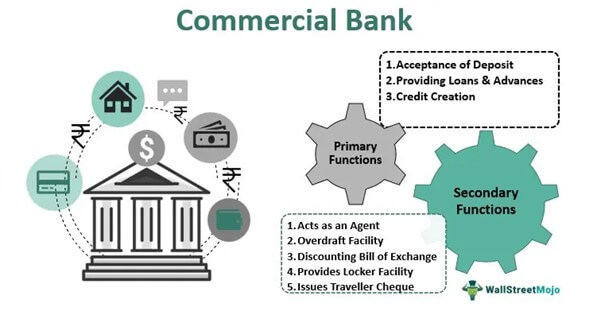

A commercial bank is a financial institution that provides various financial services to individuals, businesses, and organizations. These services include accepting deposits, providing loans, and offering investment and money management products.

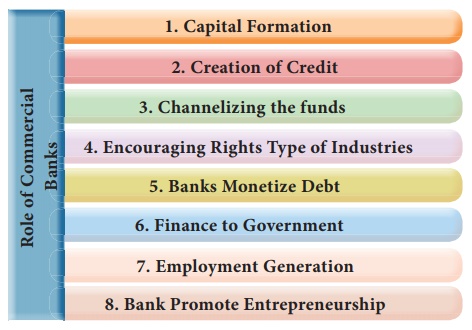

The importance of commercial banks cannot be overstated. They play a vital role in the economy and are crucial for the smooth functioning of the financial system.

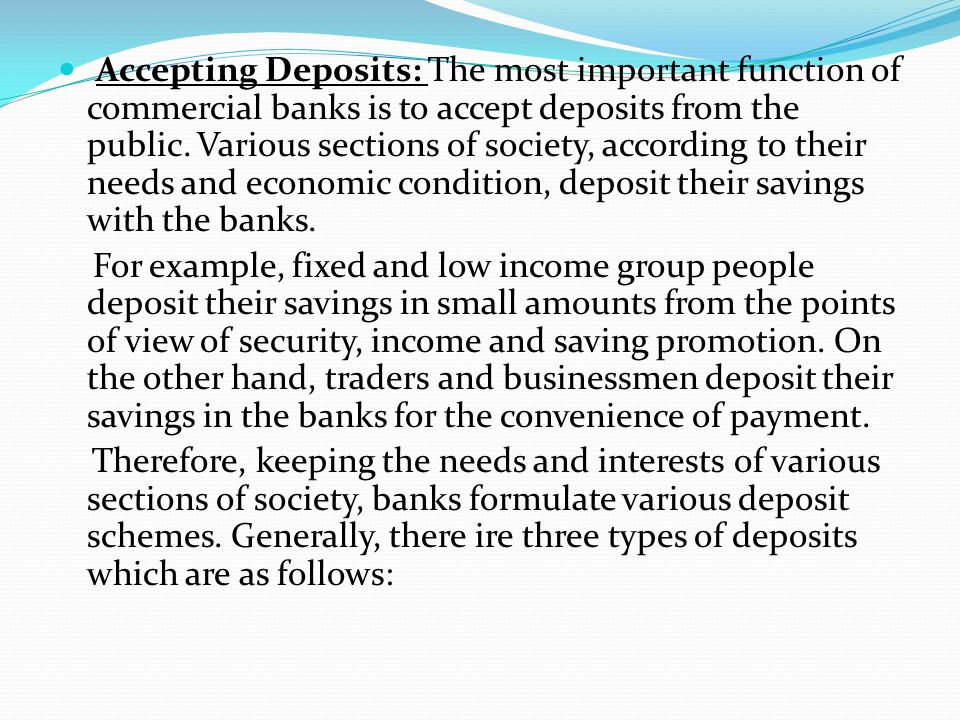

One of the primary functions of commercial banks is to accept deposits from individuals and businesses. These deposits provide the banks with a source of funding, which they can then use to lend to borrowers. By accepting deposits, commercial banks provide a safe and convenient place for people to store their money and earn interest on it.

In addition to accepting deposits, commercial banks also provide loans to individuals, businesses, and organizations. These loans can be used for a variety of purposes, such as financing a home, starting a business, or expanding an existing business. By providing loans, commercial banks help to stimulate economic growth and development.

Commercial banks also offer a range of investment and money management products, such as savings accounts, certificates of deposit, and money market accounts. These products provide individuals and businesses with a way to save and grow their money over time.

In addition to their financial services, commercial banks also play a crucial role in the payments system. They facilitate the transfer of money between individuals and businesses through various channels, including checks, debit cards, and electronic fund transfers. This helps to ensure that money can flow smoothly throughout the economy and facilitates trade and commerce.

Overall, commercial banks are an essential part of the financial system and play a vital role in the economy. They provide a range of financial services that are crucial for individuals, businesses, and organizations to manage their money and achieve their financial goals.