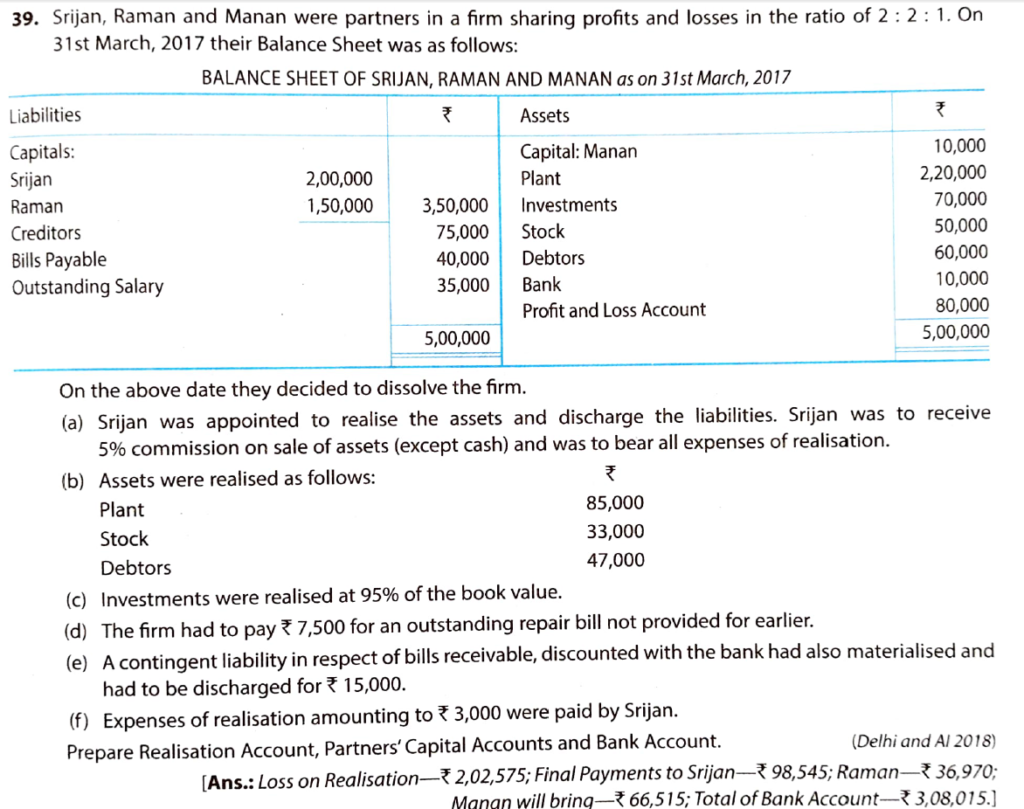

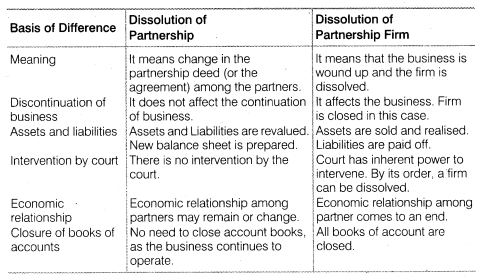

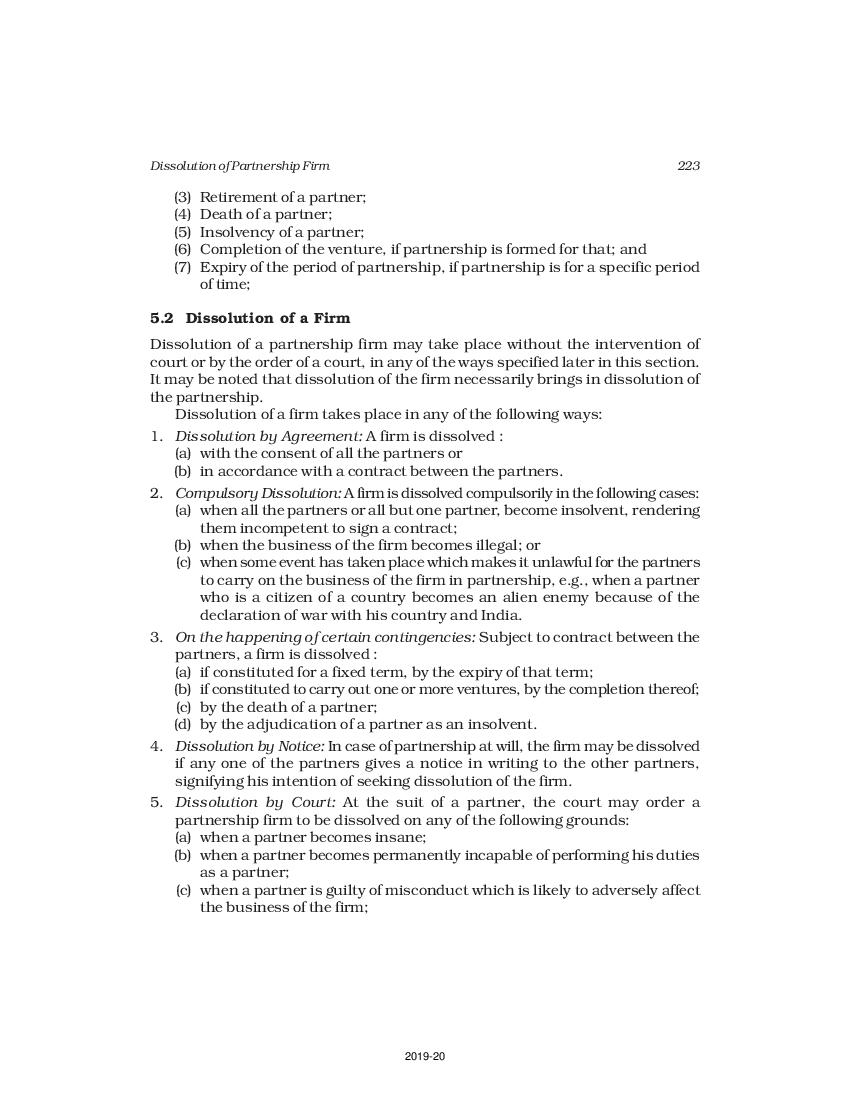

Dissolution of a partnership firm refers to the process of ending the partnership and bringing the business to an end. It is the legal process of winding up the partnership firm and distributing its assets among the partners.

There are several reasons why the dissolution of a partnership firm is important.

Firstly, dissolution helps to resolve disputes among the partners. Partners in a partnership firm may have disagreements on various matters such as the distribution of profits, management of the business, and allocation of responsibilities. Dissolution allows the partners to end the partnership and go their separate ways, thereby resolving any conflicts and avoiding further disputes.

Secondly, dissolution helps to protect the interests of the partners. In a partnership firm, the partners are personally liable for the debts and obligations of the business. If the business incurs debts that it is unable to pay, the creditors can demand payment from the partners. Dissolution helps to protect the personal assets of the partners by bringing the partnership to an end and distributing the assets of the firm among the partners.

Thirdly, dissolution allows the partners to move on to new opportunities. Partners may have different goals and aspirations, and dissolution allows them to pursue their own interests and venture into new business opportunities.

Fourthly, dissolution helps to maintain the integrity of the business. If a partnership firm continues to operate despite internal conflicts and disputes, it can lead to poor decision-making and a decline in the quality of the products or services offered. Dissolution ensures that the business is brought to an end before it causes harm to the partners or the customers.

In conclusion, the dissolution of a partnership firm is important as it helps to resolve disputes among the partners, protects the interests of the partners, allows the partners to move on to new opportunities, and maintains the integrity of the business. It is a legal process that brings the partnership to an end and distributes the assets of the firm among the partners.